What’s changed in the retail healthcare space?

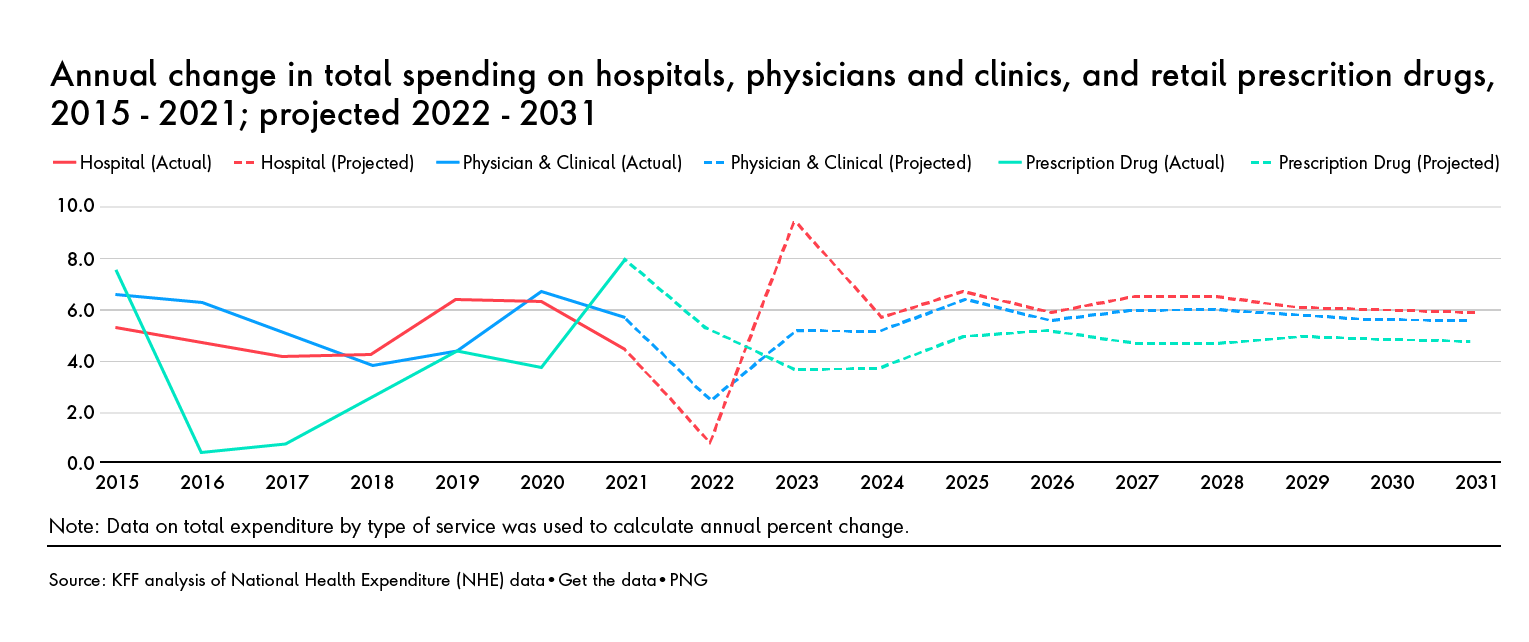

While major retail players have already built longstanding pharmacy businesses and customer relationships supported by these attributes, major healthcare industry shifts in 2023 are prompting consumers to look at nontraditional providers for vaccines and testing.

In 2023, the retail healthcare industry witnessed several significant acquisitions, highlighting the growing convergence of healthcare and retail sectors. Amazon's acquisition of One Medical, Walmart's acquisition of VillageMD and CVS Health's acquisition of Oak Street Health were among the most notable events, demonstrating the increasing role of retailers in providing accessible and consumer-centric healthcare services. These acquisitions signal a shift in the healthcare landscape, as retailers leverage their vast resources and customer bases to disrupt traditional healthcare delivery models.

At the same time, the American healthcare system is facing turbulence from many angles, from healthcare workers’ strikes across the country to the concerning trend of rural hospital closures, which is negatively affecting patient experiences. These challenges highlight the need for innovative solutions to improve access to quality healthcare, particularly in underserved communities.

Retailers have the opportunity to amplify their market position in 2024 and take advantage of the growing role they play in consumers’ lives through the frequency and consistency of in-store shopping visits, amplified by data and more compelling digital tools.