What issue can we solve for you?

Type in your prompt above or try one of these suggestions

Suggested Prompt

Insights

Five Opportunities and Challenges for Retail Healthcare in 2024

Five Opportunities and Challenges for Retail Healthcare in 2024

As the lines between shopping and healthcare continue to blur, retailers are uniquely positioned to capitalize on the growing demand for convenient, affordable and personalized healthcare services. Health consumers value their convenience and access and, at the same time, trust their consistent value and selection, putting grocers in a unique position to expand health and wellness offerings through digital business transformation.

What’s changed in the retail healthcare space?

While major retail players have already built longstanding pharmacy businesses and customer relationships supported by these attributes, major healthcare industry shifts in 2023 are prompting consumers to look at nontraditional providers for vaccines and testing.

In 2023, the retail healthcare industry witnessed several significant acquisitions, highlighting the growing convergence of healthcare and retail sectors. Amazon's acquisition of One Medical, Walmart's acquisition of VillageMD and CVS Health's acquisition of Oak Street Health were among the most notable events, demonstrating the increasing role of retailers in providing accessible and consumer-centric healthcare services. These acquisitions signal a shift in the healthcare landscape, as retailers leverage their vast resources and customer bases to disrupt traditional healthcare delivery models.

At the same time, the American healthcare system is facing turbulence from many angles, from healthcare workers’ strikes across the country to the concerning trend of rural hospital closures, which is negatively affecting patient experiences. These challenges highlight the need for innovative solutions to improve access to quality healthcare, particularly in underserved communities.

Retailers have the opportunity to amplify their market position in 2024 and take advantage of the growing role they play in consumers’ lives through the frequency and consistency of in-store shopping visits, amplified by data and more compelling digital tools.

What are the predicted trends for retail healthcare in the next year?

Across the health and wellness landscape, the most ambitious retailers are building out omnichannel prescription services with stronger telehealth and in-person medical services. However, these services require digital skills and technological capabilities that many enterprises are struggling to scale with sufficient speed.

While health and wellness represent a major growth opportunity, the pursuit includes challenges and considerations executive teams need to deliberately address.

“What’s exciting about retail healthcare in 2024 is that we’re seeing retailers provide services and products in unexpected in unique ways. From consumer electronics retailers like Best Buy to specialty ethnic grocers, there are really no limits in terms of retail sectors getting involved. However, retailers need to remember that health and wellness is a long game. Those that dive in without the right partnerships, expertise and technological backbones will burn out quickly without the profit they’re looking for.” -Pete Groves, Senior Managing Director

Here are five exciting opportunities and their biggest challenges in 2024:

1. From bricks to clicks: omnichannel pharmacy growth can fill in the gaps from “pharmacy deserts” with “super apps”

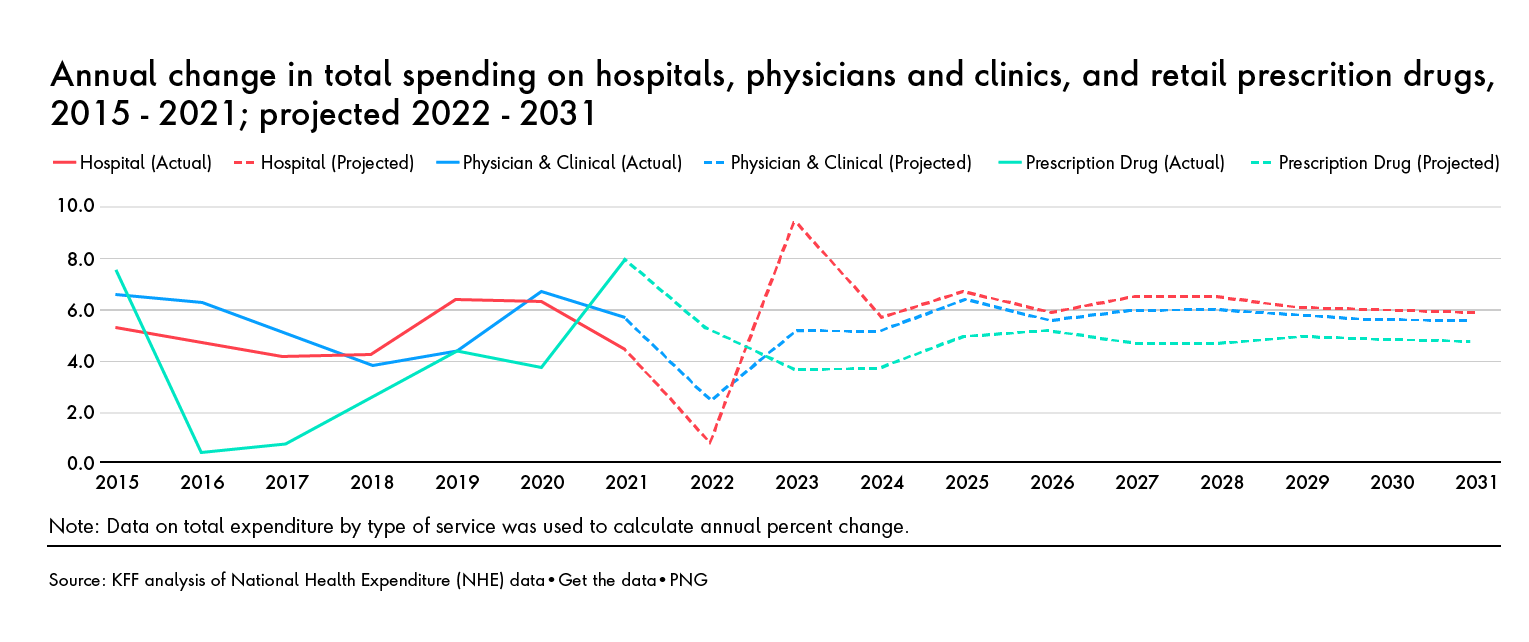

In a nutshell: Prescription drug spending is soaring, and consumers demand a seamless digital buying experience. How can grocery retailers replicate the in-person care of local pharmacies online as pharmacy locations close their doors?

“We’re comfortable with pharmacies being more or less everywhere. Consumers expect their prescriptions from their closest retailer or shipped directly to their house. Pharmacists, as the most accessible healthcare professionals, are the cornerstone of this convenient and patient-centric care model.” – Pete Groves, Senior Managing Director

Unlocking Pharmacy, Health and Wellness: The Retailer’s Playbook

Three actionable ways to drive customer loyalty, patient engagement and profit through health and wellness offerings.

2. Rural renaissance: in-store retail health clinics bridge the gap in rural healthcare

In a nutshell: Rural patients struggle to make it to the doctor’s office, but their nearest pharmacy, grocery or specialty store is probably close by with better hours. Retailers need to automate the omnichannel experience for in-store health services to take market share from traditional health clinics.

“Grocers have a dedicated customer base going to the store every week because they need food. Traditional healthcare providers have the opportunity to take advantage of this massive physical store footprint.” – Scarlett Lok, Senior Client Partner

3. Rethinking food-as-medicine for all customers

In a nutshell: While high-income customers have eagerly embraced food-as-medicine, cost of living increases have driven the average consumer away from health and wellness-focused food and products. Retailers need to up the ante through promotions and partnerships.

“So much attention is paid to healthy eating, and the level of conversation has risen—mass grocers are natural leaders to take this “back” from higher-end specialty grocers and to make this a holistic part of the shopping experience, in every community.” – Pete Groves, Senior Managing Director

4. Retailers prescribe a healthy dose of competition to health insurance

In a nutshell: The majority of Americans feel let down by the U.S. healthcare system—and much of this frustration is tied up in payments, i.e., health insurance. Retailers have a $25 billion opportunity to not only solve the biggest healthcare industry hurdles for their customers but become trailblazers in this new market.

“The U.S. healthcare system is complex and expensive for so many Americans, and traditional healthcare services are leaving many behind. We see a major opening for relevant retailers to be a trusted and straightforward digital “access point” for many communities that are too often overlooked by the major healthcare players.” – Scarlett Lok, Senior Client Partner

5. B2B retail is digitizing—and healthcare shouldn’t be left behind

In a nutshell: Grocery retailers have the opportunity to serve health professionals with a seamless B2B experience, but the B2B medical supply segment is fragmented, making it challenging to create loyalty in a new market.

“Home Depot and Lowe’s have done a great job of creating a specialized experience for contractors, while also serving DIYers, and they have loyalty programs that make their “B2B” play very compelling. Grocers have the opportunity to do the same with a variety of B2B health and wellness segments—from home health aides to nutritionists and other health professionals.” – Pete Groves, Senior Client Partner

The future of retail healthcare

Consumer interest in health and wellness is only increasing, especially as inflated healthcare costs are driving the necessity of preventative care above more expensive symptom management.

In 2024, grocers will face new challenges in balancing consumer experience, sensitive patient information and new partnerships to expand retail health and wellness offerings. The top players can carefully carve out their niche through a deep, data-driven understanding of their customer’s needs and health goals and use this understanding to provide expanded physical and digital experiences.