A new type of change — creeping uncertainty — will be layered on top of the ever-present, rapid technological acceleration… and pose a series of serious issues for many organizations — not least of all those in wealth management.

He argues that in an unstable economic environment, fear will become a more significant factor in determining where potential clients take their savings. Firms will need the appropriate technologies and related processes to provide serious advice to worried clients and handle consequential decisions.

With so much happening in the world, the public also increasingly expects financial institutions to articulate a sense of purpose beyond benefiting shareholders.

Wealth and Asset Management 4.0 found that European firms are generally the most driven by ESG (environmental, social and governance) concerns, especially with the European Union’s adoption of new regulations. In the United Kingdom and Ireland, 56% of surveyed investment providers said their clients expect them to have ESG knowledge.

To be clear, creating pleasant digital experiences will still be essential. But the ability to scale services and cope with increased demand while providing robust security will only grow in importance — as will having the flexibility to invest for a better future.

The promise of cloud enabled technology

A key to unlocking all of this is cloud, a central component of Industry 4.0: the emerging era of the Industrial Revolution, characterized by automation, interconnectivity and real-time data. Too often thought of as merely a storage method, cloud computing is truly a new paradigm that enriches and accelerates other technologies, which enables new capabilities and processes.

Migrating more IT services to the cloud doesn’t just mean off-premises storage. It means building sleeker, faster platforms and services directly in the cloud, with modern engineering methods and iterative improvements. It means having modular platforms, with distinct blocks that can be altered or removed without disrupting the whole.

For wealth management firms in the United Kingdom, cloud creates the opportunity to establish a strong, flexible technology foundation that can be scaled quickly and easily to deal with fluctuations in demand. So, in times of economic uncertainty and evolving regulations, companies can have the agility to change directions without losing work or momentum.

Rich data in Great Britain

Throughout the world, people tend to appreciate digital advancement without fully understanding how it transpires. This trend holds true for the UK as well.

Publicis Sapient’s Data Collection and Consent Survey, powered by IPSOS and sponsored by Google Cloud, found that 64% of Britons have a positive view of technology’s impact on their personal lives, but that 77% know little to nothing about what companies do with the data collected from them.

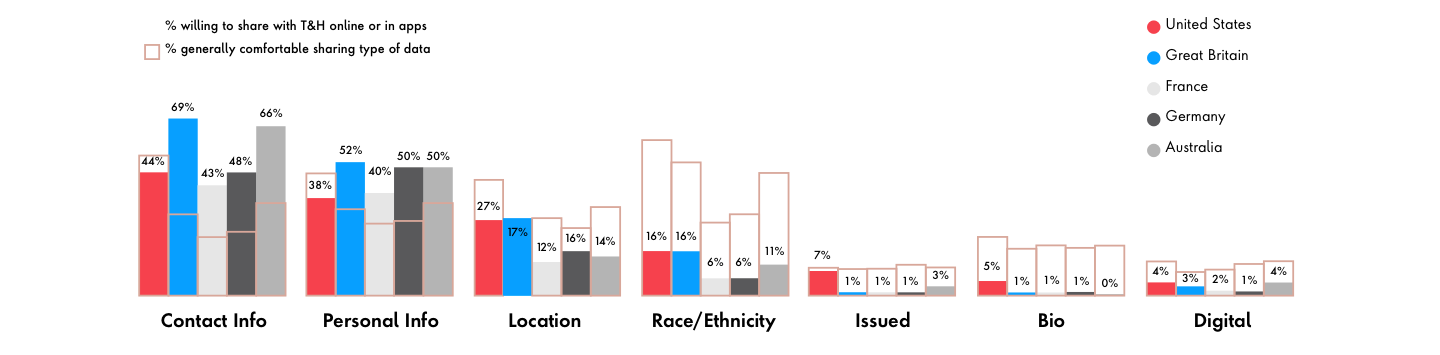

When asked about financial services companies in particular, Britons were more likely than Australian, American, French and German respondents to share their personal information (74%) and contact information (76%). However, the British were far less likely than the Americans to share their location, issued or biometric information with financial services companies.

Types of data people are willing to share with FS companies online