Win at payments by modernizing your tech stack and delivering your customers the experiences they crave.

What issue can we solve for you?

Type in your prompt above or try one of these suggestions

Suggested Prompt

Transforming Corporate Payments

There’s a battle raging in the payments space

Customers today can choose from a huge range of payment methods and channels, with a host of banks, fintechs, PayTech companies and tech giants all competing for their own slice of this lucrative market.

Fail to rise to the challenge, and banks risk losing hard-won customer relationships and ceding position in the payments space.

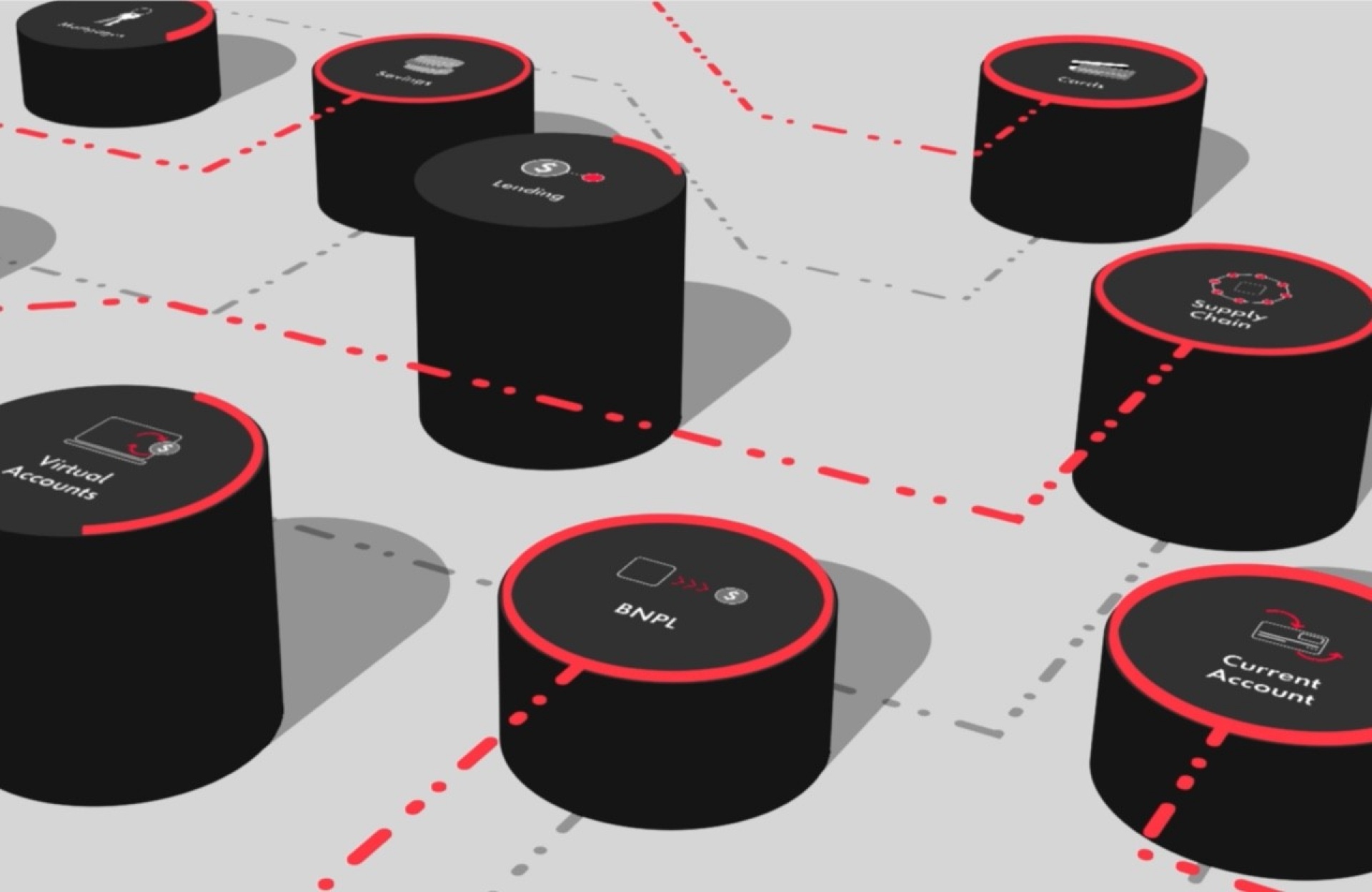

To cement their position—and avoid becoming simply the ‘plumbing’ of payments—banks need to offer customers the thing they crave the most: invisible payment journeys that integrate seamlessly into their lives.

How can banks win at payments?

Get ready to safeguard your place in the payments landscape. We’ve identified five must-win battlegrounds you’ll need to target.

How can we help?

The time to transform is now. Explore our payments solutions.