The Transformative Solution

First, we created a single multidisciplinary team of tech, UX, creative and strategy experts, working side-by-side in agile sprints to speed up time to go -live. We then analyzed the business, identified customer pain points and created a four-step plan to achieve the client’s vision.

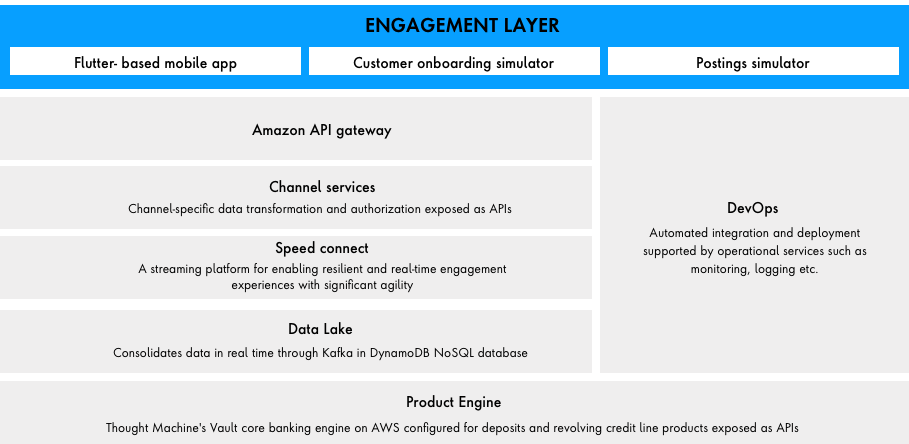

We built the product engine on Thought Machine’s core banking platform. For the mobile app, we chose Flutter due to its flexible open-source development framework, strong cross-platform support and single codebase. We then went back to basics with brand, creative and UX workshops and exploration, creating a new, iterative design from the ground up that was tested with live customers throughout.