An end-to-end journey

Unlike other retailers, grocers face unique inventory issues like the freshness and availability of produce. An increase in in-store pickup or home delivery poses supply chain challenges, along with designing in-store experiences that accommodate these services.

“Grocery is a very low-margin business,” Vivek Puri, group vice president, growth and strategy lead, Publicis Sapient, said. “If you look at the old paradigm and how they reconfigure their supply chain to the digital customer, there are a lot of challenges.”

Emerging supply chain trends play a critical role in shaping the overall customer experience. Grocers should leverage data to determine the best approach.

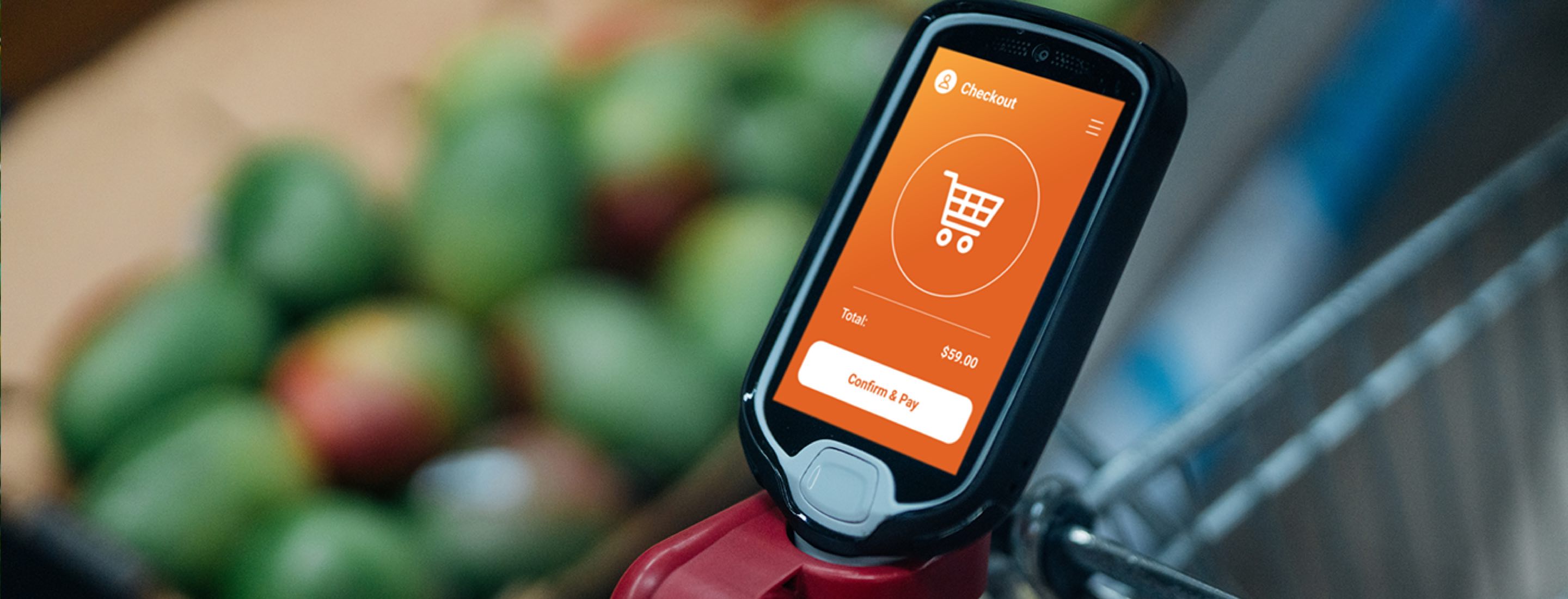

- More delivery options give the customer choice and flexibility. Examples include curbside pickup, locker or kiosk pickup, subscription services, buy-online-pickup-in-store, click-and-collect and delivery option-based pricing.

- Insights on shopper fulfillment preferences, inventory, order fill rates, and last-mile fulfillment give an end-to-end view of the customer journey. Grocers can use data to create services that meet customer demand, while minimizing cost across the entire distribution chain.

- New delivery models mean changes and investments in transport, with grocers exploring new ways to optimize delivery routes for speed and efficiency. Examples include working with third-party carriers for last-mile fulfillment, developing or acquiring a delivery partner or creating localized pickup centers. In-store, shelf management, processing, and staffing to accommodate increase picking need is a focus when improving efficiencies.

- Increased demand for speed and convenience puts pressure on grocers to develop an agile approach to demand planning. A de-siloed system that unites analytics and operational data within a cloud-based platform reduces friction between planning and execution, allowing for better resource planning, inventory optimization and location-based insights.

For example, Loblaw took a “continuous improvement” approach to digital business transformation, becoming one of the first grocers to offer delivery and pickup in Canada. Loblaw’s PC Express Online service lets customers place order digitally, with pickup and delivery options across 700+ store locations.

The future of grocery

The global grocery market is projected to hit $1.9 trillion in sales by 2023. At the same time, new generations of digitally native shoppers are entering the market – shifting expectations and demand from retailers. While technology and data play a role in driving these innovations, the ability to keep the customer front and center is paramount for success.

“Once grocers begin to really leverage data effectively, they can enable experiences that are truly relevant, that’s going to be a real shift,” Hubbard said.