Why energy traders are evolving from profit-takers to value orchestrators.

What issue can we solve for you?

Type in your prompt above or try one of these suggestions

Suggested Prompt

The Multi-Commodity Mandate: How Trading Desks Create Enterprise Value

The world’s appetite for energy has almost doubled in the past year for both primary and secondary sources, a surge that neither wind farms nor oil rigs can meet on their own. To satisfy demand, they must work together.

Power-hungry datacenters, extreme weather and electrified industrials are redefining what “baseload” even means. The energy system is no longer just hydrocarbons. It is power, carbon credits, metals and molecules interacting in real time. As the landscape grows more complex, so do the pressures: shorten learning curves, drive down production costs and make energy more affordable for increasingly price-sensitive consumers. At the same time, volatility patterns are also shifting. Oil prices have stabilized since the pandemic, but electricity futures and intraday congestion events are breaking records for trading volumes. Metals like nickel add instability to battery and grid economics. Gas remains the swing fuel, yet the gravitational pull of profits has shifted toward electrons and carbon.

This convergence—of fuels, data and markets—is where today’s trading opportunity lies. The firms that can see across commodities, model their interactions and trade the correlations in real time will be the ones that turn volatility into value.

Keeping up with demand

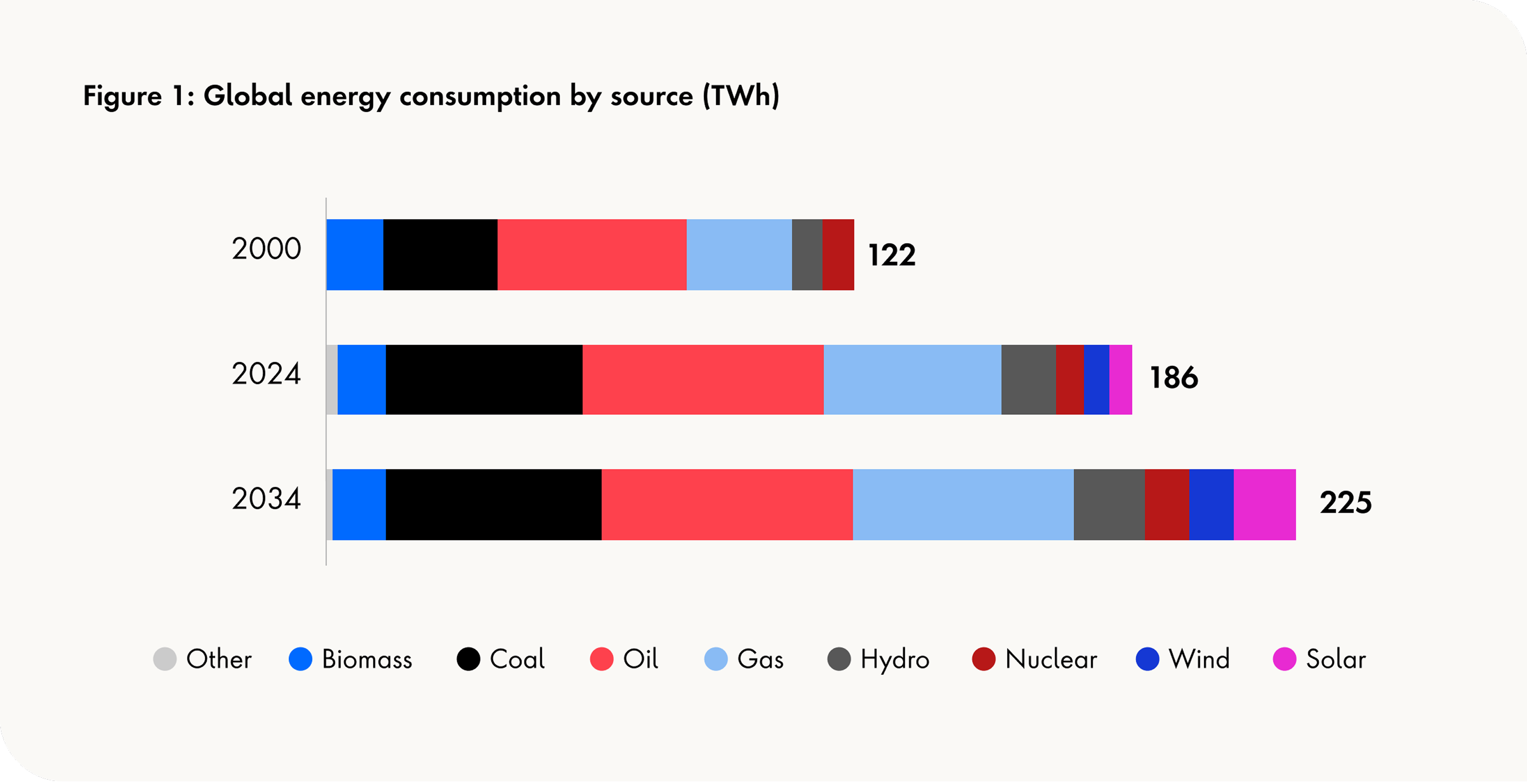

Demand across nearly every energy sector is still climbing, signaling the need for a more diversified global energy landscape (Figure 1). Integrated majors and merchant players alike are becoming orchestrators of complex, interconnected portfolios that span molecules, electrons and the materials that link them.

This isn’t just the pursuit of the latest volatility spike, but a smarter way to de-risk margin and asset growth. By monitoring, modeling and monetizing how commodities interact in the market, trading organizations can build resilient, multi-commodity positions that integrate natural offsets to absorb shocks and protect margins.

The theme of the next quarter century is energy addition, not substitution. Hydrocarbons continue to grow even as renewables scale:

- Coal up 66 percent since 2000

- Oil up 27 percent

- Gas up 66 percent

Meeting rising demand means compressing learning curves to drive down production costs. Even after a 90 percent plunge in utility‑scale solar levelized cost of electricity (LCOE) since 2010, wholesale power prices are still rising more than three times faster than the Consumer Price Index (CPI). The affordability gap is widening and traders who understand those cost dynamics will be the ones best positioned to capture opportunity across the value chain.

Volatility is on the move

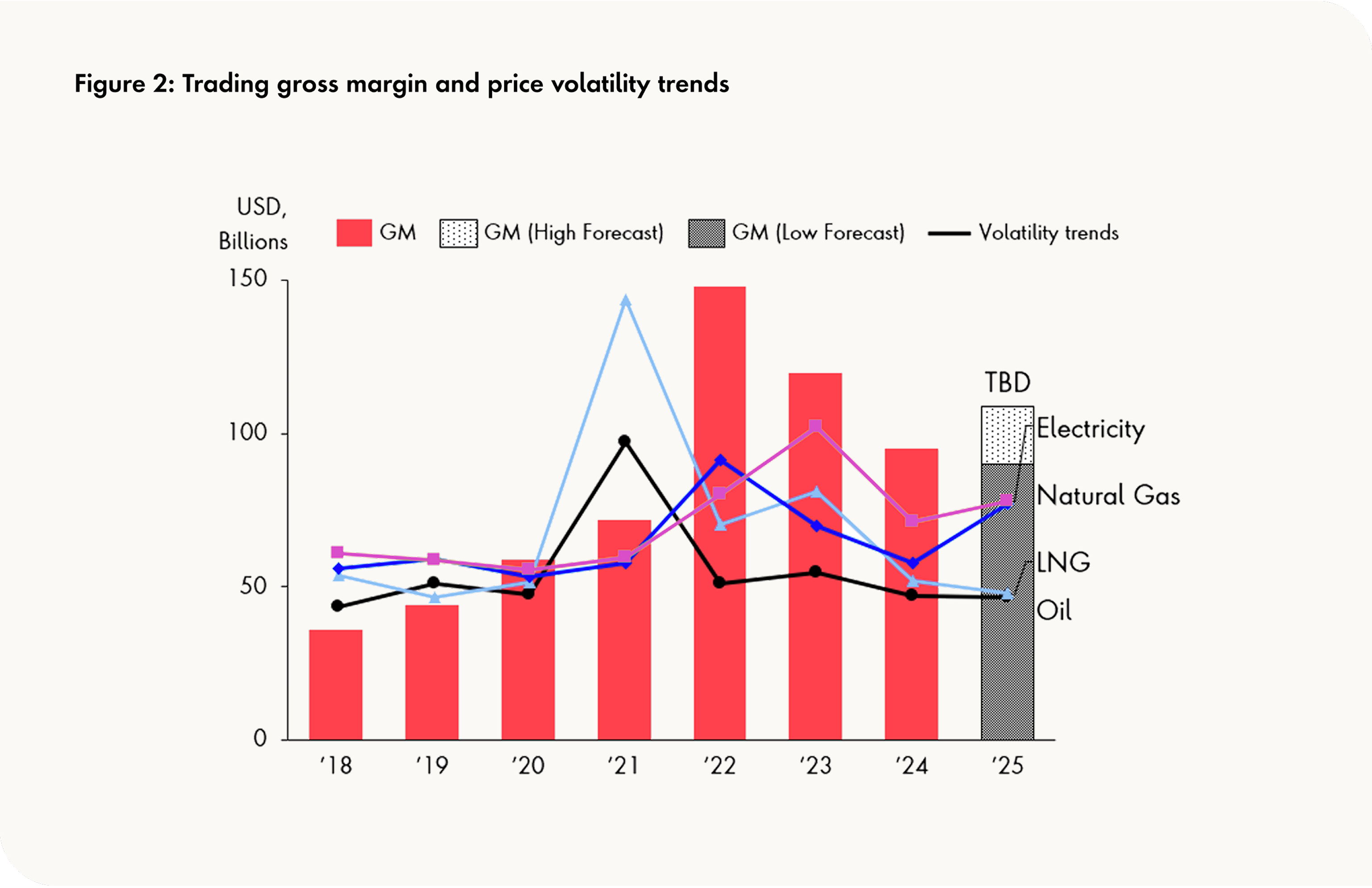

Volatility in crude has finally normalized after the shocks of the pandemic (Figure 2). CME’s Energy CVOL index shows WTI realized volatility falling from 48 percent in 2022 to 29 percent in 2024. But electricity is telling a very different story.

In Europe, record trading volumes on ICE power futures rose 74 percent month over month in January 2025, proof of both deep liquidity and growing opportunity for traders equipped to take advantage of intraday price spikes. In select North American regions, out-of-market commitments pointed to congestion on over 50 percent of calendar days, giving power traders frequent chances to capitalize on abnormal market conditions.

Meanwhile, metals like nickel are adding volatility to battery and grid economics, and gas continues to play its role as the market’s swing fuel. But the center of gravity for trading profits is shifting from barrels to electrons, from hydrocarbons to hybrids.

Trading breadth is no longer optional

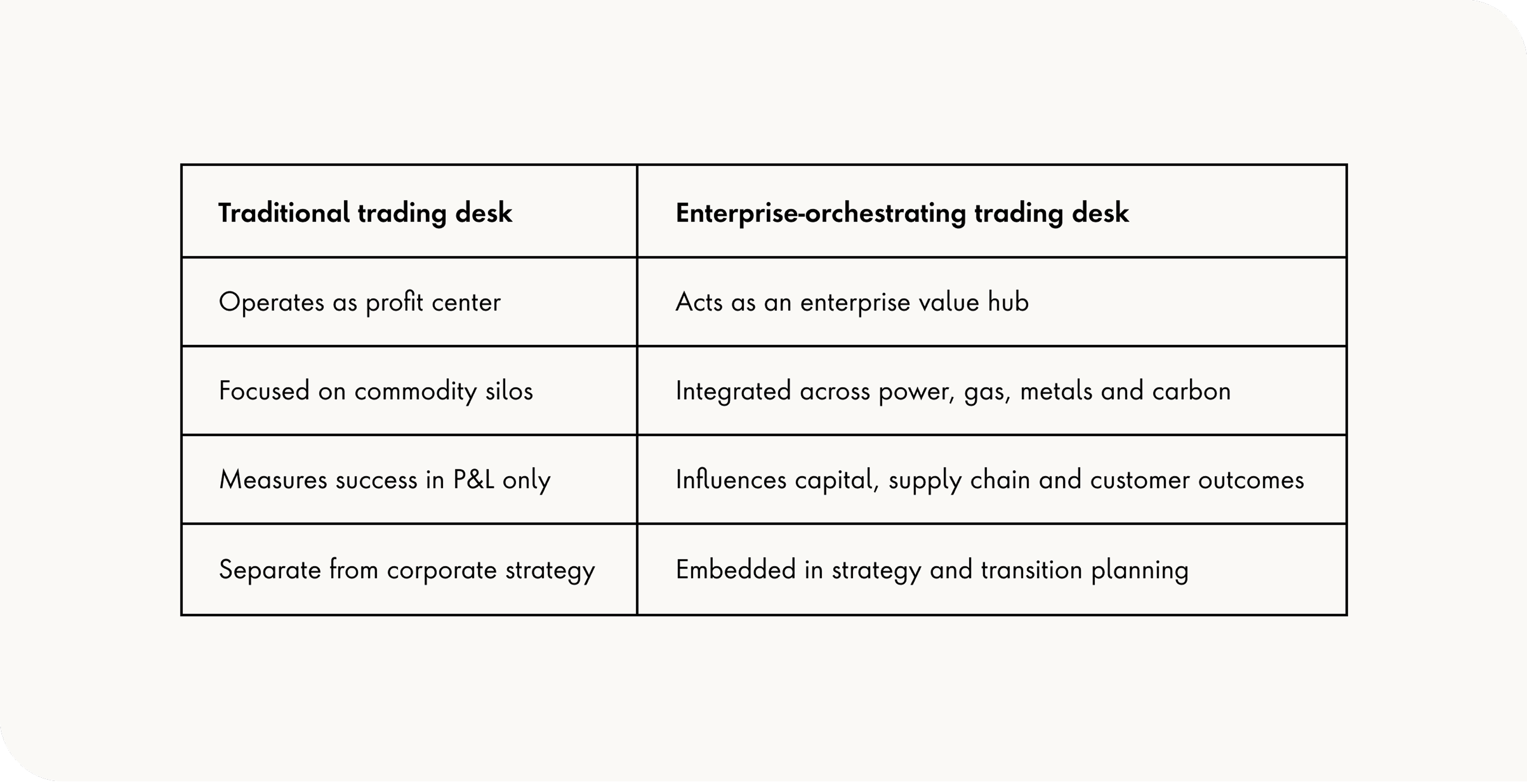

For decades, trading desks were judged on one thing: profit and loss (P&L). That metric made sense when commodities moved in silos—oil here, gas there, metals and power somewhere else.

But those days are over. Today, shocks in one market ripple across others. A gas supply crunch reshapes power prices. Metal shortages disrupt renewables. A single weather event can swing global portfolios.

That’s why the trading desk can no longer operate as a stand-alone profit center. It must sit at the center of the enterprise, orchestrating strategy, risk and growth across the entire value chain.

Trading teams already have the widest field of vision. They see across commodities, time horizons and geographies. They understand how disruptions cascade and where hidden correlations turn into new opportunities. And they have the models, analytics and technology to monetize those connections in real time.

We’re already seeing the shift in action:

- A North American integrated energy major is transforming its trading organization into a global hub, unifying once-siloed regional desks into a single platform. Coupled with value-chain optimization initiatives, the organization is unlocking enterprise-level gains across supply, logistics and commercial operations, creating a line of sight from molecules to margins.

- A large European utility is wiring plant-level operational technology (OT) data straight into its market-side IT stack while standing up a battery-storage trading desk. This enables arbitrage of power, gas and carbon in real time, monetizing flexibility and shaving imbalance costs as its renewables business scales.

- A global merchant trader has augmented traditional discretionary trading with AI-driven micro-trading, capable of quickly responding to price shifts across fragmented spot hubs, turning market noise into durable P&L.

The pattern is clear: When trading organizations evolve from isolated desks to enterprise orchestrators, they not only tap into new profits, but new kinds of value.

The mandate: from profit center to enterprise orchestrator

Capturing the upside of multi-commodity trading isn’t just about new risk limits or book restructuring. It demands a mindset shift from chasing volatility to building lasting enterprise capability. That means sharper risk intelligence, operational excellence, adaptive trading approaches and valuation-based capital allocation, all powered by modern technology and data.

The next generation of trading desks requires five interlocking capabilities:

- Sophisticated risk: Leading trading houses calculate market, credit and liquidity exposures for power, gas, liquids and metals on one stack, using portfolio‑level Value at Risk (VaR), expected shortfall and “what‑if” stress scenarios to steer capital and stay in the market during price shocks.

- Value chain optimization: Optimization spans sourcing, logistics, processing, trading and marketing, and linking OT data (e.g., plants, storage, vessels) with commercial positions so that every molecule/electron is routed to its highest‑value outlet. Maximizing these improvements requires a transparent enterprise data foundation and a cross-functional organizational structure with clear roles, responsibilities and decision authority.

- Advanced trading capabilities: Execution, signal‑generation and algorithmic trading processes leverage vast datasets, arbitrage day‑ahead versus intraday prices and manage sub‑30‑minute balancing mandates—now the norm in liquid hubs.

- Valuation-based capital investment: Gauge deal fairness by comparing enterprise-value metrics to peer transactions, while looking for upside optionality in assets (e.g., storage tanks, power plants, liquified natural gas [LNG] contracts) that provide managerial flexibility under market uncertainty.

- Modernized tech stack: A cloud-based, containerized energy trading and risk management (ETRM) core provides elastic, real-time trade capture, mark-to-market and multi-commodity risk, while open micro-service APIs unlock AI forecasting, battery-optimization and regulatory modules. A unified streaming lakehouse ingests market, IoT and asset data for sub-hour analytics, enabling new trading products or regions to go live in just weeks.

But capabilities alone will fall short: The majority of large enterprise transformations fail for lack of buy in. The real differentiator is people, where organizations can align traders, risk managers and business leaders behind a shared “why” and “how” as well as a continuous change mindset.

What’s next

This is part one of our three-part playbook for the multi-commodity era.

- Part 1 – Strategy: Why multi-commodity trading is the new enterprise mandate

- Part 2 – Technology: How CTRM 2.0 architectures enable the modern trading desk

- Part 3 – AI: How AI and advanced analytics transform execution and decision-making

If this first chapter explains the why, the next two will show the how from modernized tech stacks to AI-driven decision support.

The message is clear: Volatility, complexity and connectivity aren’t headwinds. They’re new sources of competitive advantage for firms ready to orchestrate across commodities.