Source: Global Banking Benchmark Study

The lifecycle-led imperative

Customers do not follow a straightforward path and their financial journey is often complex and multi-faceted, intertwined with pivotal life moments like starting a business, purchasing a home, funding a child's education or planning for retirement. Governments are also recognizing the importance of life events when providing services to citizens. For instance, the NSW State Government has identified eight life events, ranging from starting a family to end-of-life planning, as key areas that should be focused

Consider Linda, a mid-level professional at an insurance company. As Linda starts her career and her side business grows, her financial needs change. At first, she's focused on building wealth. Later, she thinks about spreading her investments and reducing risks. As retirement nears, she considers how to leave a legacy. Traditional banks might see her steps as separate events, as discrete transactions. But a lifecycle-led approach sees the interconnected narrative of professional growth, family considerations and long-term aspirations.

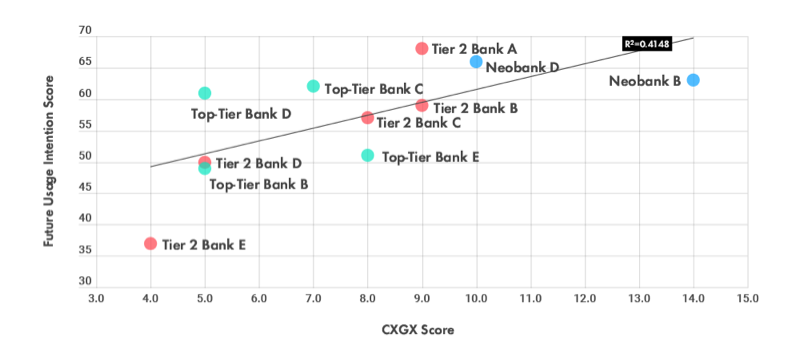

Embracing lifecycle-led strategies isn't merely an adaptive move, it's an opportunity to refresh and elevate your business model from its foundation. Ultimately, high customer experience scores today are linked to a greater willingness among consumers to interact with a bank in the future. For banks looking to sustain or accelerate growth, this is an important insight.

Relationship between CXGX and future intended usage