Source: Global Banking Benchmark Study

We’ve been part of major programs where a customer-centric perspective transformed the way banks approach cost reduction, funding and allocation of resources. Instead of focusing solely on the operating model, this approach asks whether the solution or capability driving cost is even needed in the first place.

By putting the customer at the center of your decision-making, you can identify and remove any barriers to value delivery, ultimately leading to a more efficient and customer-centric organization.

Our commitment to this approach is underpinned by two transformative methodologies:

- Service Design's Macro Lens allows us to oversee the entire customer journey and lifecycle as we pinpoint inefficiencies and design strategies to address them, which translates to tangible cost savings. . This is where we find and eliminate zombie processes, channels and rework

- Our HCD’s User-Centric perspective ensures we are immersed in the user's world as we craft solutions that are instinctively user-centric, promoting smooth interactions, reducing bottlenecks, and minimizing operational issues

Uplifting user experiences reduces the dependency on support, translating to direct savings.

For example, consider the myriad of customer queries a bank receives daily about password resets. By simply refining the user experience with a self-service password reset feature that's easy to find and use, customers can resolve their issues without calling support. This reduction in call volume not only decreases operational costs but also frees up support teams to tackle more complex issues, enhancing overall service quality.

Another ever-increasing concern is online security. By understanding user behavior, a bank can introduce timely security prompts or multi-factor authentication during unusual or high-value transactions. By integrating these features based on user insights, the bank can mitigate the risks associated with fraud or unauthorized access, ensuring both the customer's and the institution's assets are secure.

Aligning design with the customer's journey and lifecycle, rather than confining it to operational compartments, manifests in organic efficiencies and streamlines for efficiency. There are many new ideas being developed regarding the loan application process, such as interactive document guidance and submission, real-time credit score visualization, instant scenario testing and emotion responsive feedback.

How CX boosts the bottom line

A wide body of research shows that optimizing customer experience directly correlates with heightened operational efficiency, diminished risk and significant cost savings. According to Gartner, 89 percent of companies across all sectors now compete primarily on customer experience, compared with just 36 percent in 2010. In a Forbes survey, 75 percent of companies said their top objective was to improve customer experience .

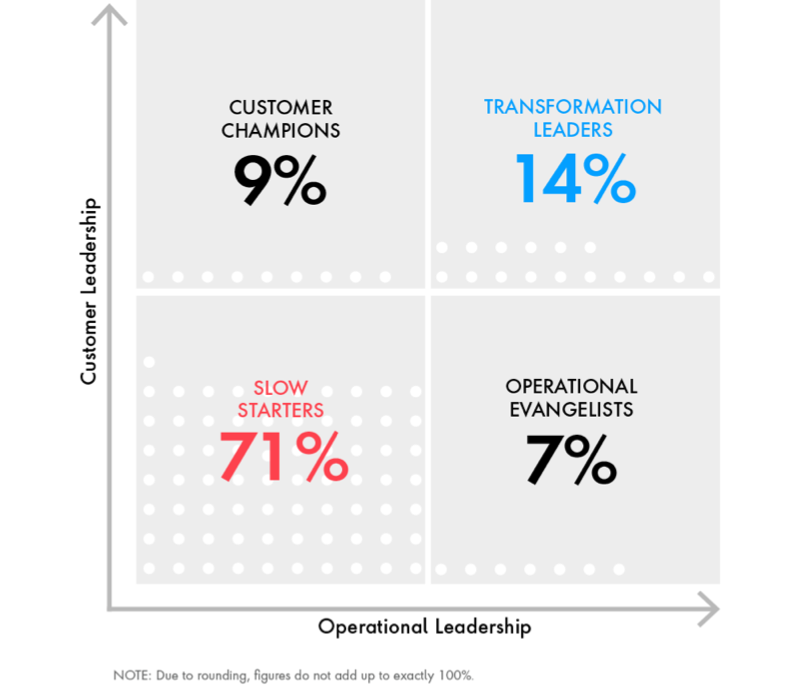

Public Sapient’s Global Banking Benchmark Study underlines this. For banks that are "transformation leaders,” 99 percent regard customer experience as a key metric. These banks are most focused on innovating core product streams (41 percent) and creating new products and services that blur the lines of traditional financial services offerings (37 percent).