Empowering the Mortgage Borrower

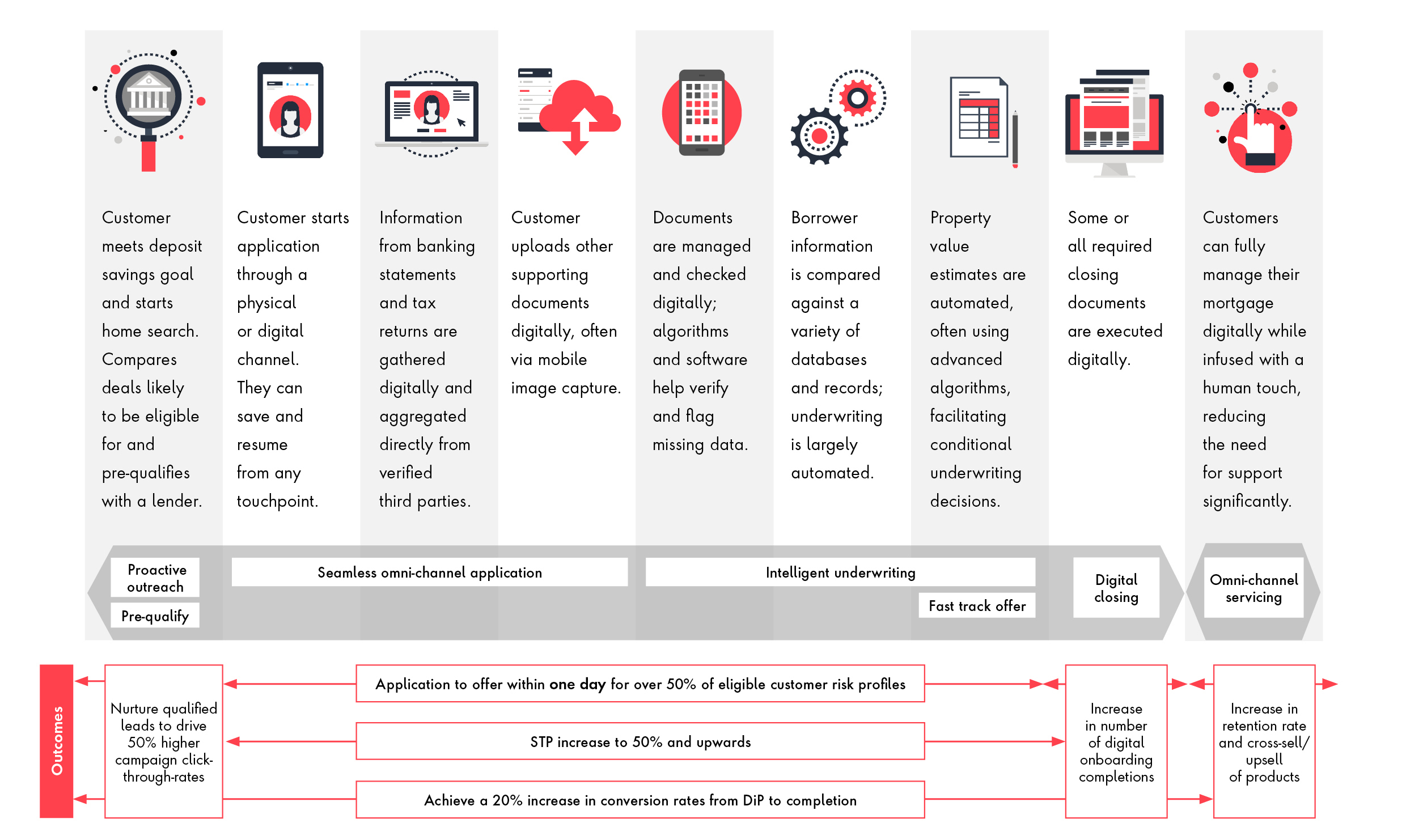

The process of buying a home can be very complex and stressful, to the extent that people feel discouraged from moving because of it. On average, applying for a mortgage and getting an offer can take anywhere from two to four weeks due to a number of factors that can delay the approval process, such as the collapse of a property sale, customers’ creditworthiness, missing information, property valuation and property chain problems.

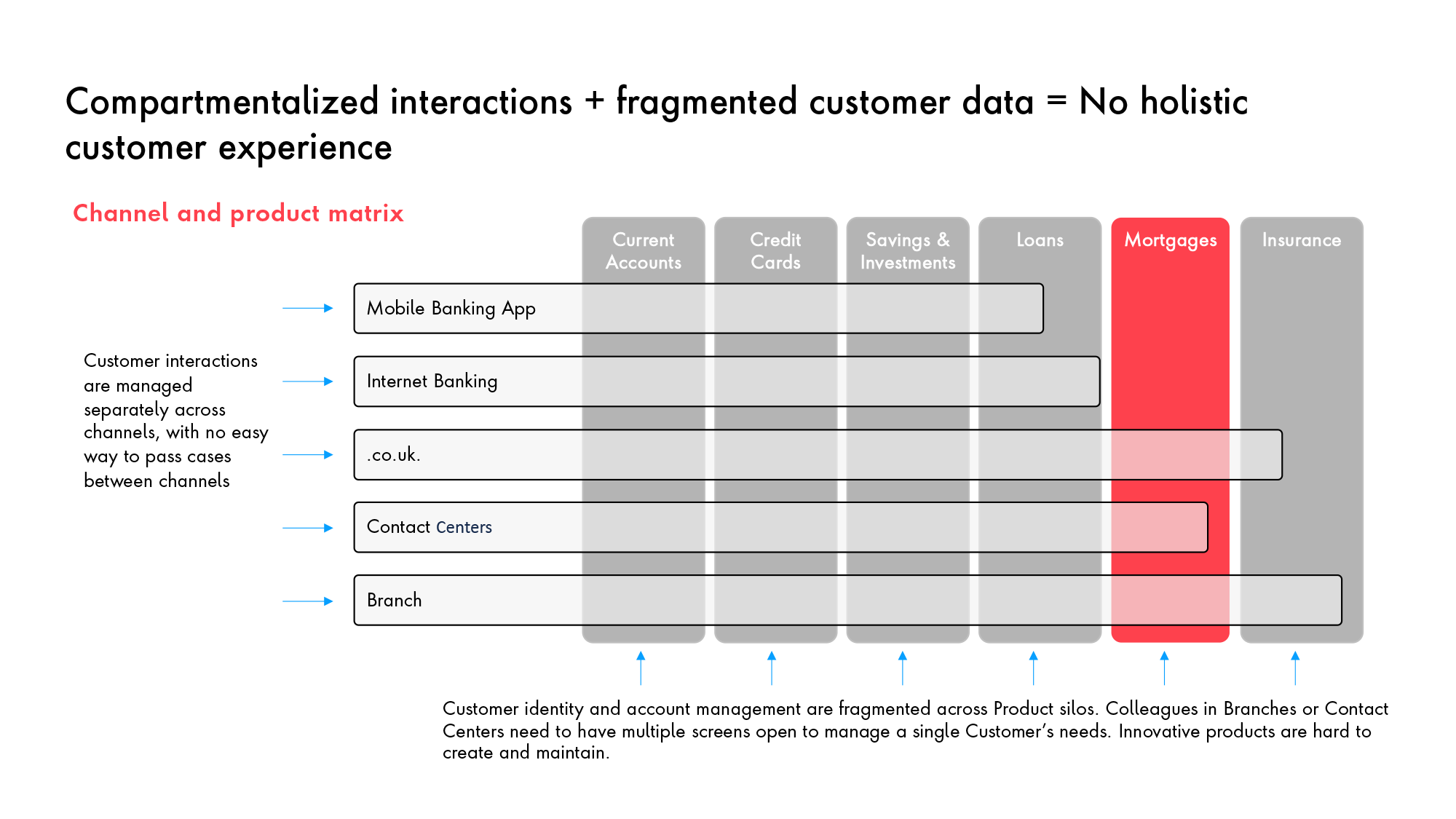

In addition to these external factors, mortgage applications rely on a slow and sometimes disjointed process thanks to compartmentalized operating models and the reliance on paper-based and manual processes for underwriting and credit decisioning. Lenders are taking key steps to enable digitizing the entire mortgage value chain.

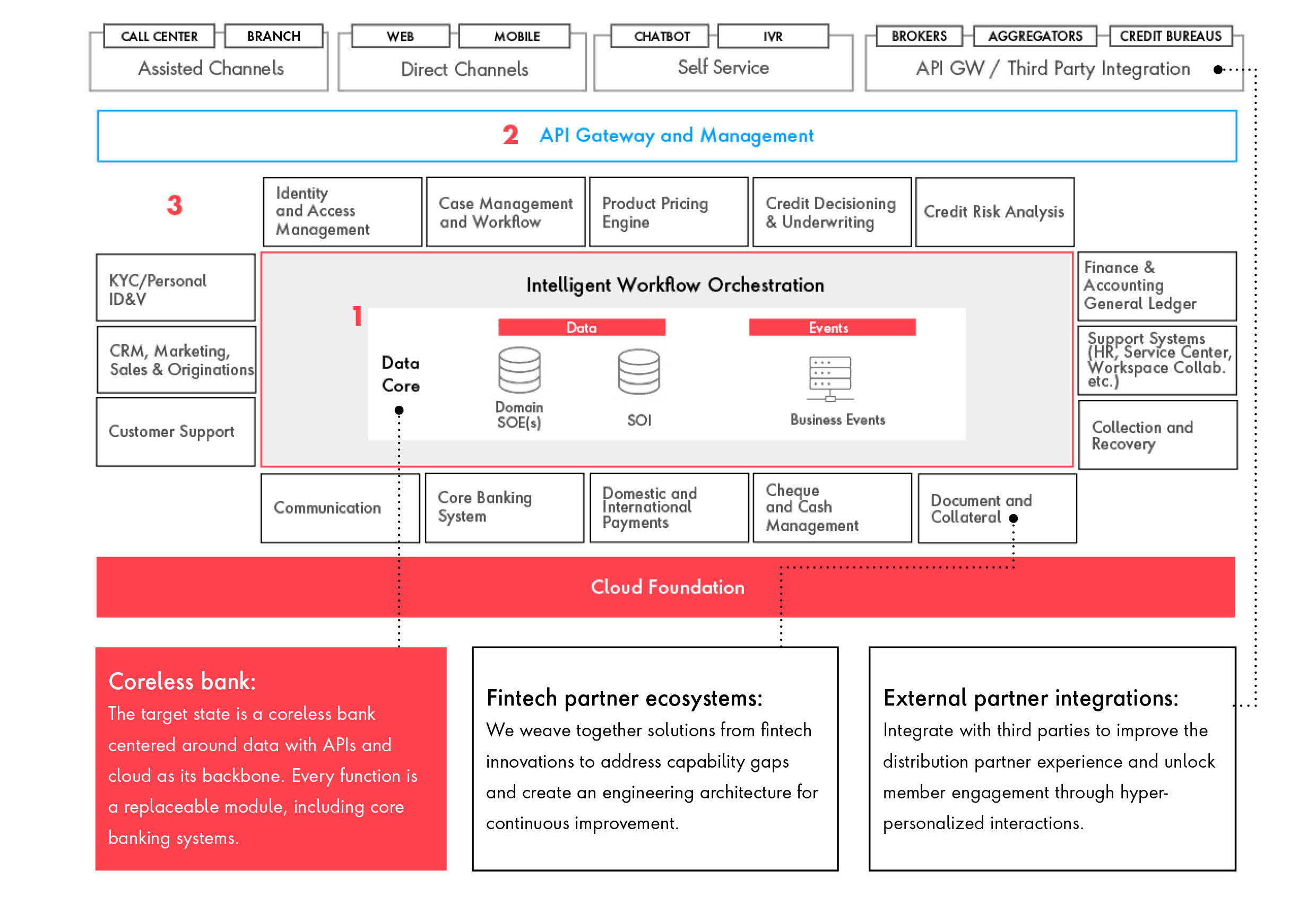

A transformation that shapes a single integrated digital thread to drive data across the front and back office can then help to simplify and streamline the process of securing a mortgage, which, in turn, will empower the mortgage borrower. However, there are a number of challenges that financial institutions must overcome in their journey to modernize and revolutionize the mortgage market.

Mortgage industry insights: The case for truly connected experiences

Taking the U.K. as an example, there is a huge market for the mortgage business with a staggering £1.6 trillion in outstanding residential mortgage loans (FCA, Q2 2022) where over £300 billion in mortgage advances were made in 2021, the highest since 2014.

However, we see a market that is rapidly changing. Customer loyalty, for example, is dwindling despite the top 10 U.K. mortgage lenders accounting for 84% of the market.

One of the causes of reduced customer loyalty is the strong competition between rival financial institutions. Both traditional and challenger banks are competing for customer attention, which contributes to better deals for borrowers and drives personalized choice at speed for those seeking a mortgage.

We continue to anticipate changes in the market. Given the global volatility in interest rates, mortgage rates will inevitably fluctuate over time, with higher interest bringing about a cooling of the new mortgage market and driving focus on remortgage activity instead.

Sources: Publicis Sapient Research, Statista 2022

Opportunities for growth

While remortgage activity is predicted to drive business over the next year, bank operating models will continue to struggle with high costs and long cycles.

For instance, the average timeline to close a mortgage is around 45 days, and the average origination cost is £4,000 per loan.

Moreover, distribution through the broker channel can be expensive for lenders, with 0.35% being a typical broker commission or procuration fee on a full loan size.

As financial institutions harness data intelligence and technology to target customers directly, broker distribution share is expected to gradually shrink from 77% to 50% by 2030. Lenders should choose to do more business with brokers that provide the most value and select them as strategic partners to scale cost-effectively. Brokers can set themselves apart by proactively offering concierge services, delivering personalized propositions and making customer relationships a top priority.

Furthermore, by supporting brokers to utilize broker tech through API integrations with broker aggregator platforms, lenders can help to improve broker productivity and meet customer expectations.

More importantly, there is an opportunity to invest in digital mortgages where, with an enhanced focus on direct distribution, lenders can fast-track offers for eligible customers in a matter of minutes. For greater impact, existing direct relationships with customers can be leveraged to proactively cross-sell and upsell personalized products and propositions by prequalifying eligible target segments intelligently. With the use of data and technology, lenders will then be able to drum up significant direct business and retention on an execution-only basis and empower the borrower.

Sources: Mortgage Finance Gazette, Broker mortgage market share could drop to 50% in the next decade, How much does a mortgage broker charge?, Origination insight report, ICE Mortgage Technology, McKinsey analysis, A change in technology is coming to the UK mortgage