Achieve faster lending without the high costs of new systems

What issue can we solve for you?

Type in your prompt above or try one of these suggestions

Suggested Prompt

Lending Transformation

Publicis Sapient Loan Accelerator built on Collaboration Manager in the Microsoft Cloud for Financial Services

Publicis Sapient Loan Accelerator built on Collaboration Manager in the Microsoft Cloud for Financial Services

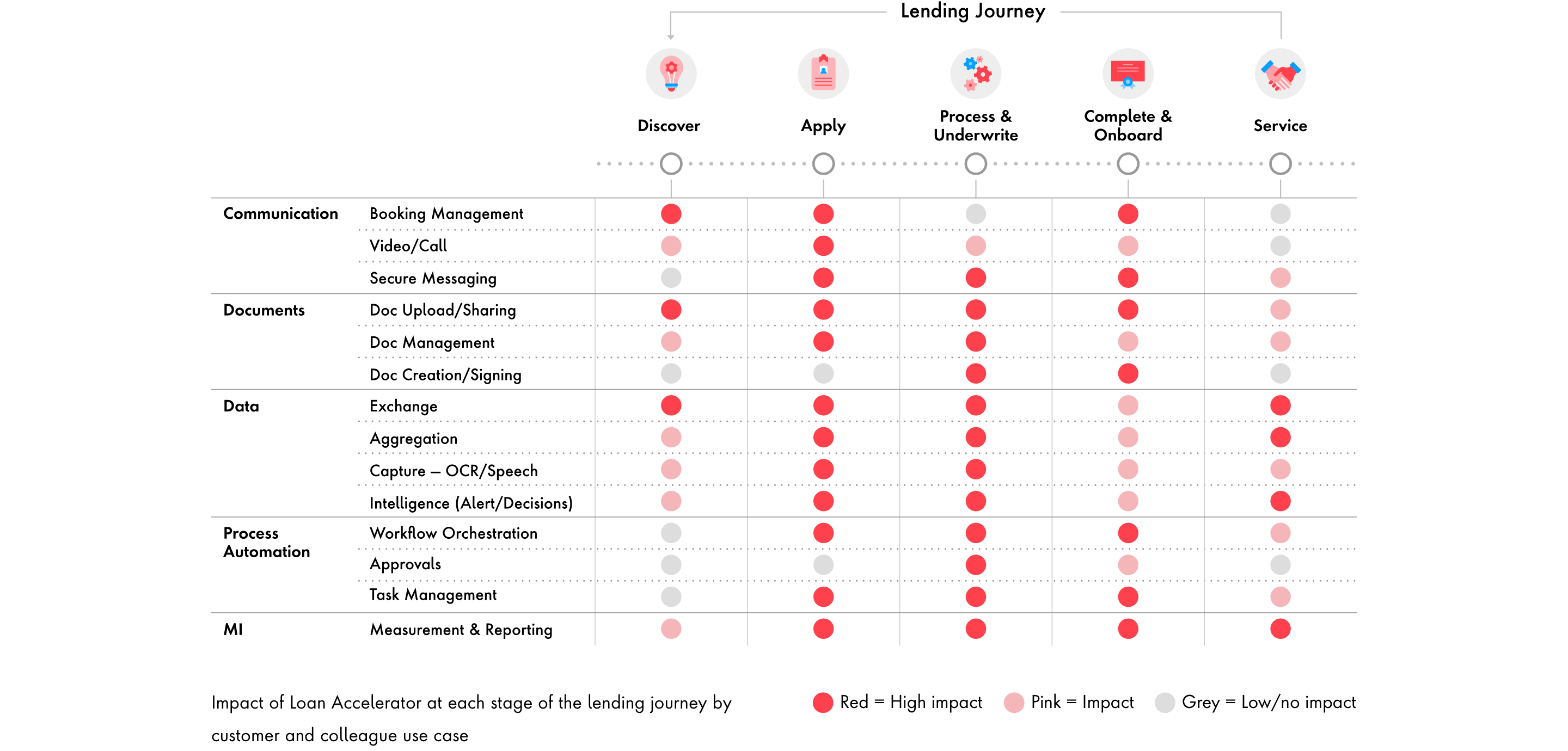

Loan Accelerator, developed by Publicis Sapient to run on Collaboration Manager in the Microsoft Cloud for Financial Services, is the most cost-effective and fastest route to digital lending. Loan Accelerator integrates with existing Microsoft technologies, including Teams, to transform lending from a disjointed, manual, and cumbersome process into seamless, streamlined,and convenient customer experiences.

The solution encompasses appointment scheduling, customer communications, task management, documentation, approvals, and team collaboration. Much of the process is automated, reducing effort, cutting the cost per loan, and eliminating the risk of human error. The result? Productivity is boosted by more than 15%, loan decisions are 30% faster, and NPS rises by 20 points or more.

Transforming the lending experience

for everyone

Facing intense competition from digital challengers, Loan Accelerator gives established lending organizations the means to focus on three critical areas of their business:

- Improve collaboration: digital technologies remove the barriers created by organizational and data silos. Less effort is expended, customers enjoy a faster service and employees are more engaged.

- Focus on customer experiences: keeping customers fully informed and radically accelerating the time to cash helps ensure happy borrowers who return with more business.

- Increase efficiency: Sharing customer data and applying techniques like artificial intelligence enables faster decision-making and creates efficiency improvements across the lending process, boosting productivity.

It’s time to transform your lending business

Let’s make a start. Schedule a call with us to discuss your needs and hear more about how Publicis Sapient Loan Accelerator can transform your lending processes.

We would also like to invite you to a free initial working session to explore how we can help. We will tailor the agenda to your needs, but typically a session would include:

- Establish your lending transformation goals

- Loan Accelerator demonstration

- Discuss a road map for accelerating transformation

- Agree project stakeholders

Following the session, we would provide a complete, bespoke transformation road map for you.

Implement Loan Accelerator rapidly and with

confidence

With deep experience of the financial sector and established expertise in Microsoft Teams, Azure, Collaboration Manager and more, Publicis Sapient is a safe pair of hands for helping an organization transform its lending business.

Publicis Sapient has the insight to help define a lending vision, create the implementation strategy, and integrate all the systems, tools and processes needed to achieve digital transformation goals.

Digital loans made easy with Publicis Sapient

Transform lending to achieve seamless employee collaboration, deliver great customer experiences, and boost process efficiency. Our free e-book outlines how it can all be done.

Digital Lending Infographic

Our infographic provides a quick and convenient guide to the facts and figures of digital lending and the gains that organizations can achieve by transforming outdated processes.