Press Release

New joint venture creates one of the largest fintech entities in Southeast Asia.

Type in your prompt above or try one of these suggestions

The landscape for incumbent banks has never been more hostile. And with challenger banks and super-apps like Gojek and Grab eroding their market share, incumbents need to offer innovative, convenient and seamless customer experiences to compete.

Unfortunately, it’s not a quick fix. Banks need to reinvent how they engage with the customers, while lowering costs and driving efficiencies if they’re to succeed.

Siam Commercial Bank Group (SCB Group) had a clear objective: to become a regional financial technology group to rival the customer-centricity and operational efficiency of digital natives and to leverage this newfound expertise across both banking and non-banking services. By monetizing their tech stack across new business verticals, SCB Group hopes to build customer loyalty, attracting new customers and —by offering a free-to-use service—to help drive down the cost of living for consumers in Bangkok.

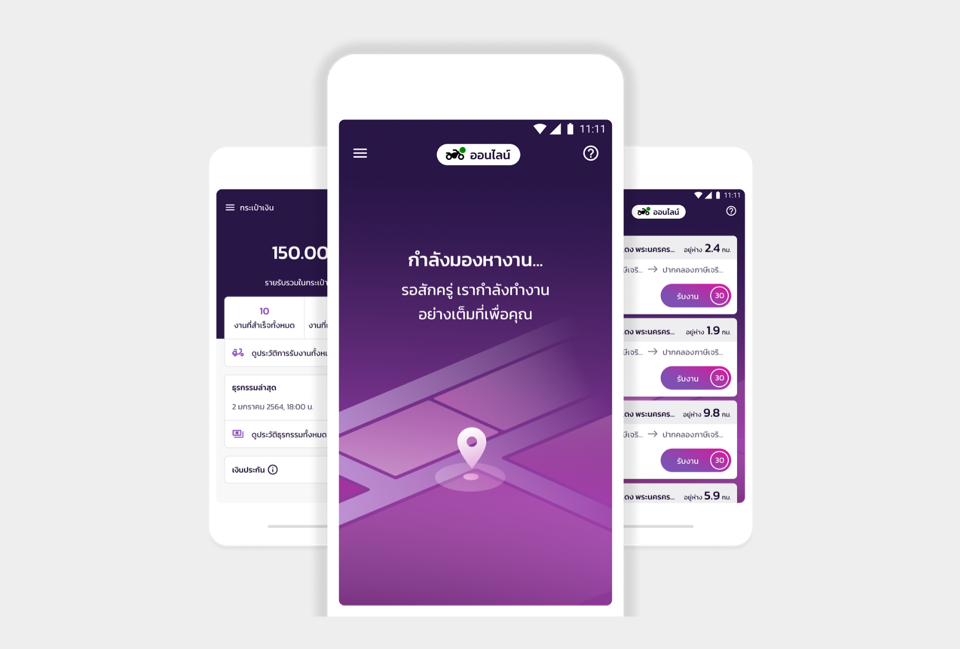

The first step in SCB Group’s journey was the Robinhood app developed by SCB Group company Purple Ventures, a new app in the mold of UberEats, Deliveroo and Grab, to launch as a pilot scheme across Bangkok. They enlisted our support in getting this app up and running within an ambitious five-month timescale.

We constructed the platform around a front-to-back “steel thread” that connects a mobile app, API and micro service layer, data lake, onboarding and compliance systems, core banking systems and payments. With this approach we built the foundation of Robinhood’s new architecture in just five months, while allowing for continuous incremental improvements to be deployed in the coming months and years.

For the mobile app, we chose Flutter, due to its flexible open-source development framework and strong cross-platform support.

The app is now live and free to use for eateries and customers alike across 76 zones in Bangkok and its surrounding areas. It is also newly open in Pattaya and Chiang Mai. With more than 30 seamless production releases in 2 months, along with 200 new user stories released post go-live, the rider app has set a new standard for SCB.

And with an average idea to production lead time well within the target of 4-6 weeks, Robinhood can add new features and functionality to the platform quickly and efficiently.

Robinhood already has plans to scale the app to cover‘Mart’ services for grocery shopping, ‘Express’ services for delivery and online travel agent (OTA) services, demonstrating how with the right tech, banks can drive growth, attract new customers and take on digital natives at their own game.

Publicis Sapient RIDER leverages secure, scalable, and fully resilient managed cloud infrastructure on AWS to provide 24x7 operations with zero downtime. Services can be scaled-up quickly and without production impact, in a self-healing environment that can recover from pod issues and respond to traffic surges and changing operational conditions without manual intervention. The fully elastic nature of the deployment means that services can be automatically scaled back if not fully utilized, for cost control and maximized efficiency. Publicis Sapient built the platform in only four months, leveraging most of the suite of AWS cloud services: nearly 30 Java microservices are hosted on 200+ EC2 instances, with CloudWatch, MSK, SNS, AppSync, ElasticCache, OpenSearch, and AWS API gateways working in tandem to provide fully automated operations, with end-to-end monitoring, SRE, log and audit visibility, and built-in fault tolerance and disaster recovery.

“We’re proud to work with Publicis Sapient as a transformation partner on our journey to reinventing the financial services market in Southeast Asia. Publicis Sapient understood the opportunities and challenges we identified as part of this project and have worked closely with us to innovate our business model, seize the opportunities technology can provide and work with us to develop digital-first, client-centric experiences quickly and efficiently.”

Trirat Suwanprateeb , CEO, SCB TechX