The popularity of point-of-sale (POS) finance options has grown significantly, leading influential market players to focus on checkout finance and offer credit alternatives such as "Buy Now, Pay Later" (BNPL). This response is driven by changing consumer behaviors influenced by emerging retail trends.

The rapid expansion of the BNPL model is currently driving unsecured lending. This payment method has emerged as a compelling choice, particularly among Gen Z and millennial consumers who are actively shaping the future of shopping. Its appeal lies in its interest-free credit structure, simplified approval processes and convenient fixed payment schedules, making it a preferred option over traditional credit cards. Clearly consumers value BNPL. So, what’s next for merchants and providers?

As the latest digital wave in financial services, BNPL is looking to disrupt the traditional credit card model. In the U.K., card-linked installments have emerged as the dominant choice for new entrants aiming to swiftly capitalize on market opportunities. These offerings bear similarities to BNPL but leverage the existing Visa or Mastercard infrastructure utilized by banks for their card businesses. However, this business model does not facilitate customer acquisition efforts and may result in the cannibalization of banks' existing credit card business with lower profit margins.

BNPL is at the forefront of embedded finance, where a loan product seamlessly integrates into the customer journey of a partner company, rendering the finance provider invisible to the customer. This integration enables financing to be provided at the most suitable moment, reducing friction, enhancing the customer experience, fostering loyalty, lowering customer acquisition costs and generating greater lifetime value.

Nevertheless, it is important to acknowledge that merchants typically establish relationships with only one or two BNPL providers, and, once these relationships are established, they tend to be long-lasting. Consequently, entering the domain of "embedded" BNPL involves intense competition. Banks interested in entering this market need to act swiftly to secure their position.

As BNPL continues to see rapid growth, particularly in e-commerce, providers are grappling with several challenges in an unregulated environment. One major concern revolves around the potential harm to consumers who may be unaware of the risks associated with accumulating debt. To tackle these issues, efforts are being made to bolster regulations and introduce effective control measures in the industry, aiming to mitigate the risks and protect consumers. This recognition of the need for stronger regulations indicates that the current BNPL 1.0 model is not sustainable in the long run. But what does the next wave of BNPL look like?

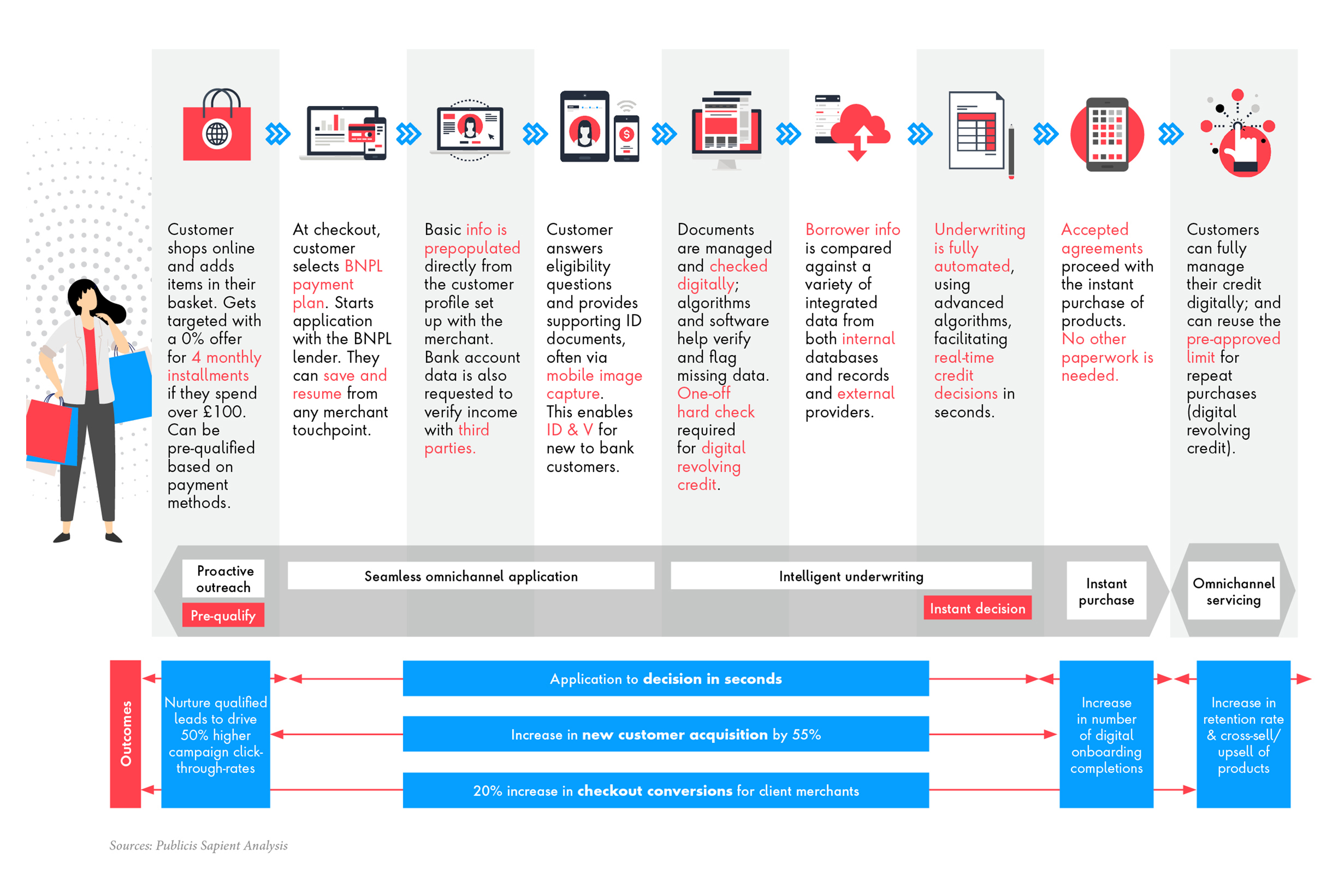

BNPL 2.0 represents a safer and fully regulated alternative that promotes responsible lending practices. With the implementation of BNPL 2.0, merchants can offer an embedded and personalized checkout experience, leading to significant growth through improved conversion rates and cost-effective customer acquisition strategies. This regulated approach ensures that lending practices align with consumer protection measures while still providing the convenience and flexibility of installment-based payment options. By adopting BNPL 2.0, merchants can enhance their business performance and provide customers with a secure and tailored checkout experience.

What issue can we solve for you?

Type in your prompt above or try one of these suggestions

Suggested Prompt

Buy Now, Pay Later

Download: Your Guide to Buy Now, Pay Later 2.0

Download: Your Guide to Buy Now, Pay Later 2.0

Explore the next wave of Buy Now, Pay Later

BNPL 2.0 Customer Journey: An embedded, personalized checkout experience

Developing a comprehensive one-stop shop for unsecured lending amid the convergence of Open Finance and the Amazon-ification trends requires careful strategic planning and consideration.

Natasa Kyprianidou , Senior Director Product Management

-

Your Complete Guide to Buy Now, Pay Later 2.0

Welcome to our step-by-step guide to implementing BNPL 2.0 solutions as part of an unsecured lending strategy. Inside, you will discover how to:

- Identify market opportunities for your business

- Drive financial inclusion while ensuring responsible lending

- Define your product vision and strategy

- Shape a one-stop shop unsecured lending value proposition

- Architect your value chain through modular technology

- Determine your go-to-market model

- Unlock benefit potential and accelerate value realization

Related Reading

-

![]()

What Australian Banks Should Learn From Buy Now, Pay Later (BNPL)

Banks are approaching the BNPL challenge in different ways. But which is the right approach for you?

-

![]()

How to Make Embedded Banking Work

Download the report to discover our five-step approach to nailing banking-as-a-service.

-

![]()

Build a Modern Coreless Bank in Four Steps

Create a future-proof coreless banking solution and deliver the experiences your customers deserve. Download our four-step guide to find out how.