Transportation & Mobility

Why Connected Services Are the Route to Profitable OEMs

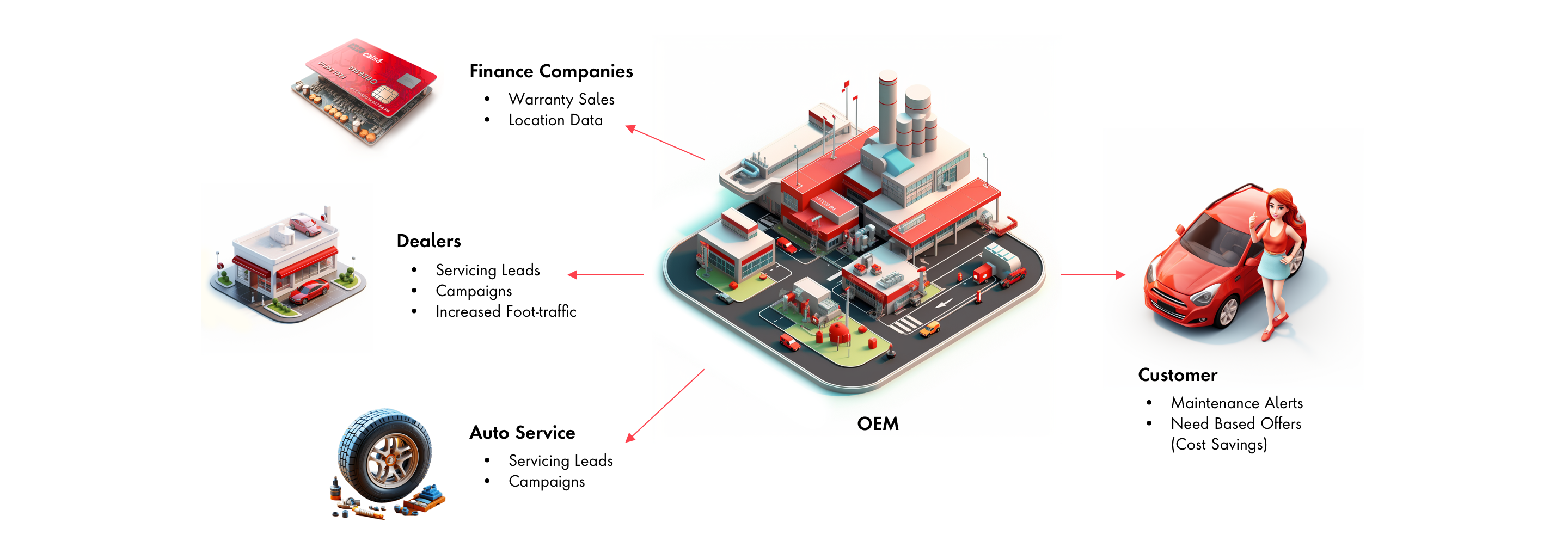

In recent years, most Original Equipment Manufacturers (OEMs) have launched mobile apps for their brands, with the intent of driving loyalty, dealer satisfaction and revenue generation opportunities.

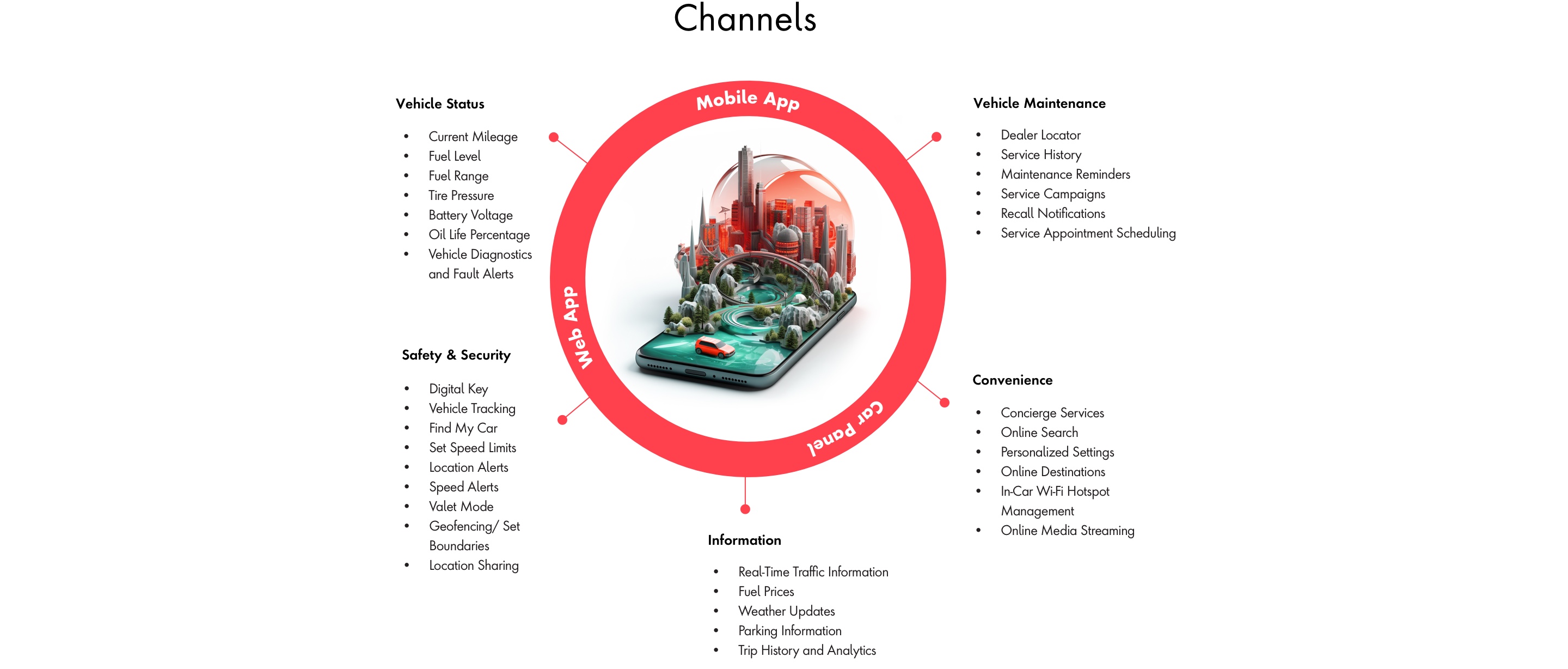

Each year, connectivity features in mobile apps for cars are increasing in scope and capability. It is now fairly common to see features such as lock/unlock, start/stop, find your car, climate control, odometer and gas level introduced as standard in car deal packages. More recently, in-app advanced features such as parking assist and autonomous self-parking have been introduced. This focus is understandable as it affords OEMs a direct line of communication with their customers that did not exist before, while also giving customers a feeling of control and enhanced customer experience. Mobile app and function usage provides OEMs valuable feedback for improving the customer experience in newer models and determining what customers find valuable, helping OEMs go to market faster using data-driven insights to make predictions and inform product and experience.