As the pandemic took hold, new media properties seemed to emerge every day. People spent more time on social media and competition for ad space intensified. As Vox's Recode reported, viewership for Twitch and Facebook Gaming, where people can watch and communicate with others playing video games, nearly doubled during the pandemic. According to SimilarWeb, from 2020 to 2021, visits to TikTok increased by nearly 600%. Meanwhile, visits to Instagram and Twitter increased by 43% and 36%, respectively.

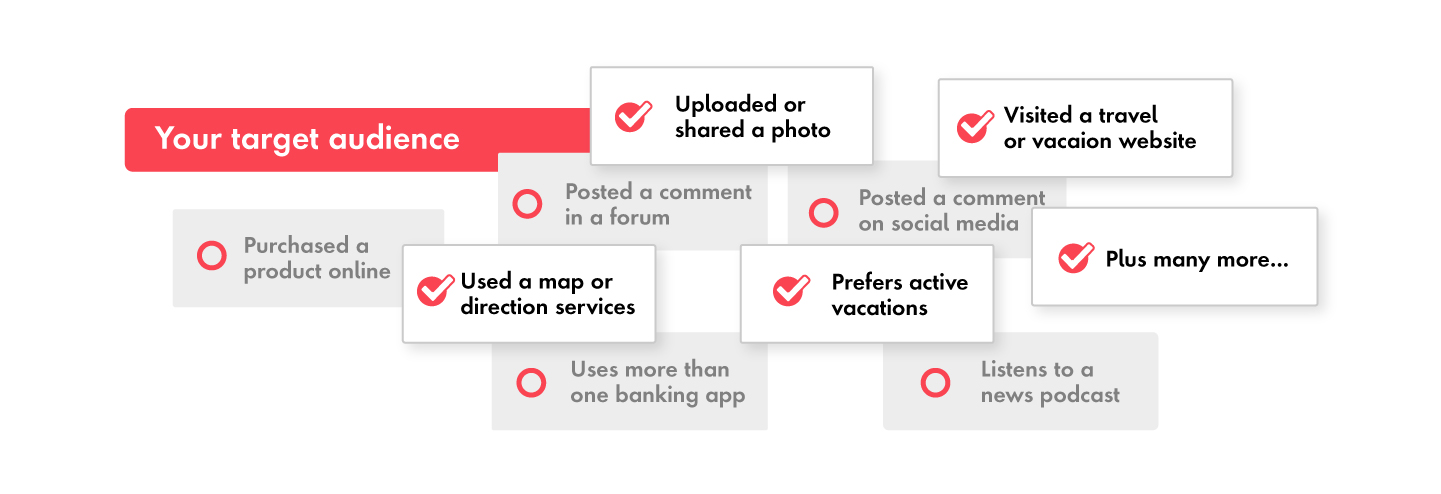

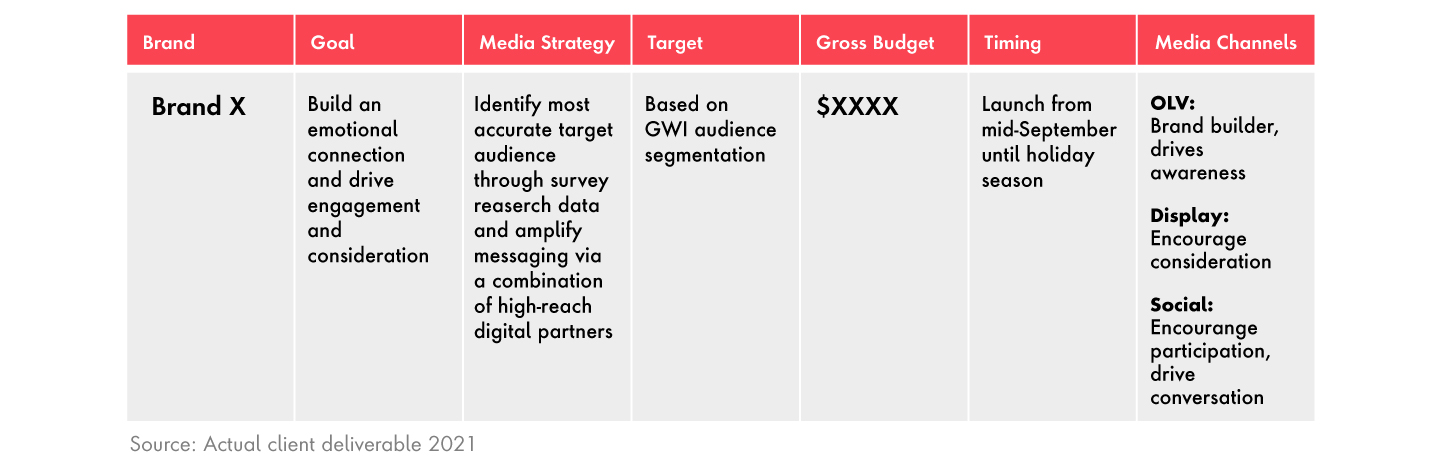

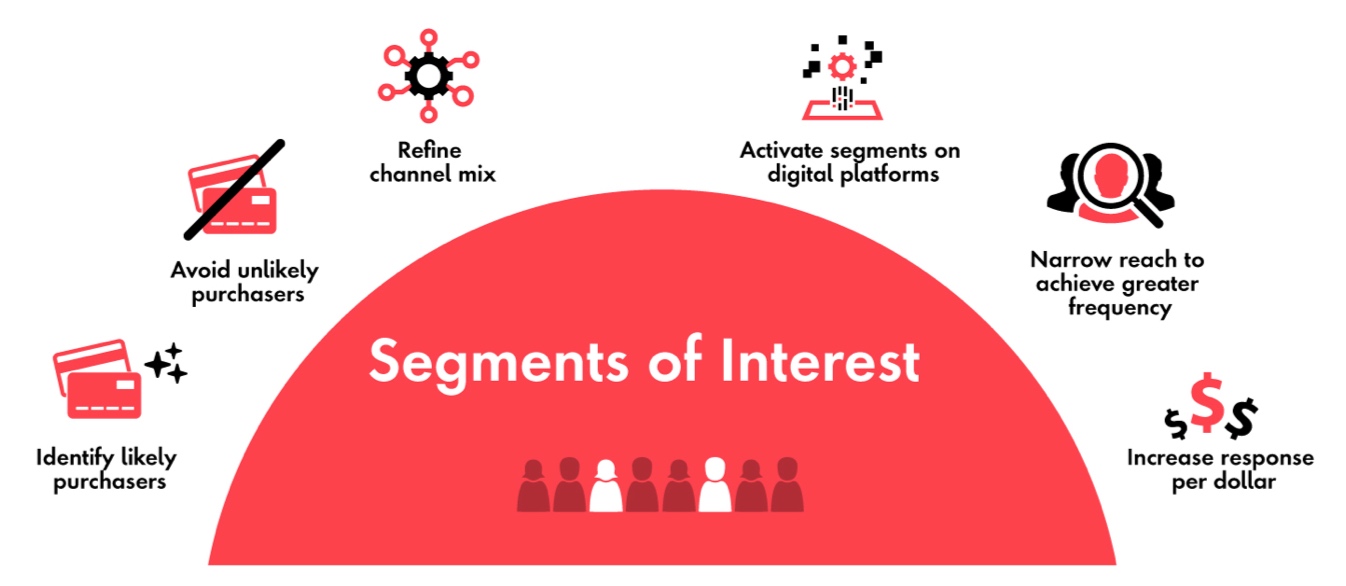

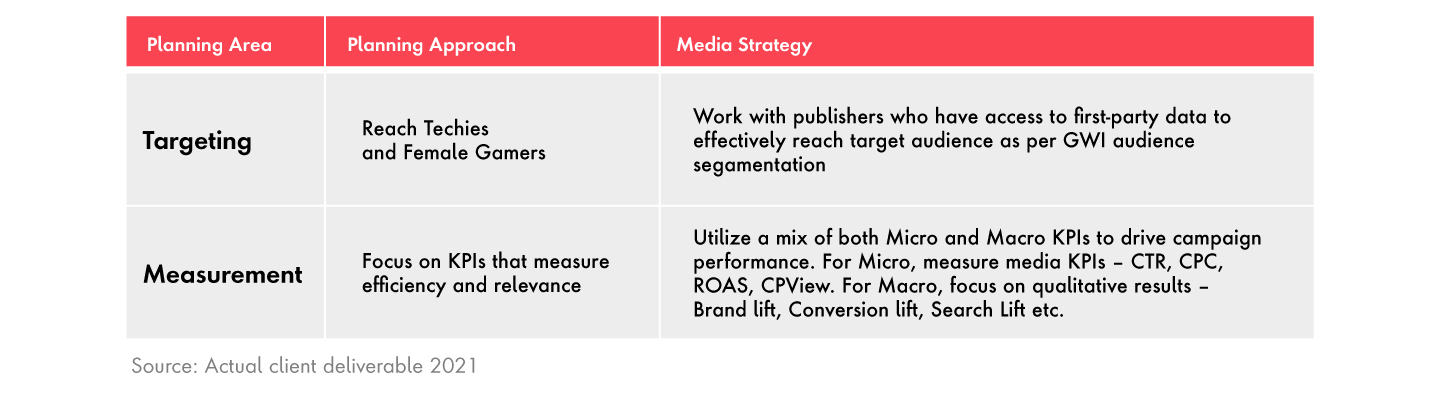

To be successful in this fluid yet highly competitive environment, brands need to conduct survey-led research for the best ways to reach their audiences in an impactful and efficient manner. Data and insights are indispensable for brands that want to evolve with the times.

How Does Survey-led Research Work?

Survey companies work with a range of industry-leading panels to source respondents while ensuring representative samples in each country. People who choose to accept the survey invitation then answer a series of questions about the matter at hand.

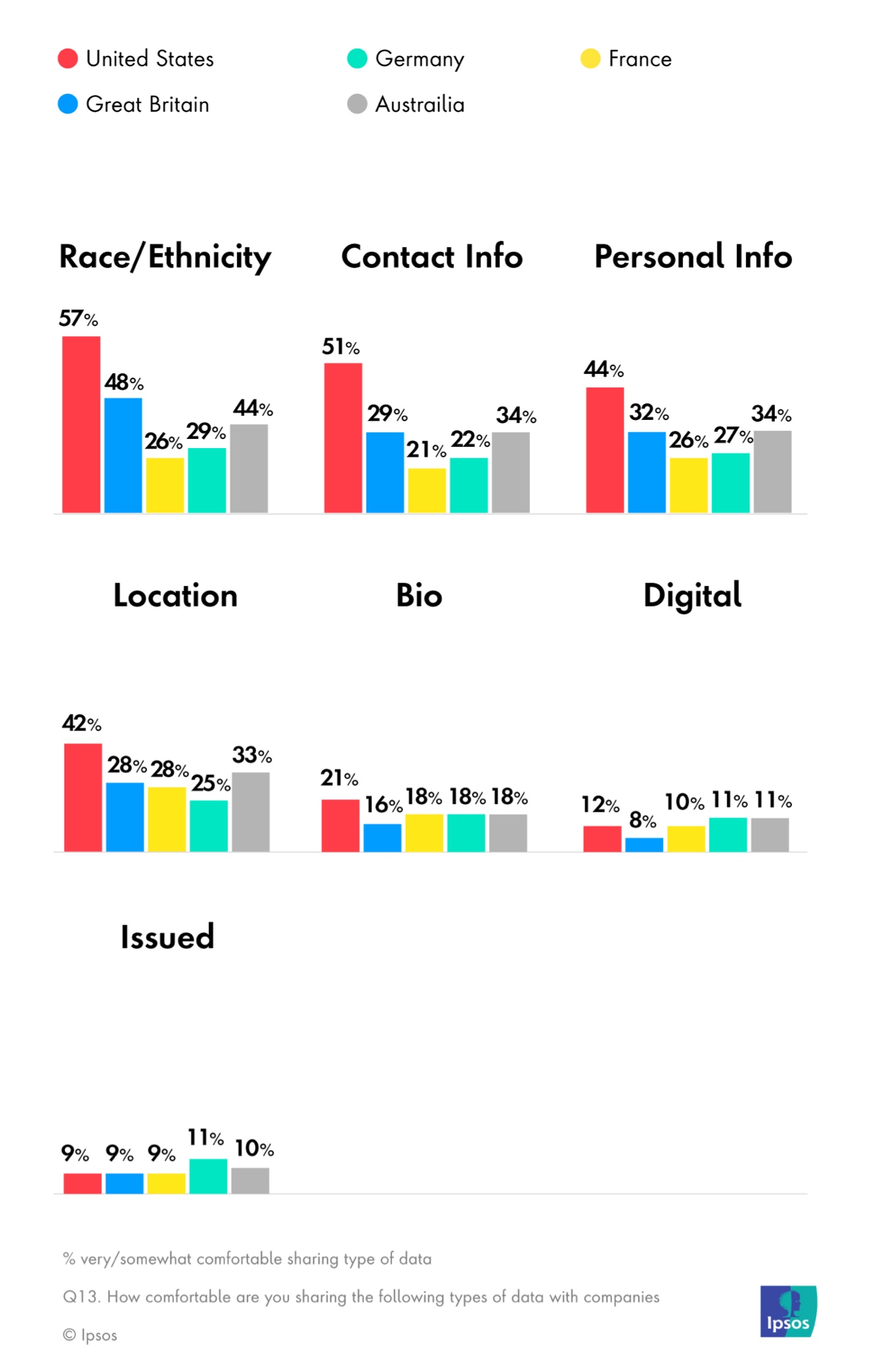

Once the survey is completed, participants are redirected back to the source panels. These panels hold personally identifiable information (PII) and generally, survey companies never ask for or receive this information. However, companies do collect details including IP address and ask for permission to drop and read cookies on an individual’s browser. The surveyor attaches a unique identifier (a string of alphanumeric characters) to each panelist’s survey responses so they can synchronize survey responses with browsing behavior and accurately measure exposure to specific advertising campaigns.