What issue can we solve for you?

Type in your prompt above or try one of these suggestions

Suggested Prompt

The Growth of the Grocery Micro Fulfillment Center (MFC) Market

The Growth of the Grocery Micro Fulfillment Center (MFC) Market

The micro fulfillment center (MFC) market is growing at an explosive rate, and grocery is leading the charge. According to a recent survey, North America will have one MFC for every 10th of all 40,000+ grocery stores by 2030.

Recent studies predict MFCs in the grocery industry represent a cumulative opportunity worth $10B by 2026. Out-of-the-box MFC solutions are increasingly becoming available to support end-to-end scenarios, including curbside.

However, MFCs are eroding some bottom lines because of sub-optimal processes. While they may be able to fulfill customer expectations, there are areas where MFCs are further complicating the operation.

In this article, we’ll discuss the state of grocery MFCs, the current complications with fulfillment methods using MFCs, and solutions to increase bottom lines for the growing MFC market.

The Rise of Grocery Micro Fulfillment Centers

What is a grocery Micro Fulfillment Center (MFC)?

A micro fulfillment center is a small, automated facility often connected to a pre-existing retail grocery store or warehouse that supplies e-commerce delivery orders and pickups through automation.

MFCs help decrease costs for last-mile deliveries by locating the entire fulfillment process (order receipt, picking, packing and delivery) closer to the end user.

The MFC’s inventory is separate from the inventory of the retail floor, creating a different and more efficient process for online ordering.

Micro fulfillment vs. dark stores

Micro fulfillment centers and “dark stores” are both autonomous fulfillment warehouses used exclusively to fulfill online orders. The terms are often used interchangeably, but MFC is more often used to describe an autonomous warehouse connected to a brick-and-mortar grocery location, whereas a “dark store” is more often used to describe a totally separate location from any in-store shopping. Dark stores and MFCs are used by grocery retailers as well as restaurant chains and other retail stores.

Why are grocery MFCs on the rise?

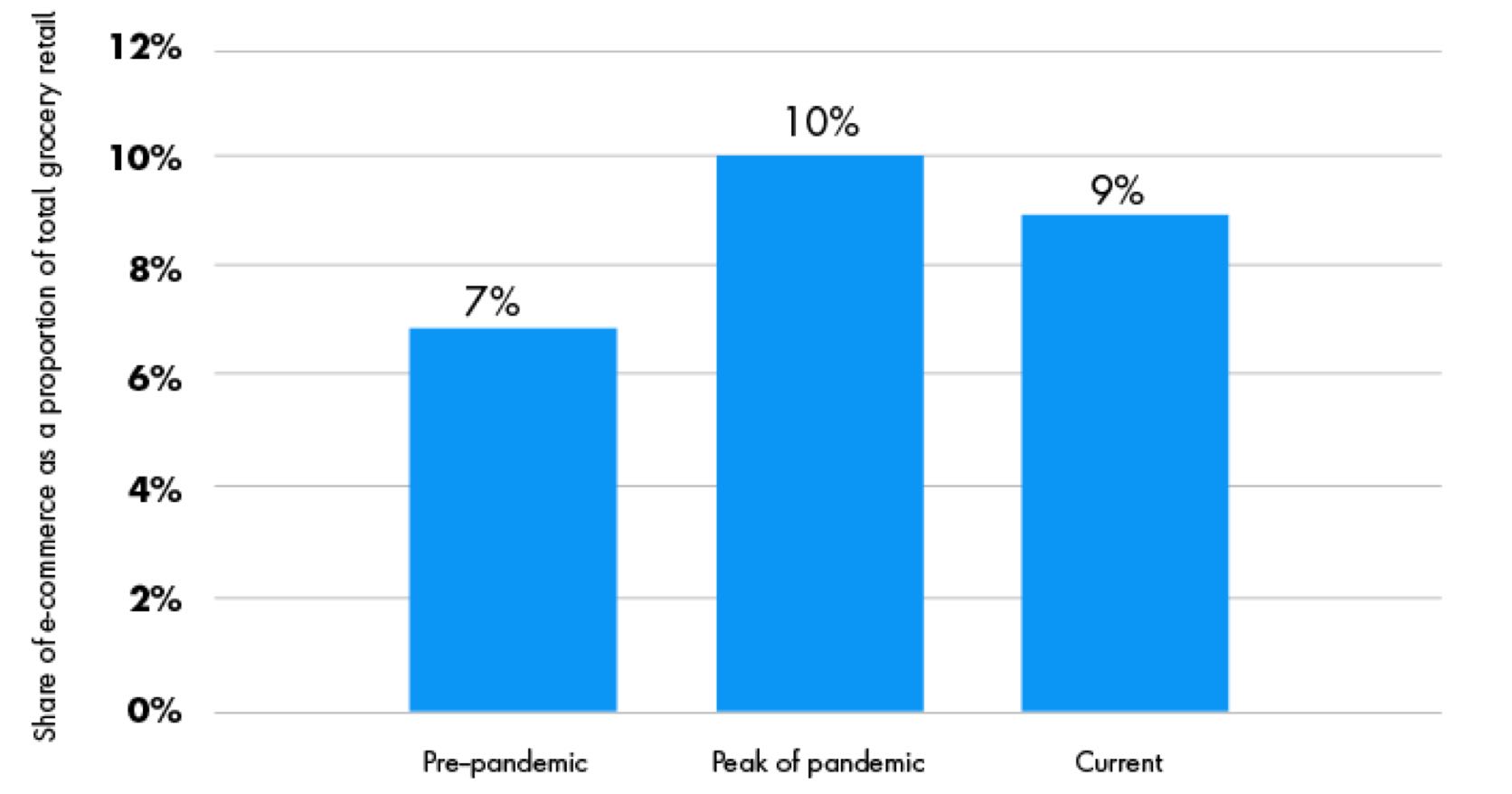

The promise of MFCs became apparent after the COVID-19 pandemic increased demand for online grocery shopping and delivery. While most grocery stores use the retail floor as a space for in-store shopping and online order fulfillment, retail store floors are simply not designed to work as a fulfillment center. MFC’s make the e-commerce process faster for customers and more efficient overall.

Today, the effect of the COVID-19 pandemic remains one of the key accelerators for the prosperity of the grocery segment within e-commerce. MFCs are expected to grow at a CAGR of 60% at a global level, while North America still has the highest concentration.

To fuel this further, it is predicted that grocery will be the main contributor to the MFC market with a 70-80% market share.

Global development of e-commerce shares of grocery stores before and after the coronavirus (COVID-19) pandemic

Albertsons grocery company is one of several large grocery retailers jumping into MFCs. The company recently partnered with Takeoff Technologies to utilize their MFC solution for streamlining grocery fulfillment. This will allow the company to process 3,500 online grocery orders weekly per location for a two-hour service otherwise impossible with the existing technology platforms.

How top grocery stores are implementing micro fulfillment centers

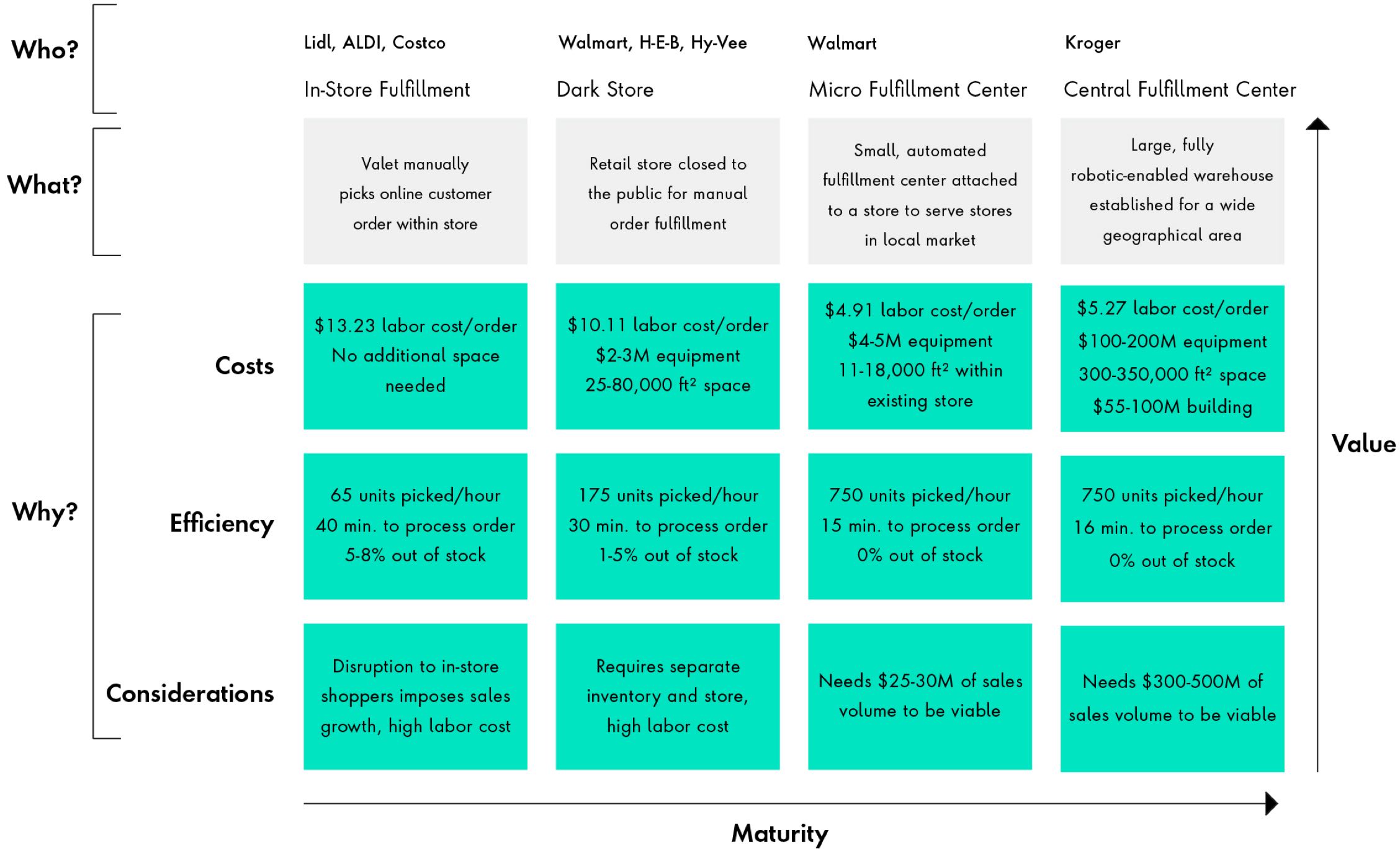

Other grocers are adopting advanced fulfillment models from dark stores to customer fulfillment centers to scale curbside pickup and last-mile delivery.

Below is a comparison of the approaches of some leading retailers, which depicts how these companies are implementing a curbside pickup model rather than a delivery model using MFCs.

Grocers are adopting advanced fulfillment models from dark stores to customer fulfillment centers to scale curbside pickup and last-mile deliver

Source: MWPVL

1. Micro Fulfillment: Passing Fad or Permanent Market Shift?, September 2019

How Profitable is Online Grocery Order Fulfillment?

According to a recent study, 86% of grocers are dissatisfied with their online profitability, 92% are dissatisfied with their online order picking efficiency, and 86% are dissatisfied with their labor utilization.

While MFCs can help solve picking efficiency and labor utilization concerns, grocery delivery profitability is still a problem.

The cost to pick, prepare and deliver an online grocery order is $10 to $25, with an average of $11 to $12 for most deliveries.

Unlike other industries where economies of scale decrease the cost per unit with increasing scale (volume of orders), the cost to fulfill online orders remains constant when using a store's staff or third-party labor to fulfill an order.

If a grocery retailer fulfills and delivers one order at the cost of $20, it can be expected that fulfilling 1,000 orders using the same process will still cost $20 per order.

Delivery involves additional complicated capabilities like dispatching and routing. Store managers and customers need the simplest way to track the drivers. Also, the chain of custody gets tricky and will require digital proof of delivery.

The Problems with Grocery Delivery Using Micro Fulfillment Centers

While MFCs have helped bring down the fulfillment cycle time, wider adoption requires scaling in operation. There are several other major concerns for grocery retailers related to delivery: profitability, brand loyalty, cart abandonment, and customer flexibility.

Grocery delivery versus grocery pickup profitability

According to a 2020 study, the only profitable online grocery model is automated micro-fulfillment center click-and-collect online grocery. This method had a 2% profit margin.

The least profitable method was home delivery with hand-picked fulfillment by the grocer, with a -15% profit margin.

Overall, click-and-collect, or pickup grocery fulfillment, is more profitable than any grocery delivery options.

Grocery delivery’s impact on brand loyalty

The inability to keep up with the demand for grocery delivery has resulted in many retailers contracting third-party delivery companies.

The main issue with this model is that third-party delivery does not reflect the image or brand of the store, which can create a lack of brand loyalty for customers and a lack of visibility for grocers.

Contract day employees work on alert-based triggers to fulfill deliveries for one of the numerous delivery service companies. There is no way for brands to monitor or enforce accountability for customer service.

The most common complaints are that the delivery drivers misplace groceries, might deliver only part of the remaining order, or refuse to deliver the groceries to the customer without being tipped upfront.

What we heard

“I think curbside is a blessing. Curbside helps me save time by not walking or waiting in line.”

“I feel much better doing curbside pickup [vs. delivery], because I trust that store employees know their products.”

“Curbside was easy, took about 10 mins—-going to the website, creating an account, putting my payment information in—-it was all so fast.”

“I actually really like this idea of curbside. You hopefully pay less of a service fee or driver tip. Minimum fee would be nice.”

Cart Abandonment for Grocery E-Commerce

Customers are sensitive to the delivery cost, primarily due to rising inflation in the U.S.

According to recent studies, additional “hidden” costs like taxes and delivery fees are the prime reason for digital shopping cart abandonment.

There are instances when an online retailer advertises free delivery, and only at the last minute does the consumer discover that this isn’t the case. For example, the consumer goes to checkout, fills in their preferred fulfillment method, adds credit card and shipping details, and only then (five-plus minutes into the checkout process) do they discover that their preferred delivery window costs significantly more than they expected.

In such a case, a high degree of cart abandonment is observed across the segments.

Customer online grocery order flexibility

When a customer schedules a delivery window, it’s difficult for them to change that time and date. They may have an option, but it will require orders to be re-routed, which requires specific delivery management capabilities.

If a customer can no longer receive a perishable online grocery delivery, the groceries could expire sitting outside.

How to Rethink Grocery Fulfillment Pain Points

While many customers prefer the convenience of grocery delivery, using MFCs as part of a curbside pickup fulfillment model can be more profitable and helps avoid the pain points detailed above.

Why does curbside pickup make sense for grocery MFCs?

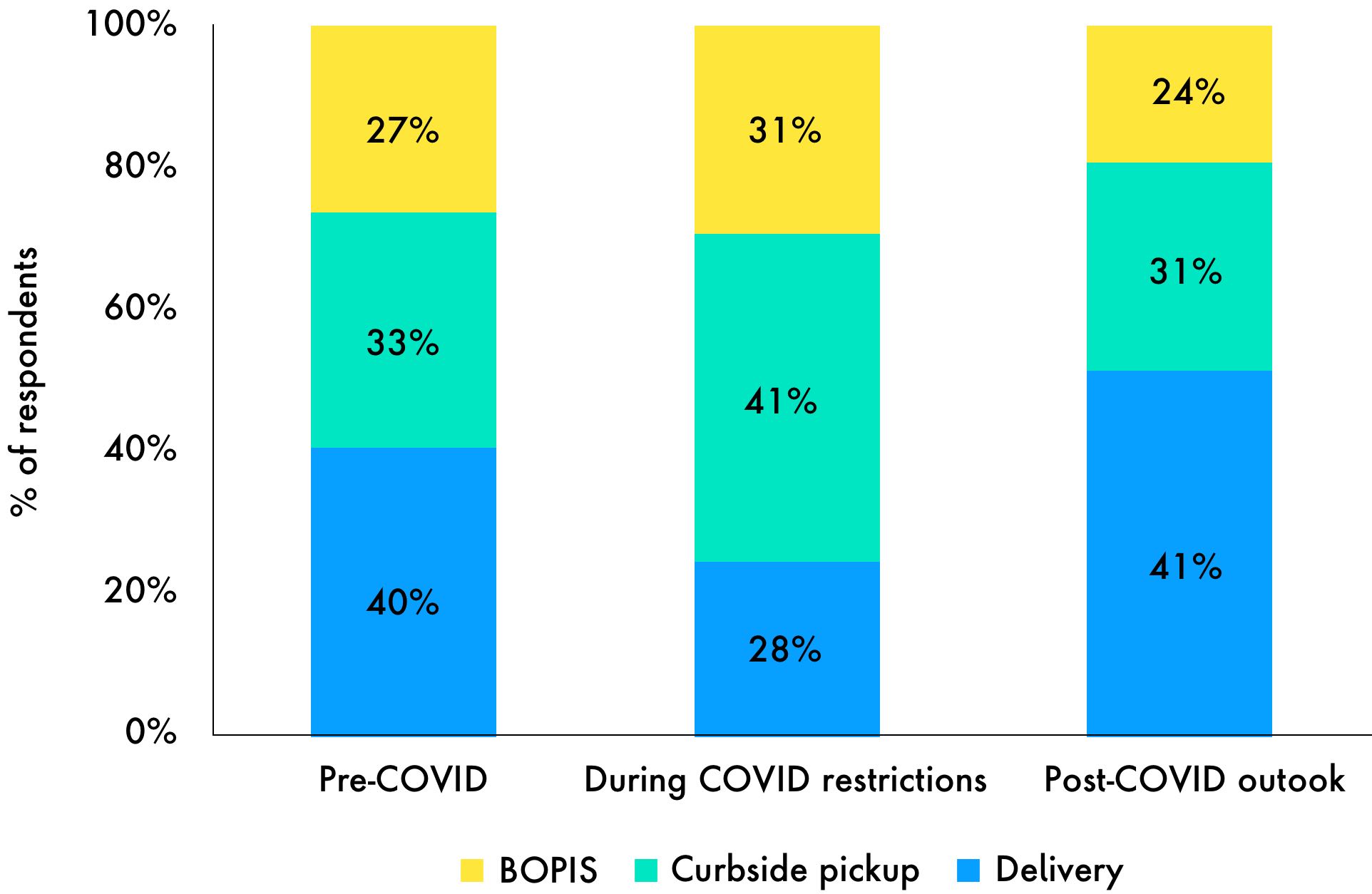

- 75% of consumers prefer pickup as their primary method of fulfillment, primarily due to costs associated with delivery

- 46% of online grocery sales are fulfilled through pickup, over delivery or ship-to-home

- 61% of online grocery customers used curbside pickup at least once in the last year (2021)

Research shows that curbside pickup is not just a COVID-19 temporary fix. It’s a fulfillment method that most consumers like and many consumers prefer.

Sources: Mercatus/Incisiv, Brick Meets Click/Mercatus

1. eGrocery Transformed: 2021 Market Projections and Insight, U.S., October 2021

So, how can grocery retailers improve pickup options using MFCs to improve online grocery profitability?

Using geofencing technology for grocery click-and-collect

Using geofencing technology for grocery click-and-collect

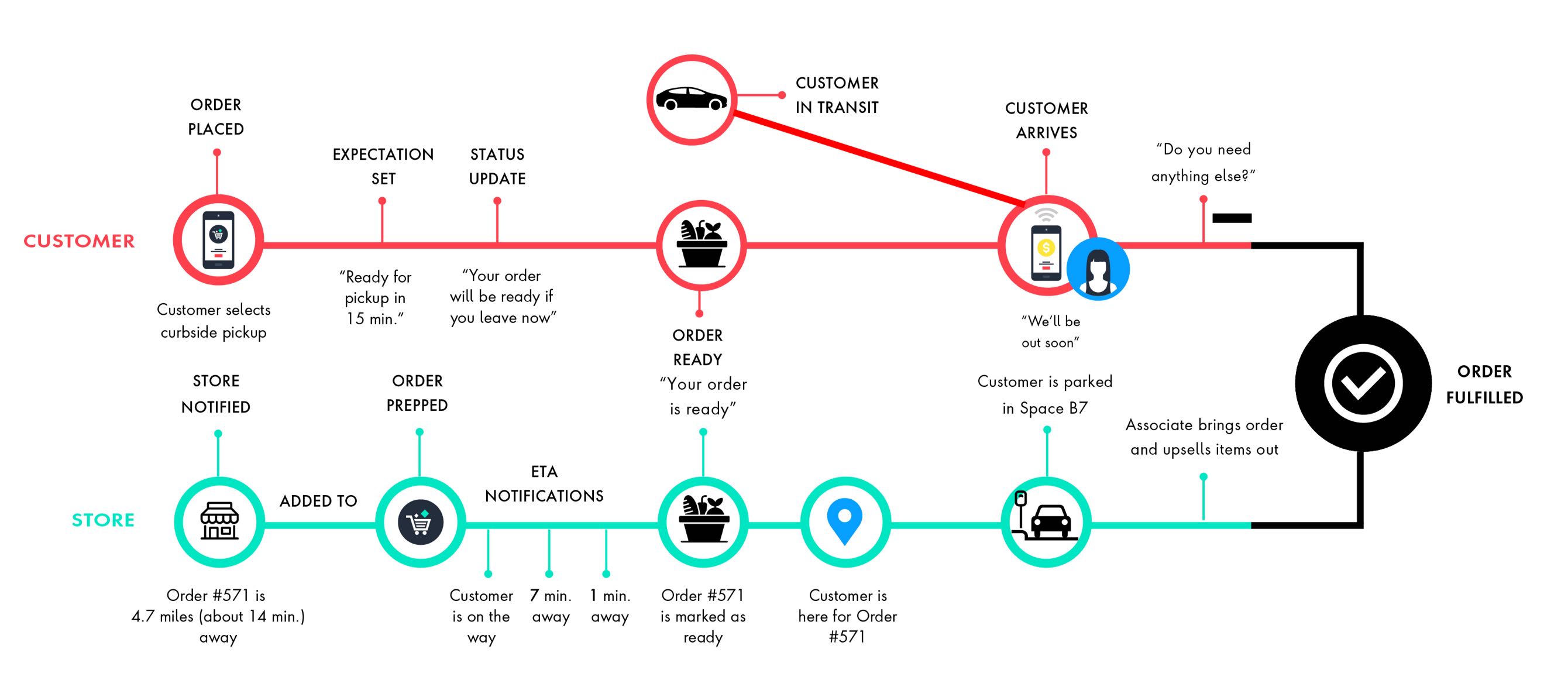

Geofencing technologies ensure a frictionless customer experience and increase operational efficiency. Grocers and other retailers are implementing geofencing technologies to boost operational efficiency and meet consumer expectations.

Retailers leveraging these technologies hand off items within less than two minutes of arrival. The flowchart below explains how some major retailers have implemented geofencing to expedite curbside fulfillment.

Furthermore, retailers are partnering with map service providers that update customer ETAs based on location and traffic, streamlining the curbside order handoff.

For example, the partnership between Kroger and Google enables consumers to see the best time and route to pick up their orders, thus increasing predictability and customer delight in opting for curbside pickup.

Using intelligent grocery pickup technologies with MFCs

Grocers who leverage optimized pick technology to carry out multi-order waves or zone picking have seen labor costs decrease by 30% and profit increase by $10k per store annually.

Intelligent pickup technologies enable MFCs to further lower their delivery timelines by automating the entire pickup process.

An example of this is Walmart’s deployment of the autonomous order picking Alphabot, which streamlines the order process by lowering dispense times, increasing accuracy, and freeing associates to focus on the customer.

Looking Ahead: Reshaping the Future of Micro Fulfillment Grocery

While MFCs can improve picking operations, their upfront expense can be daunting for retailers, especially when many have been able to increase pick rates through other less costly strategies like labor specialization.

Focusing on store pickup over delivery as part of an MFC strategy can help boost profit margins and still bring fulfillment in-house.

The MFC market will continue to be driven by online grocery, rapid delivery and dark stores, and as grocery retailers continue to compete with rapid delivery services like Instacart and Gopuff, building out a unique MFC plan can help grocery stores prepare for the grocery e-commerce future.