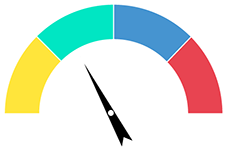

The results of this year’s Mobile Experience Barometer demonstrate that there is significant scope for most providers to improve their mobile offering.

Given the spiralling cost of energy and the withdrawal of cheap fixed tariffs, most customers no longer have the option to save money by switching. This leaves managing their energy consumption better as they only practical way to reduce bills. Customers are looking to their suppliers to do more to help them, and we see mobile apps as the key enablers.

The winners will be the providers who can equip their customers with information and tools to help them to save money. Customers expect more than generic hints and tips on energy saving. They are seeking features such as time-of-use tariffs and contextual information based on their smart meter data – such as breaking down consumption by appliance (as provided by British Gas) or offering comparisons with similar households – along with timely, actionable advice.

They also want more integrations with third-party apps such as Alexa or Google Home, as well as energy management apps such as Hive or Nest that give them greater control over their energy consumption. With their focus predominantly on basic account-management functionality, most energy suppliers are failing to grasp this opportunity to provide consumers with the intelligent, value-added services they want.

Finally, we believe their generally poor performance on brand personality illustrates a further opportunity: to use more distinctive brand personality to differentiate their offering in a market where switching based on price will be a less powerful trigger for consumer choices, at least until the energy crisis is behind us.