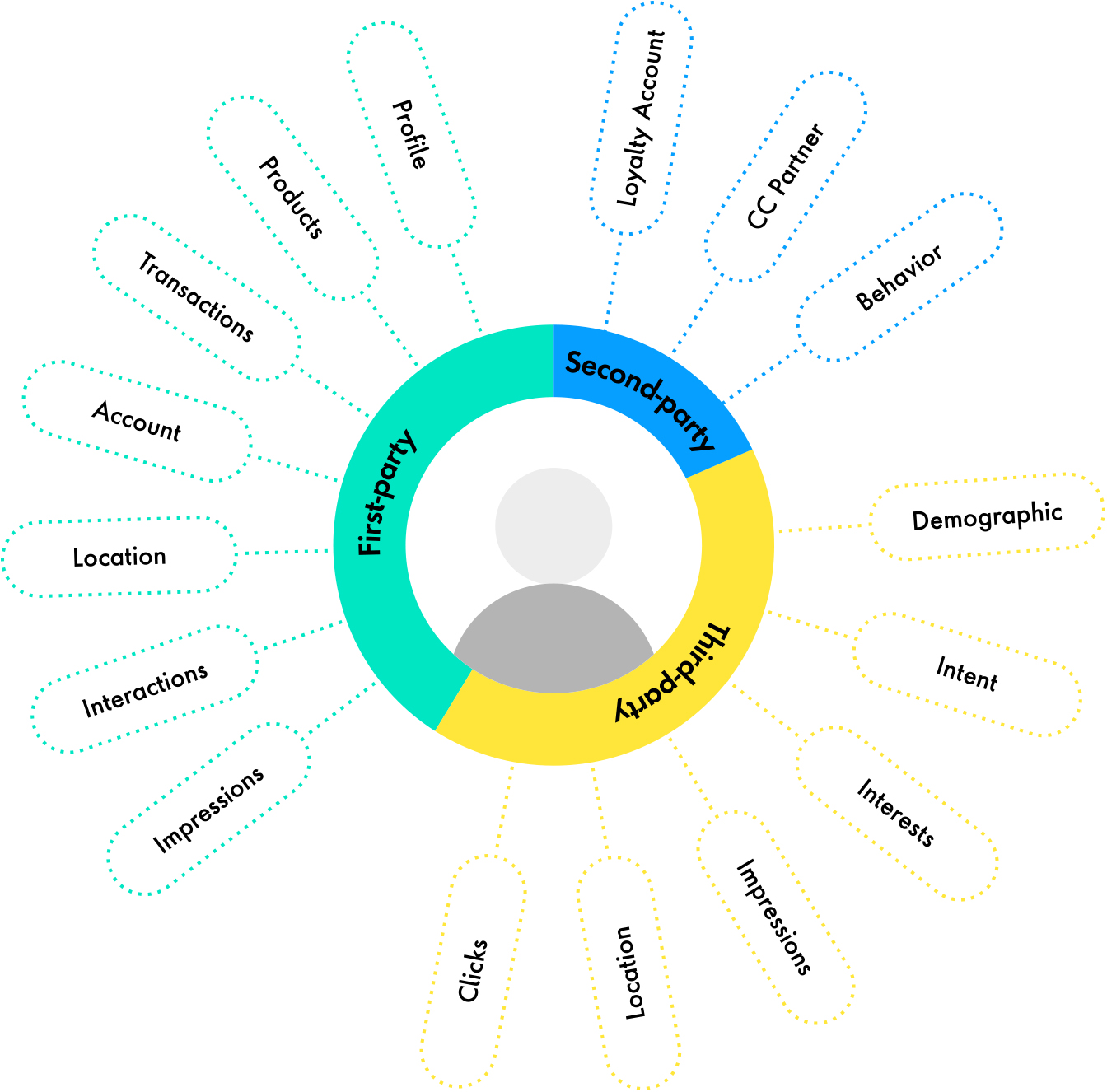

When it comes to Anticipatory Banking or other AI and machine learning approaches to better predict and deliver on your customer needs, the ability to capture signals is critical. For example, if a bank wants to identify customers who need financial guidance, it needs to look for signals like requests for credit limit increases, higher credit card transactions and increased activity in a particular category. If that category is health, the bank might also confirm an increased number of visits to doctors offices, etc. Together, these signals tell the bank their customer is facing a medical crisis and will likely need additional funds to pay for treatment, allowing it to present offers or products that can help the customer meet health-related financial commitments. To capture these signals, however, you need the right foundational infrastructure, as well as technologies to transform data into insights.