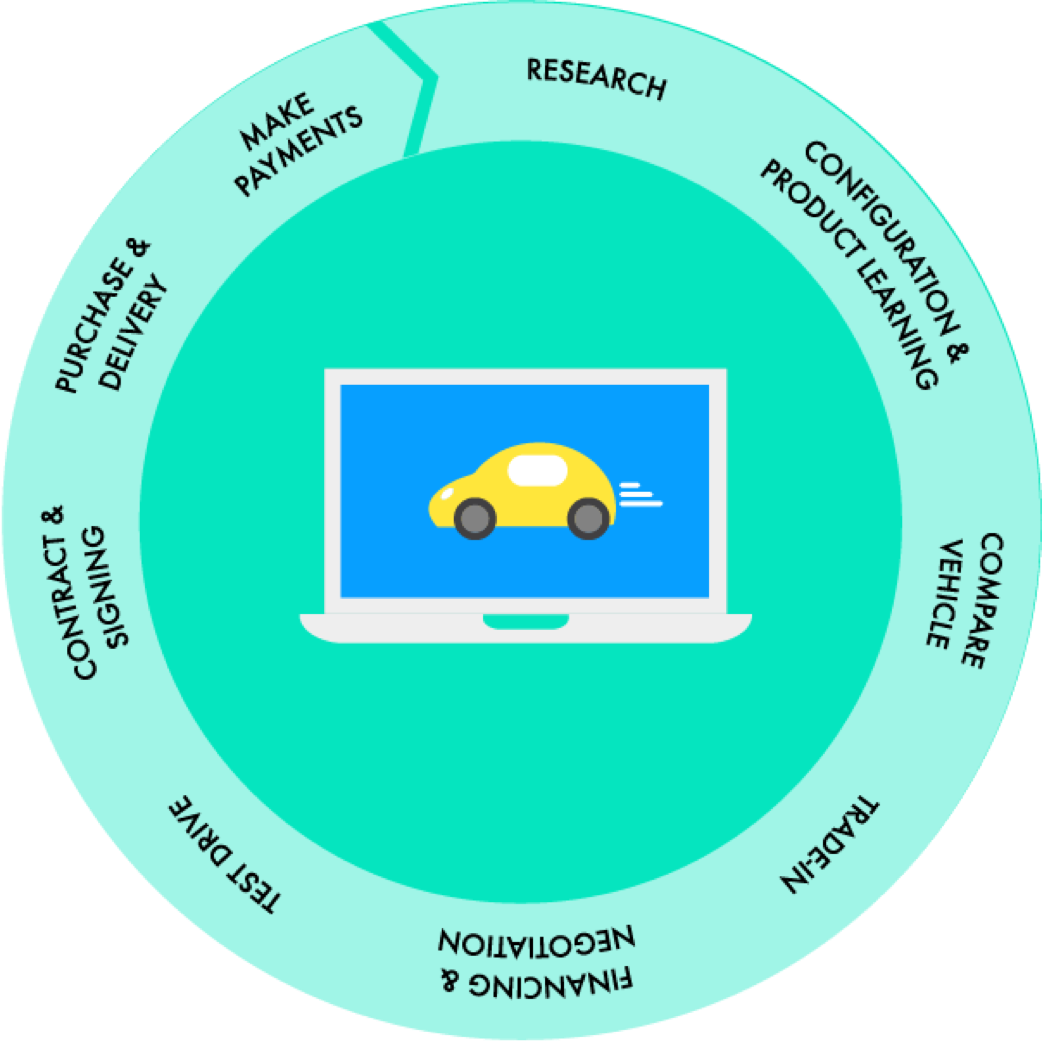

Traditionally, "digital retail" in the auto industry implied customers could learn about, research and compare vehicle features on OEM websites and traditional sources like Consumer Reports. More recently, a number of digitally focused disruptors such as Carvana, Carmax and Tesla have entered the market, offering unique, omni-channel experiences like flexible return policies, virtual auctions, home deliveries, online negotiation and virtual trade-in valuations.

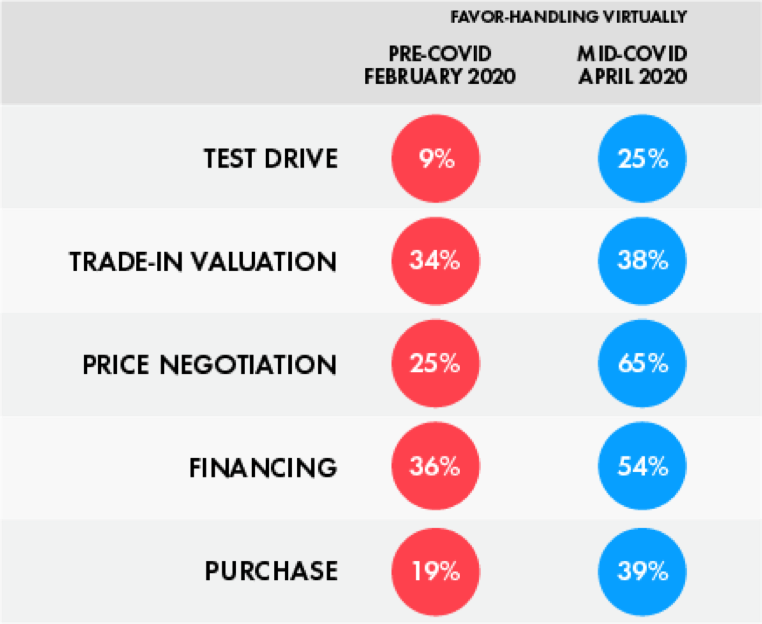

These digital leaders recognized a shift in customer expectations and focused on creating seamless user experiences across the entire shopping journey. As traditional OEMs began to take notice, some companies made major investments in digital commerce capabilities, such as Fiat Chrysler’s Online Retail Experience, Honda’s Shop Simple program and Porsche’s Online Retail Pilot. Dealers and OEMs who invested in digital shopping experiences have been able to counteract some of the industry-wide losses from the pandemic and are poised to benefit the most as we move towards recovery. Many digitally enabled OEMs are seeing increased, higher quality leads that are 30 percent more likely to buy and a two to four-fold surge in website traffic compared with pre-COVID-19. These online toolsare, in some instances, responsible for more than 20 percent of new leads during the second quarter of 2020.

Some dealers have been quick to respond, replacing traditionally in-person activities with digital capabilities. In addition to maintaining the sales funnel for dealers, customers are enjoying a truncated sales experience and digital services such as home delivery and e-contracting. Ironically, spending less time with customers in person will allow dealers to unlock higher customer lifetime value down the road. As seen in research, a better, more streamlined user experience increases consumer satisfaction and loyalty, and allows dealers to remain safe, increase conversion rates and garner rich customer insights, all of which further the ability to create personal, authentic relationships with customers in perpetuity.