Create efficient and effective marketing and sales

To remain effective in the face of disruptive new players and business models, the sales network will require a ground-up transformation that focuses on connecting the people, technology and operations across all of these participants. Integrated data platforms allow each entity to connect meaningfully with customers who have rising expectations. Whether they sell directly through key account managers, online or rely on a multichannel ecosystem built upon third-party partners, OEMs must manage the feasibility and profitability of each channel—and that is no simple task. The key question is how to optimize investments depending on a brand’s specific business model, product lifecycle, target audience, market and competitive landscape.

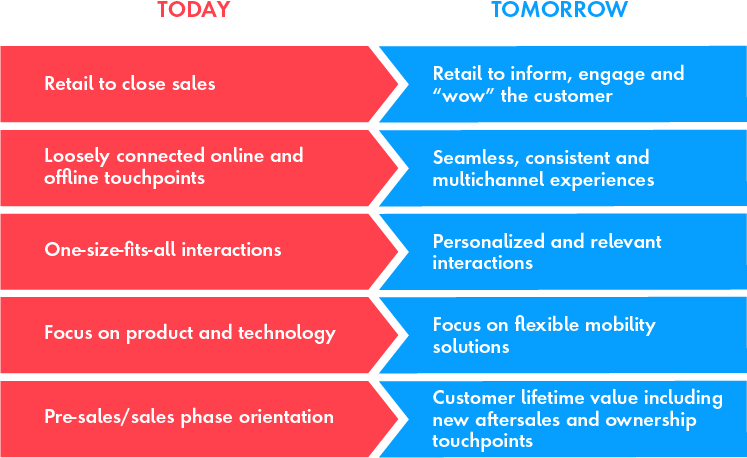

To meet these expectations, marketing and sales will need to create optimized and personalized digital assets and touchpoints informed by data and insights. It’s important to move quickly and flexibly with the market–at this stage, sales and marketing must shift to a mindset where experimentation and innovation are encouraged, gathering customer feedback along the way. Teams must listen, test, learn and iterate in real time; feedback from customer interactions not only results in the creation of better assets that meet specific needs, it allows them to get into market faster and refine as they go. And this must happen along the entire sales and marketing value chain, from headquarters to national sales companies and importers to dealers.

Once measurement, optimization and goals are implemented across the sales channels and buyer journey, the question of where and when to invest funds in things like marketing tactics and incentives will become less risky and more predictable. However, decisions on investments must be made considering various forces in the market, competitors and automotive lifecycles across all channels.

Key challenges faced today occur on a global scale and include duplicate work, lack of measurement, disconnected experiences and inconsistencies. This new approach to sales and marketing drives transparency, speed and flexibility through multi-disciplinary teams armed with data, allowing for the creation of global frameworks, standards and best practices that can be adapted locally.

What needs to happen next

It’s time for OEMs, national sales companies, importers and dealers to bridge the gap that will allow them to collaborate more effectively to create a data-driven, seamless experience for their customers across all the channels and buyer journey. The value chain needs to transform into a consumer-focused ecosystem to cater to the emerging consumer needs. OEMs must develop trust-based collaboration with dealers to learn together, pilot new ideas and decide what to do next to impact the bottom line for both entities. Collaboration and smarter ways of working can ultimately lead to profitability for all.