What issue can we solve for you?

Type in your prompt above or try one of these suggestions

Suggested Prompt

The False Promise of Omnichannel: Time to be Channel Conscious

The False Promise of Omnichannel: Time to be Channel Conscious

Recognize existing siloes

Current customer behavior replicates the product and channel siloes across financial institutions. Too much friction exists with disparate processes and systems to allow handoffs between most bank products and channels.

Let’s say you have a customer who wants to refinance. He’s looking to buy a car but also has a kid in college who needs a student loan. He’s always on the go and does online banking whenever appropriate but feels more comfortable talking to another human for bigger financial decisions. Are the employees at his local bank branch cognizant of this customer’s actions online before providing service? And if not, how quickly can they get up to speed?

Bank branches have always been organized by functional areas overseen by different people. It was never set up for end-to-end journeys. They may have invested in the technology but have not seriously changed the day-to-day strategies staffers use to serve customers.

That’s why attempts at omnichannel can result, for instance, in customers starting in a mobile app but getting called on the phone and just going to the local brick-and-mortar branch – explaining themselves to a new person each time.

Although COVID-19 has accelerated digital-channel adoption, banks are still struggling to meet the needs of large customer populations. Even the rapid expansion of digital services has not addressed this yet.

The persistence of this problem stems from the misconception that customers value channels rather than experiences. Thinking in terms of channels is cost-minded and banker-centric. Customers don’t view their banks this way. The channel is merely a conduit to action, such as making a payment or taking out a mortgage.

Given most banks’ legacy systems environment, the cost and complexity of creating a single universal data lake for all channels and processes is to pay back with the benefits omnichannel offers.

Distinguish between channels

Basic human behavior tells us that channels are not equivalent and interchangeable. There will always be life moments, such as home purchases or retirement planning, where customers will always want more human support.

A substantial number of customers, particularly senior citizens, have not shifted to digital products. The local bank branch is still their primary method of interacting with the bank. If you keep investing in digital channels without thinking about the proper level of support for customers, banks will never be able to solve for the large population of older customers.

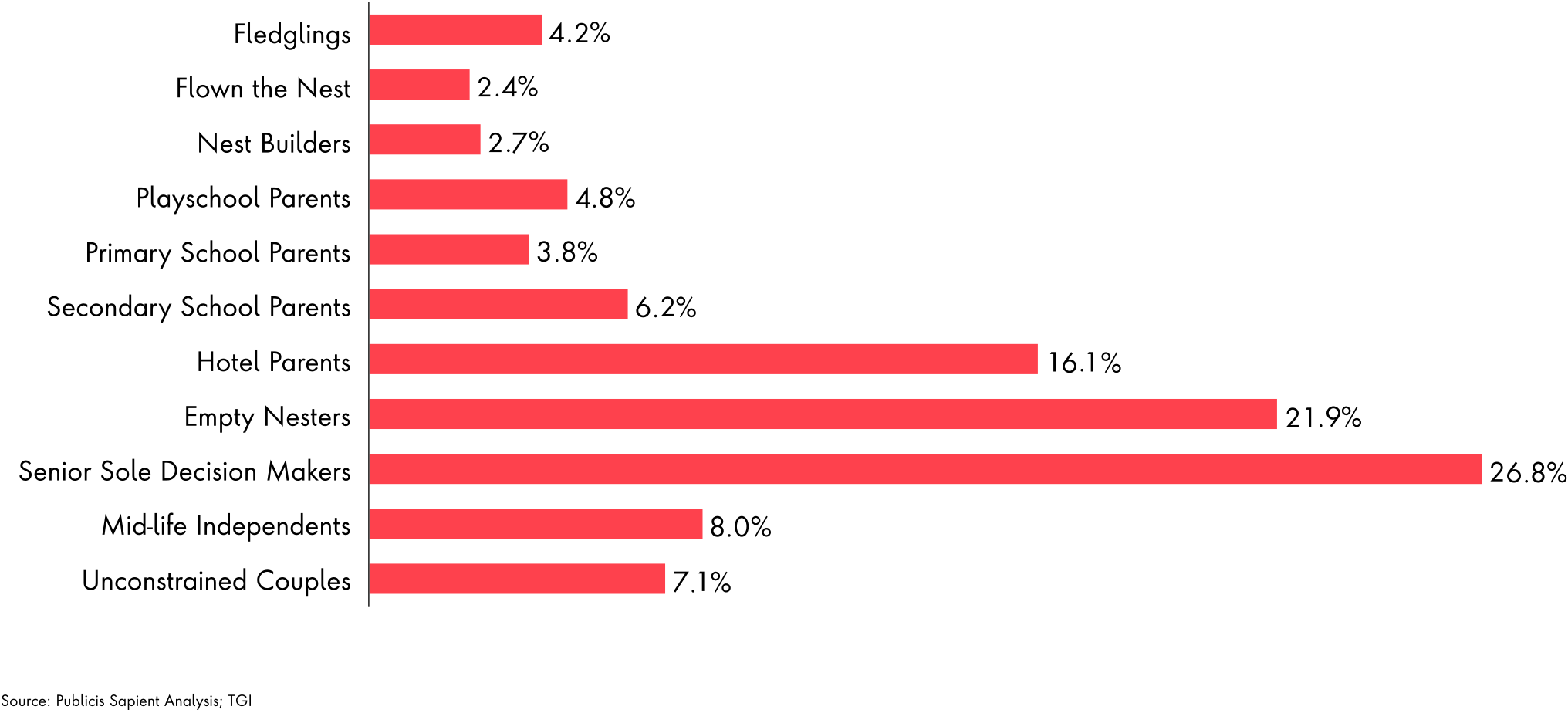

Proportion of customers that are branch-only % of the customer segment

Figure 1: Branch-only channel interactions

Most customers exhibit hybrid channel behaviors, yet there is still a meaningful proportion who are branch only.

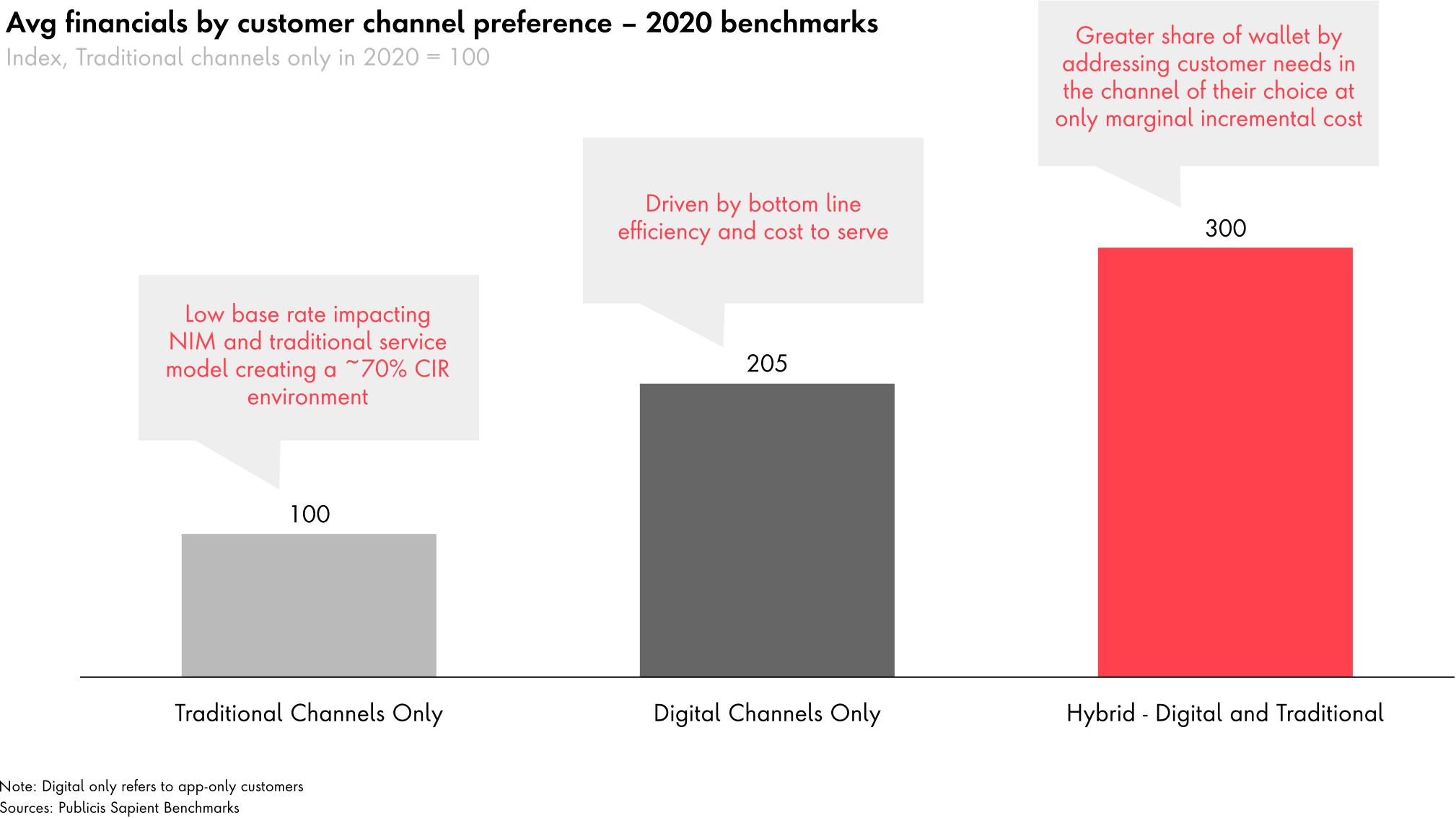

Our benchmarking analysis of banking customers shows that banks would generate the largest profit by serving customers with a hybrid of digital and traditional channels.

Banks need to prudently yet ruthlessly prioritize channel experiences that will have the greatest customer impact. We emphasize that banks should practice caution when fully assessing where they need to invest heavily and where they should focus their awareness instead on settling underlying legacy debt.

But once this distinction is understood, banks need to act. They can no longer afford to invest in all channels as if they are of equal importance and likelihood to generate a profit.

Figure 2: Hybrid channel engagement economics

Hybrid channel engagement has superior economics to both digital-only and traditional-only channels

Connect customers with the right channels

Regarding channel support, we encourage banks to work out which channels would best support specific customers given their needs and personal circumstances.

From a pure cost perspective, 90 percent of the branch visits in Thailand are just people making payments, which is a hugely ineffective way of transferring money, having people queuing up in branches. From a channel and customer point-of-view, how can you solve for these? If you free up these branches, you will have a material customer impact.

The customers that are only interacting in the branch are the lowest value customers and those that are digital only are typically the younger, and therefore, lower value again. The sweet spot is the middle-aged population that do need digital but also have more complex family and household arrangements. They need a hybrid of services. Relevant because they are worth so much more to you.

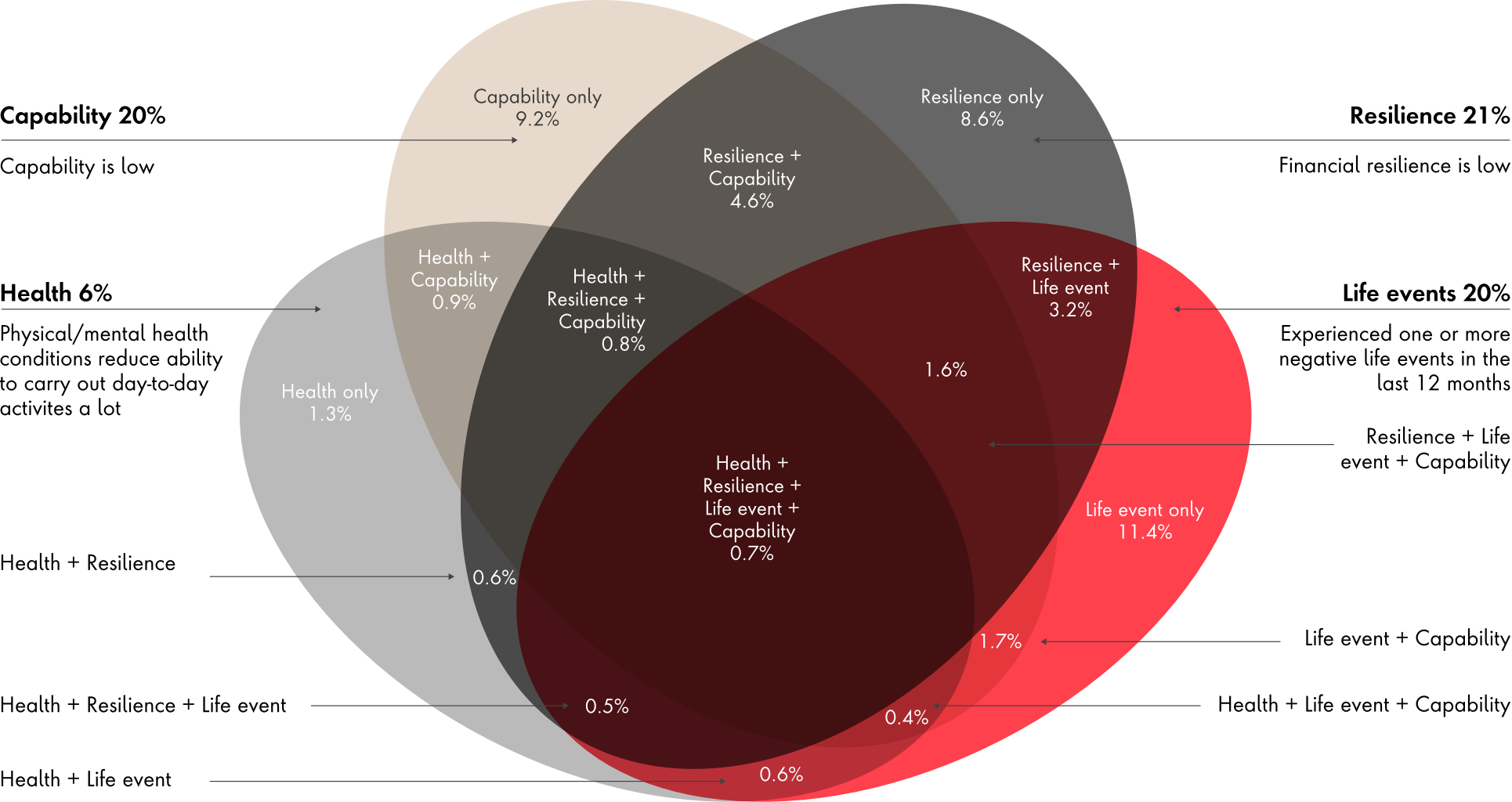

It’s also important to make sure vulnerable people are not slipping through the net. In the current economic climate, the Financial Conduct Authority (FCA) has estimated that 24 million British adults have vulnerable characteristics but has yet to publish its 2020 guidance on how this should be addressed. We encourage channel consciousness.

Figure 3: Different populations of vulnerable customers

Proportion of UK adults displaying each of the drivers of vulnerability (from Financial Lives 2020. Base: All UK adults, 18 and over [16,190])

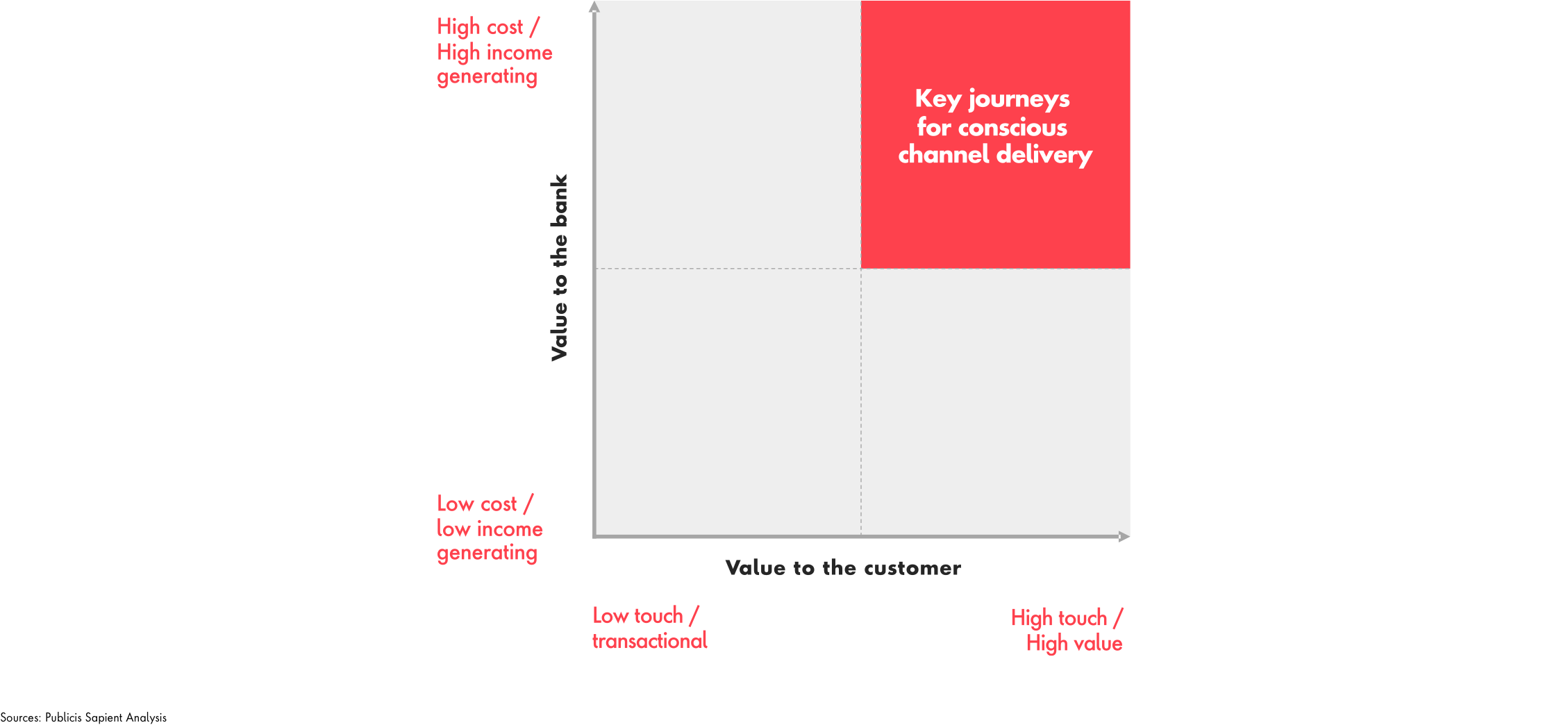

To identify and improve key journeys, a bank must look at their channel strategy from two perspectives: the value to the bank and the value to the customer. This can help banks figure out where to invest the bulk of the funds.

Figure 4: A simple approach to prioritise which journeys require a channel conscious approach

Channel strategy changes across key parts of the customer journey and the particular goal or need they have. For example, banks might want face-to-face video calls for a high-touch financial adviser but choose to have artificial intelligence (AI) handle frequently asked questions. To facilitate this, smart online banks like Monzo are using AI to triage customer-service requests to determine which need to be routed to an agent and which can use a self-service menu.

Orchestrate customer journeys

For priority journeys, banks need to both orchestrate experiences across channels and ensure consistency of data. This will vary in complexity depending on journey and the current state of the organization. For payments and transaction data, this may well already be integrated seamlessly, but the reality of high-value journeys will necessitate a combination of applications and services that are typically wholly separate.

To enable journeys across channels, it is imperative that banks unify customer data. This allows a common set of experiences to be delivered to customers regardless of their channel or product. Banks must gather, clean and combine customer data. This central data lake can then communicate with all consumer-facing platforms to deliver personalized, omnichannel experiences.

These depositories of raw data function as the entire operation’s nervous system. They can process and analyze signals that, in turn, direct the appropriate bank response via whichever channel the customer prefers.

Banks can enrich their view of the customer by incorporating first and third-party data, such as open banking transactional data and innovative data sources like Epsilon. Identity consciousness can trigger enhanced customer support when necessary.

Get started

The truth is that authentic omnichannel, a multichannel approach to providing harmonious customer experiences, is not achievable for most banks. The only realistic way to accomplish such a transformation would be to change the entire structure of an organization, dispose of legacy systems and migrate it to an entirely new operating model.

Unwilling to take the leap, most banks have been left with an insufficient omnichannel strategy that treats all channels as equivalent and interchangeable. Any digital transformation of disparate systems and teams has been labeled omnichannel – swelling the transformation ticket but failing to connect the enterprise.

The crucial step to becoming channel conscious is relinquishing the failed notion that all channels and journeys are equal so banks can focus on the most valuable. Then they can improve the customer experience incrementally.

- Hunt – Identify and prioritize the customer journeys based on value to both the customer and the bank.

- Shape – Determine the data and experience capabilities required to offer a more conscious customer interaction.

- Build and scale – Using a “steel thread” approach, delivering on the most important paths and journeys and ensuring that all the elements can be linked together, before building upon those capabilities to achieve scale.

Related Articles

-

![Promo image Graphic]()

When Banks Target New Customers, Personalization Is Paramount

Financial institutions can avoid wasting energy marketing to people at the wrong time by creating holistic views of potential clients.

-

![Mobile Phone]()

Speed Layer for Nationwide Building Society

Learn about our development of the fast, secure and scalable digital foundation that increases the resilience and availability of services.

-

![escalator signifying upward momentum]()

Accelerating Change in Financial Services

As technologies converge, banks will prepare for colossal acceleration that will fundamentally change finance. Here are seven ways banks can prepare.