Energy & Commodities

Part 3: Growth

Unlock Value with Capabilities for Energy Trading Innovation

Joseph Tabita

Type in your prompt above or try one of these suggestions

Energy & Commodities

Part 3: Growth

Joseph Tabita

Executive summary:

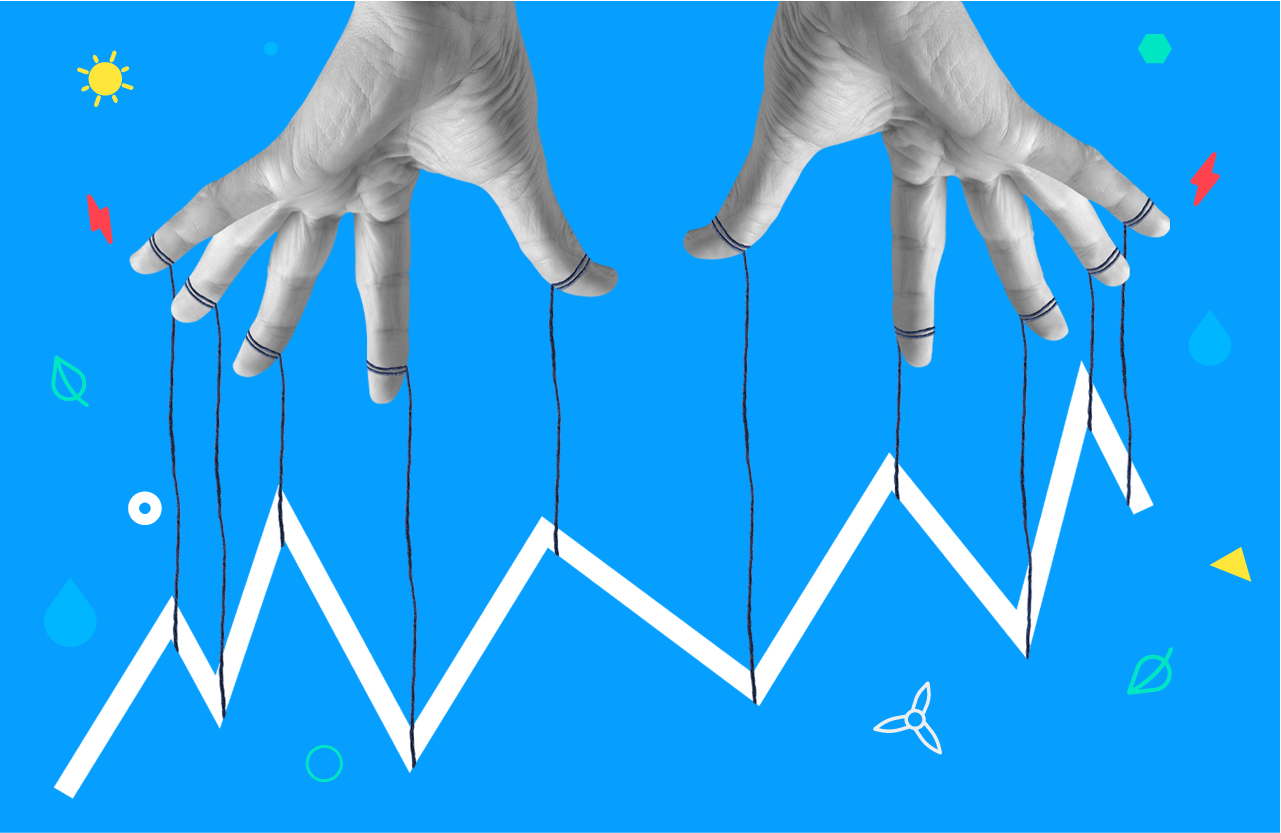

Energy trading companies are in a period of change. The energy transition, evolution of customer behavior, societal shifts, new business models and technological advancements are redefining what disruptions supply and trading organizations may face—and what they can achieve.

To address these disruptions, organizations can embrace digital transformation programs focused on one thing: innovation that supports goals and creates value.

The space between where a business is now and where it hopes to go next represents opportunity, and innovation is the path forward. Innovation is not a one-off “eureka moment.” Instead, it is a process that requires time and investment in multiple corners of an organization to marshal their digital and non-digital capabilities and deliver results.

Trading organizations can follow a three-point blueprint to embark on the digital innovation process and fuel innovation: articulate their goals, create a plan of action and invest in capabilities that will transform their ways of working.

If innovation is a process that can be broken down into steps, that process starts with a single question: What does an organization want to achieve?

Broadly speaking, there are three business goals that make the biggest impact on organizations: cutting costs, increasing revenue and enhancing agility. Each business must work out the specific combination of these that will best serve its interests. Businesses should refine their goals so that they are reasonable, achievable and impactful. An organization aiming to increase revenue, for example, should weigh the specific approach it may want to take:

Serve existing markets and customers: For example, crude and refined products will remain relevant, but the supply and demand equation will change more quickly. Creating insight and advantage here will pay dividends down the road.

Enter new markets: Power trading and network management are evolving quickly with the increased footprint of virtual power plants (VPPs) and the advent of distributed energy resources (DERs).

Create new markets: New energy commodities are going to create new markets and challenges (e.g., hydrogen and ammonia). Leading the way here may open doors to new partners and help cement a strong position in the post-fossil fuel world.

Defining and refining its goals empowers an organization to be intentional about its future—and it will unlock value by focusing growth on targeted areas, investing with precision and creating new opportunities.

Having made the key decisions about its business goals, organizations must define how innovation will support those goals, invest with those goals in mind and create a roadmap to guide innovation and investments.

If, for example, an organization identifies a goal of becoming more agile, it must define “agility” in actionable terms. Does agility mean de-siloing data so that it can streamline and automate processes? Does it mean developing new, leaner platforms that are more responsive and adaptable? In either of these cases, the organization can invest in its goal of becoming more agile by focusing its efforts on modernizing systems or building new platforms that are responsive to market conditions.

Once an organization engineers a feasible digital innovation strategy, it should develop a calendar to execute it. Targeted timelines will enable the business to progress at a reasonable pace. Rolling out a calendar not only fuels the project’s momentum, it also helps an organization determine when, where and how to invest in capabilities that will turn the goal from vision to reality.

With the key strategic decisions made and the plan in place, the organization should focus on bringing together digital and non-digital capabilities that execute its goals and foster continuous innovation.

What are these capabilities? They include new tools, future-focused technologies and streamlined ways of working that modernize business processes in an industry that has remained largely unchanged for more than a century. These capabilities include the following:

Fostering innovation is about creating value. Companies should constantly optimize existing products and services to extract more value from them and simultaneously seek new sources of revenue.

Energy companies leading change in the industry are doing this by investing in capabilities that will boost outcomes: strategy, products, engineering, customer experience and data. Together, these capabilities create value by finding solutions and setting up systems for ongoing transformation to meet future goals and stay ahead of the curve.

Publicis Sapient partners with organizations to develop impactful capabilities that drive innovation and help them face the future of energy trading with confidence, skill and purpose. Get in touch to explore how to build new capabilities to fuel innovation.

Digital transformation is a journey. Organizations can find their way forward by investing in efficiency, agility and growth.

Moving to the cloud can be an efficient game changer for energy companies, but it requires careful consideration to make the most of it.

To thrive, energy trading companies must embrace a tech-driven identity to attract top talent and embrace digital ways of working

Volatility in the energy market presents an opportunity for trading organizations to upgrade their operating model.

Microsoft-fueled energy Supply, Trading and Risk transformation prepares organizations for future challenges by modernizing systems and unlocking value.

The oil and gas sector can strengthen its value chain by unifying its approach to data.