Energy transition and volatility are making life more complex

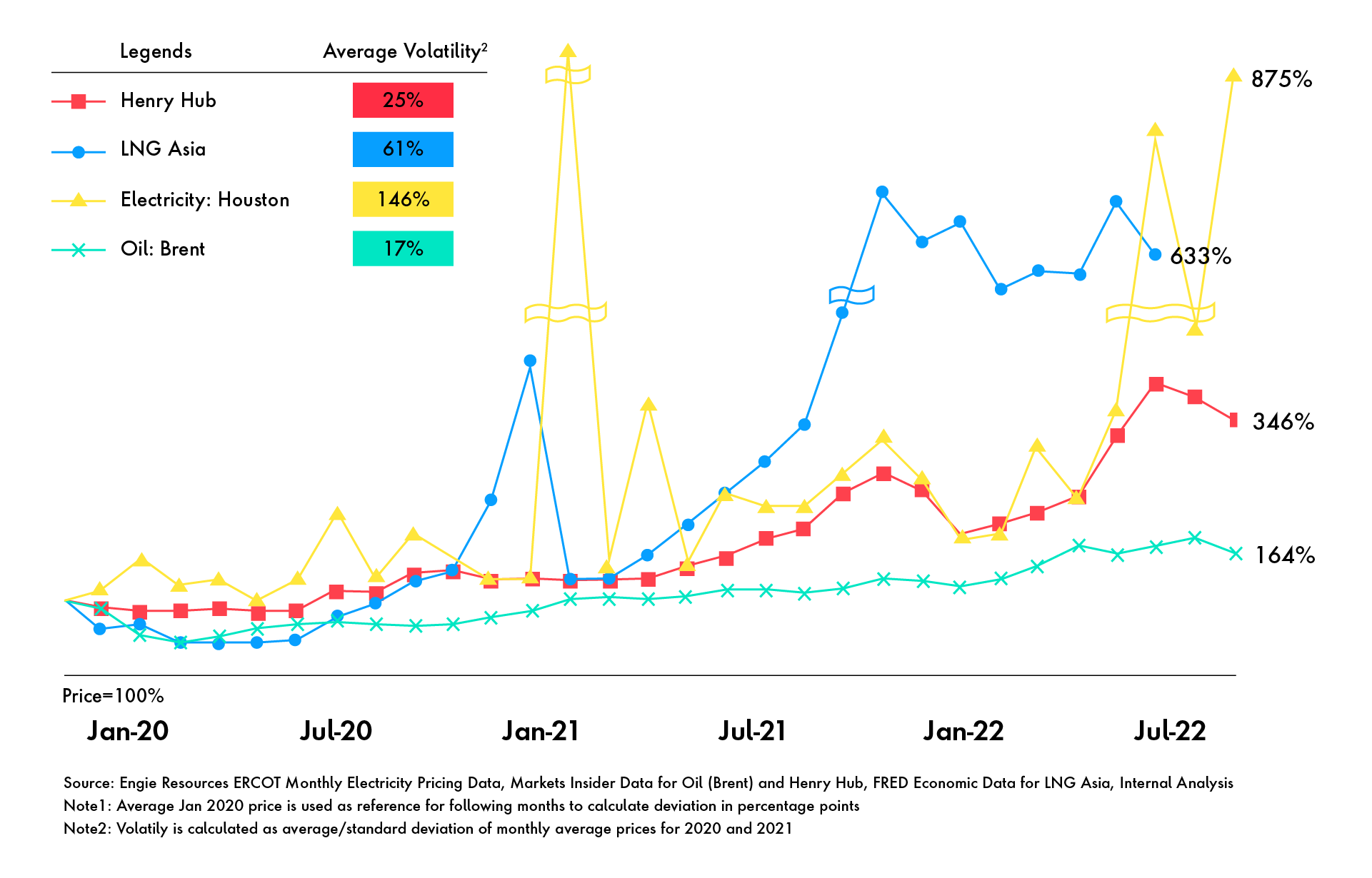

War in Europe and extreme weather events in Texas have sent shockwaves across trading markets. Is this volatility a one-off incident based on the constellation of these unique, unforeseen events? Or will volatility become a new normal, magnified by energy transition and the push for carbon neutrality by 2050?

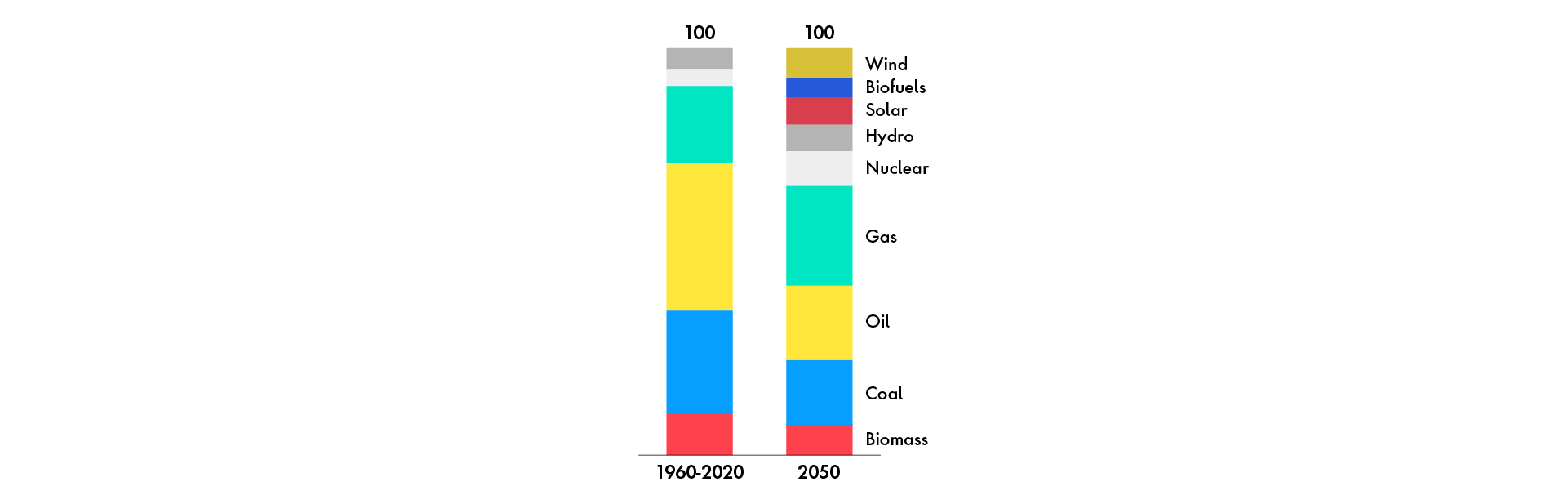

This energy transition will be different and far more complex compared to previous energy shifts. The 19th century became the “century of coal” as energy consumption transitioned away from wood. By the next century, oil had surpassed coal as the world’s primary energy source. The coming energy transition differs from past ones in a critical way: The world will not have a single favored energy source in the foreseeable future. Instead, it will depend on various interconnected energy sources (Figure 1).