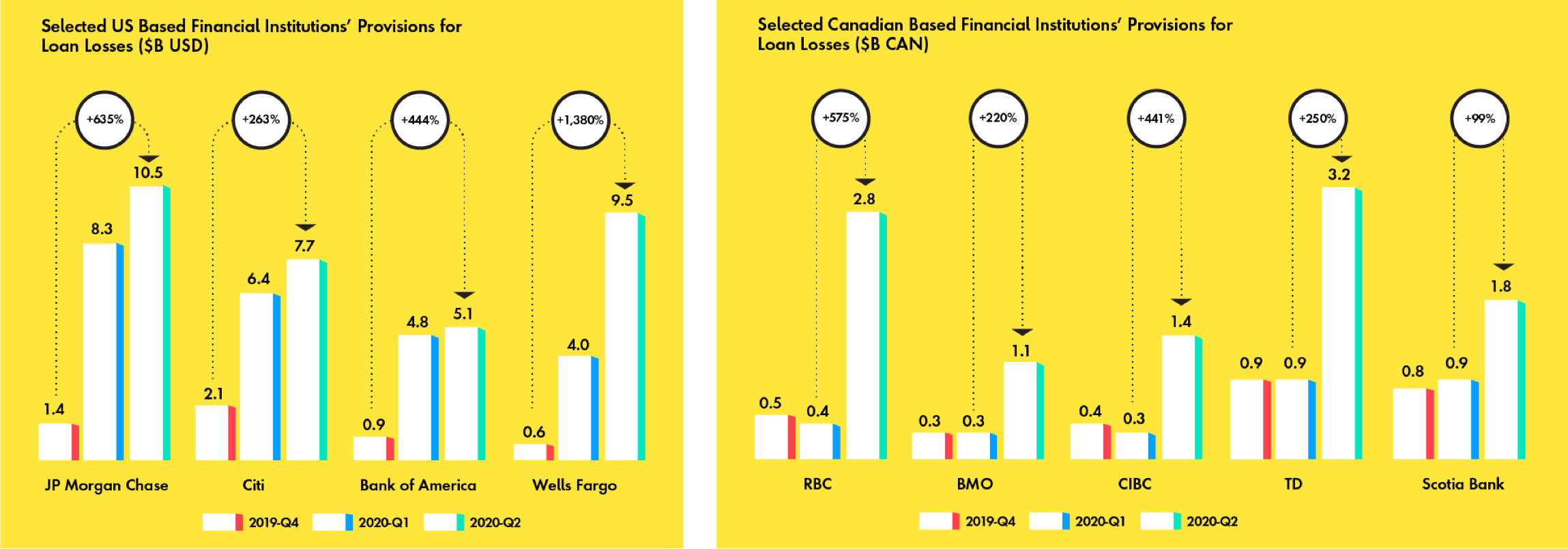

These provision increases may only be the beginning. For perspective, during the global financial crisis, which began in 2007, charge-offs were elevated for three to four years and charge-off rates in the U.S. peaked approximately two years after the onset of the crisis.

There is also potential for this recession to be even more severe than the financial crisis. Unemployment levels peaked at 14.7 percent in April in the U.S., which was materially higher than during the financial crisis (10 percent at its peak). While the unemployment rate has since dropped below 10 percent, significant uncertainty remains regarding how much and for how long government will provide financial support to citizens, and the potential for renewed lockdowns due to virus outbreaks.

Raj Chakraborty, senior managing director, financial services, said the current default rates are surprisingly low due to bank forbearance programs along with government assistance but expects a wave of defaults once that support dries up.

Today, banks typically rely on credit bureau and FICO data along with recent customer behavior in their account management models. The models may be run on only a monthly basis while bureau and FICO data, which are valuable and predictive, often have multi-month lags and do not reflect rapidly evolving consumer circumstances created by this crisis.

Chakraborty said banks need additional insights derived from a range of new real-time data sources if they want to identify problems early and manage changing situations proactively

Our solution

Banks will need to make smart decisions based on real-time data concerning the behaviors and needs of customers. Publicis’ solution focuses on three main areas:

- Customer acquisition: Suppress marketing to high-risk customers identified by advanced analytics to limit adverse credit selection while also identifying prospects that are both low risk and meet the bank’s standard underwriting guidelines – all within regulatory compliance requirements.

- Proactive distress management prior to delinquency: Identify existing customers likely to be at high risk of being in early stages of distress, gather additional information and provide relevant content and timely interventions to reduce risk and exposure.

- Hardship programs post-delinquency: Segment customers by their propensity to repay and potential lifetime value. Funnel only the right customers into targeted hardship programs, and ensure a strong customer experience and appropriate payment structures for high-value customers that are likely to repay.

Resilient customer data platforms (CDPs) are central to these data-driven solutions.

These solutions are different from other options because they leverage real-time, in-depth and wide-reaching data to redesign the customer’s experience' to 'customers' experiences as they transition into financial hardship. They have direct access to predictive-intent signals unavailable elsewhere. This means banks will pick up on default signals earlier than they would have relying on more traditional sources.