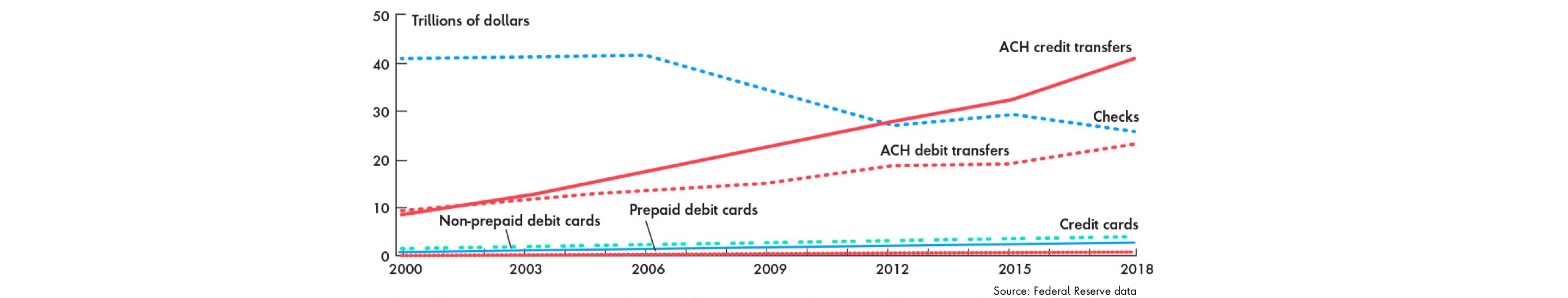

Note: All elements are a trennial basis. Card payment were also estimated for 2016 and 2017. Credit card payment include general purpose and private-label version. Prepaid debit card payment include general-purpose,private-label, and electronic benefits transfer (EBT) versions. Estimates for prepaid debit payments are not displayed for 2000 and 2003 because only EBT was collected.

There’s no shortage of data to go around, but much of processors’ data sets, like card services and non-card services, have traditionally been siloed. They have multiple customer data platforms (CDPs) for different data sets but nothing ties them all together to paint a complete picture of a customer’s spending behavior.

A large processor, for instance, made $4.1 billion in 2019—a quarter of its annual revenue—from using its warehouse of transaction data for services that include marketing analytics, as reported in Fast Company. Another processor, for example, works with data brokers to identify purchasing habits of individual customers that match criteria supplied by marketers, also reported in Fast Company. However, these payment processors aren’t actually helping to analyze or show what’s possible with their data in any of these examples.

Instead of wondering how their own businesses will navigate a cookieless world, payment processors should focus on helping to fill the void.