The digitization of banking over the past decade has followed a now-familiar pattern. Right across the industry, banks have introduced modular architectures that break their monolithic applications into smaller, task-specific components knitted together with APIs. They have swapped private data centers for scalable, cloud-based tech platforms. And they have transformed their technology culture and delivery with the adoption of Agile principles and DevOps technology, allowing much more frequent, unscheduled releases instead of the old quarterly or annual cycles.

Banks have committed to the digitization playbook because it promises major benefits. The industry’s “new stack” should help them achieve much faster technology transformation—narrowing the innovation gap that legacy-free fintechs have opened up, improving the customer experience and reaping big operational efficiencies and cost savings.

Digitization’s promise remains unfulfilled

Our experience shows that the promise of the new stack remains unfulfilled. Banks have invested heavily in digitization, but their investments have yet to deliver the scale of transformation they envisaged.

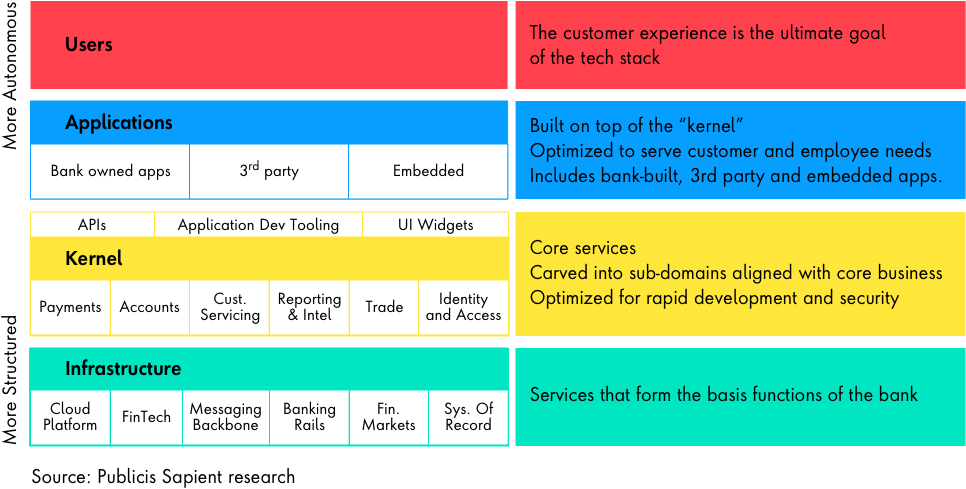

Why has banking’s digital transformation fallen short? The core of the problem is that banks’ intense focus on improving the speed of delivery has not led to system-level gains. Adopting modular architecture has resulted in multiple, semi-autonomous teams working independently on their part of the system. This creates a complexity problem for banks. It allows individual teams to move quickly, unencumbered by the strictures of the wider organization, but it results in a system that is less co-ordinated and harder to manage. What banks gain in speed with the new stack, they lose in increased complexity.

The problem with autonomy

This leads in turn to inefficiency, rising operating costs and a failure to compound the value of assets created within individual, autonomous teams across the entire organization. So, onboarding services that provide the same basic functions are implemented repeatedly by different teams, each of them unaware of or unable to use services already created by other teams. Solutions are optimized for usability with only one purpose in mind, rather than making them more generic and flexible so that multiple teams can benefit from them.

In migrating to the new stack, therefore, banks have discovered that they are losing the system-level overview and co-ordination that went hand in hand with their legacy, monolithic systems. They have committed to transforming their technology infrastructure but have not fully absorbed the implications of this transformation at the organizational level.

So, the central challenge of digitization remains unanswered: how to unlock the true potential and value of banking’s new technology stack. Addressing this critical issue is the industry’s next big opportunity.

Embrace and manage complexity

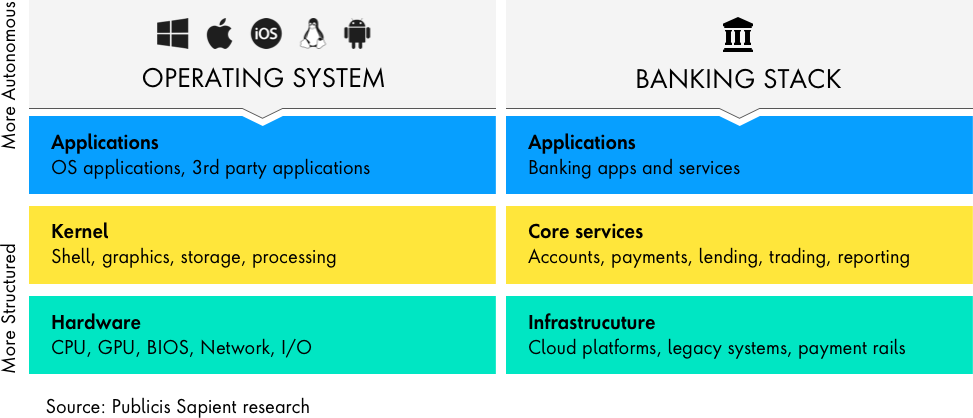

There is no going back to monoliths. Banks must instead embrace the team autonomy and system complexity that is inherent in the new stack and manage it by adopting an operating model suited to the new environment. The metaphor that best describes the solution to banking’s next challenge is not the ecosystem, but the “operating system” – a highly structured framework with the inherent flexibility to enable a rich set of applications to develop and support each other.