Whether or not the “metaverse” or “Web3” are part of your strategic business plan, these contemporary concepts are dominating discussions on the future of retail. And more importantly, offering exciting new experiences for retail consumers.

In basic terms, the metaverse is a vision of our physical world, completely online. Think of a brick-and-mortar retail location combined with an online e-commerce store all in the same virtual reality. While it’s often used synonymously with the term “Web3” (aka “Web 3.0”), their meanings are different.

Web3 refers to a future, decentralized iteration of the World Wide Web, while the metaverse is a network of virtual worlds meant to be explored and with which you can interact. Most likely, the still-evolving, blockchain-based Web3 and the metaverse will coexist and build upon each other, both relying on concepts like cryptocurrency and non-fungible tokens (NFTs).

So, how will retail experiences play out in the metaverse or Web3? Brands are still figuring it out.

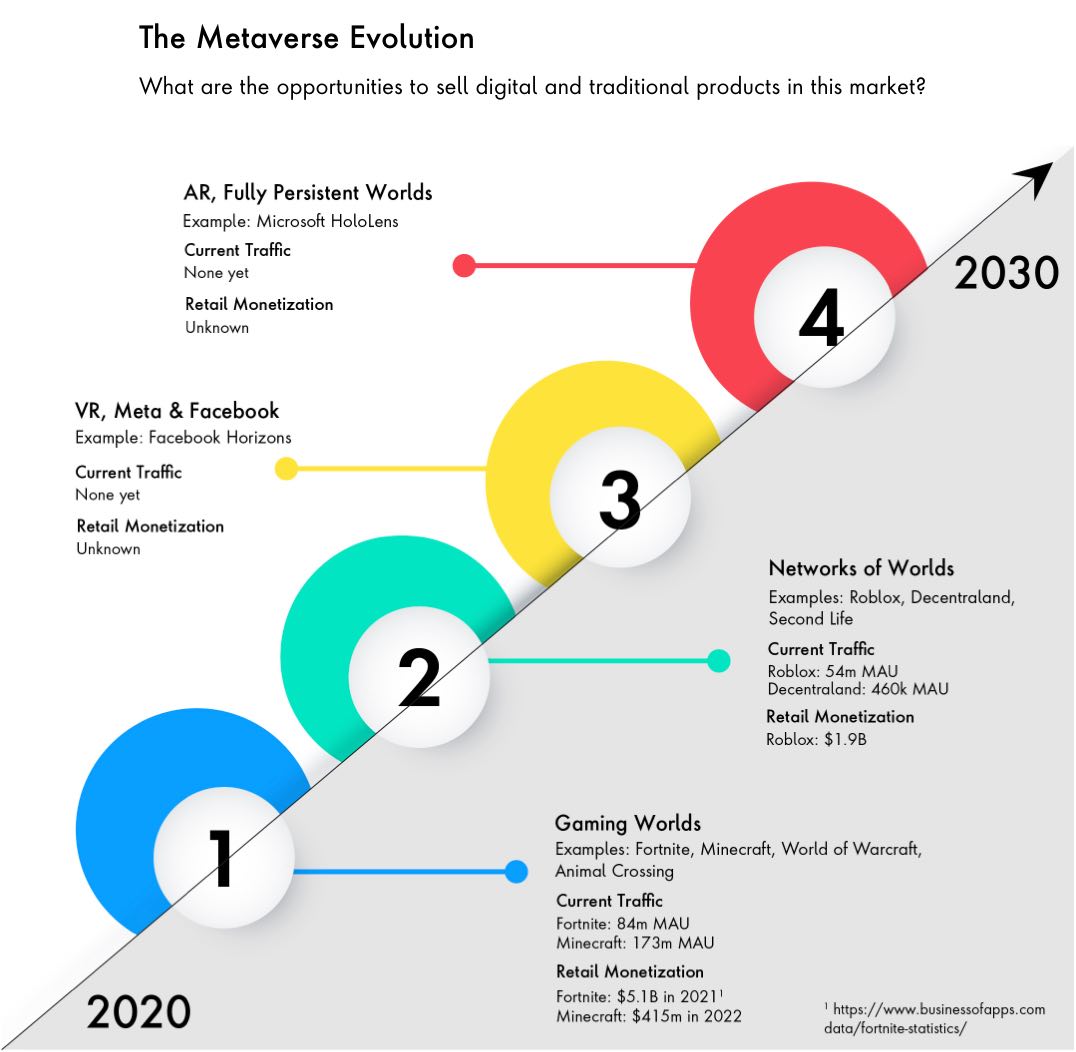

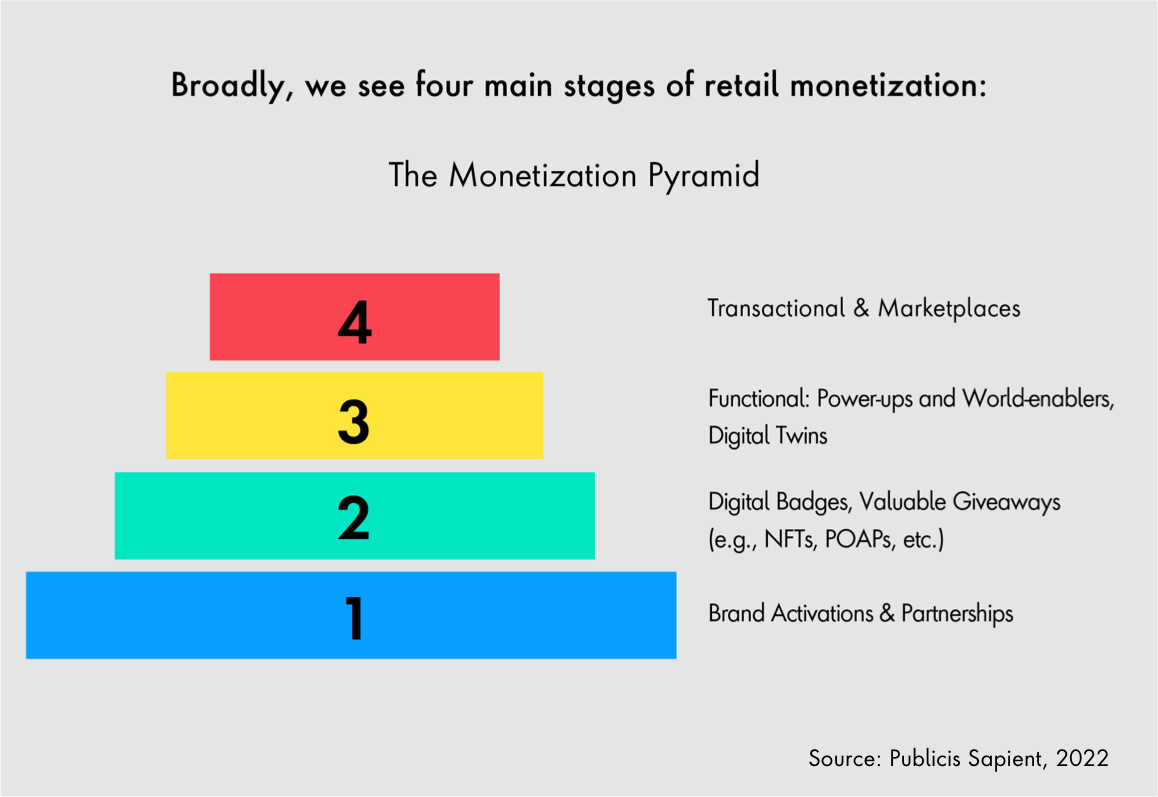

But even in these early days, the industry has already seen several evolutions of new digital worlds, each with interesting revenue opportunities for retailers.

Opportunities begin with online gaming

For starters, many retailers are observing online gaming as evidence of the metaverse’s potential for community building and revenue.

In the gaming universe, virtual worlds aren’t so novel, and some brands are using well-known games as a way to jump in.

Some of the most popular online games that operate in these interactive, 3D worlds thus far are “Fortnite,” “Minecraft” and “World of Warcraft,” which attract between 80 million to 140 million monthly active users, respectively.

While the core of these expansive virtual worlds is gameplay, users are now attending live concerts, socializing and purchasing digital products regularly.

“Fortnite” generated $5 billion in revenue in 2021. Brands as diverse as Marvel and Burberry are already operating in these worlds and even creating their own—and generating millions of dollars while doing it.

These online worlds also interact easily with the future of digital assets and financial technology: cryptocurrency and NFTs.

The next phase of the metaverse, beyond these games, involves larger game networks. The most popular is called Roblox.

Roblox, unlike “Fortnite,” is not a singular game. It’s a digital world that hosts millions of different games created by users and brands. Its associated digital currency, called “Robux,” can be converted into real money and used to buy different assets on all the games that Roblox hosts.

Other similar game networks include Decentraland and Second Life, the former of which is known for massive digital real estate transactions and a highly publicized virtual fashion week.

Finally, the evolutions of the metaverse still in their retail “infancy” are virtual reality (VR) and augmented reality (AR) platforms. These two different technologies combine the physical and digital worlds for consumers. Think of the Oculus 3D headset for VR and the Pokémon Go application as an example of AR.

Metaverse worlds built on AR, such as Oculus VR and Magic Leap, are likely several years from achieving critical mass. They are interesting platforms for experimentation but haven’t yet generated as much meaningful revenue for retailers as games or gaming networks.