After a third wave of lockdowns, nonessential retail locations across the United Kingdom reopened in April—and consumers were ready to return. Sales volumes rose 9.2 percent month-over-month in April after a 5.2 percent rise in March, with foot traffic to retail destinations seeing a 218 percent jump in the first week after reopening.

So, where are shoppers prioritizing their spending, and how have expectations of the in-store experience changed? We asked UK shoppers to weigh in with what they’re looking for in the months ahead.

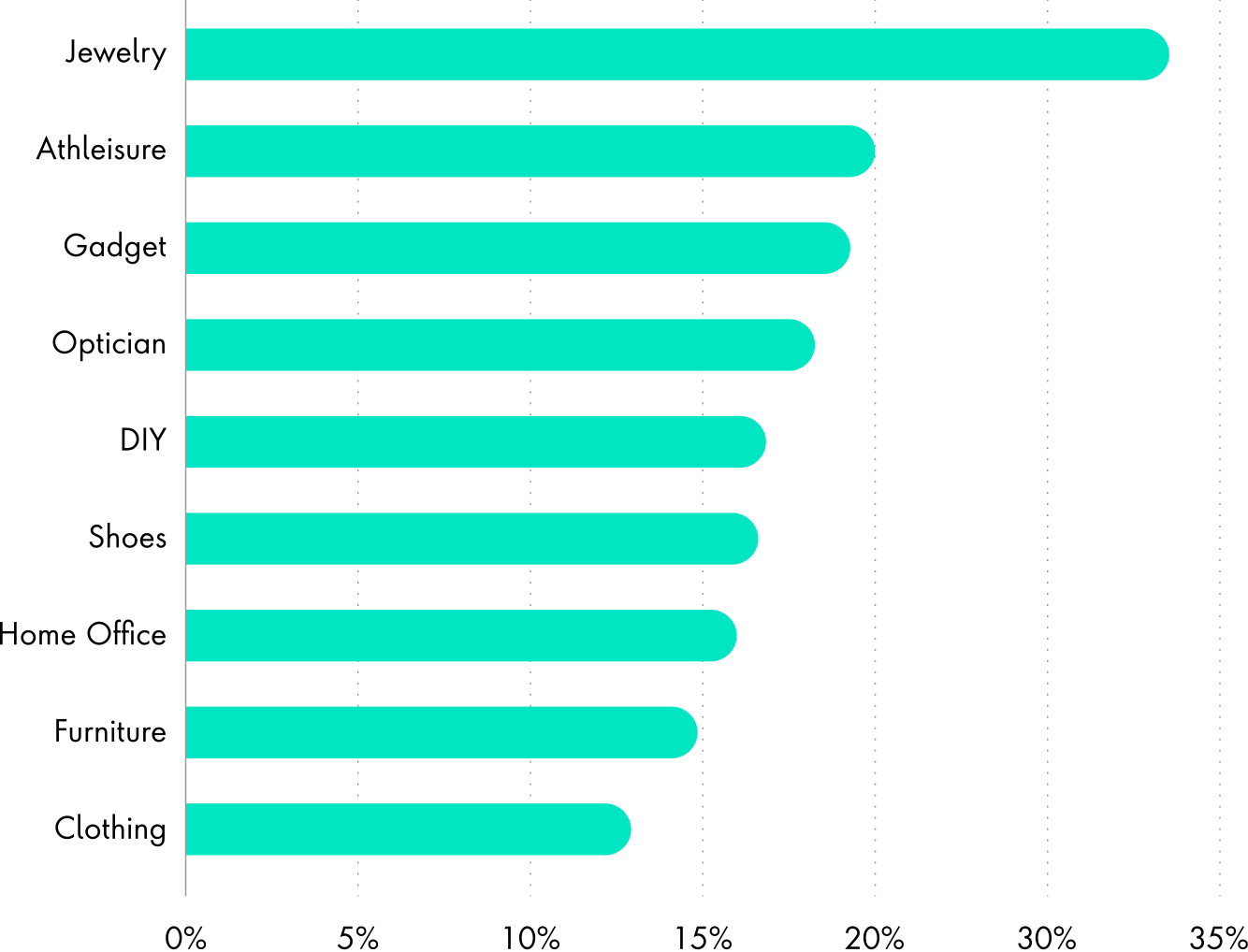

A fresh new look toward discretionary spending

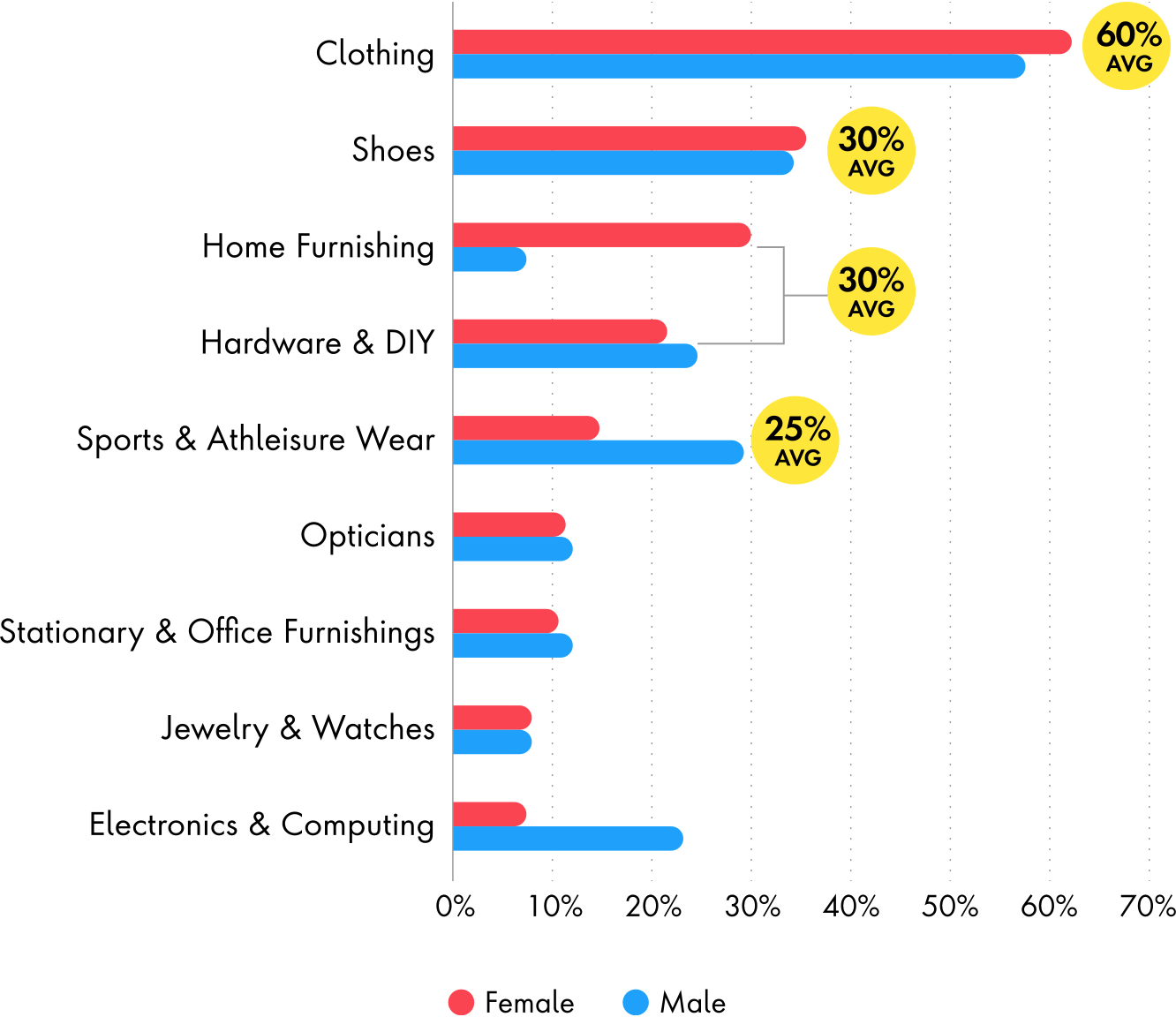

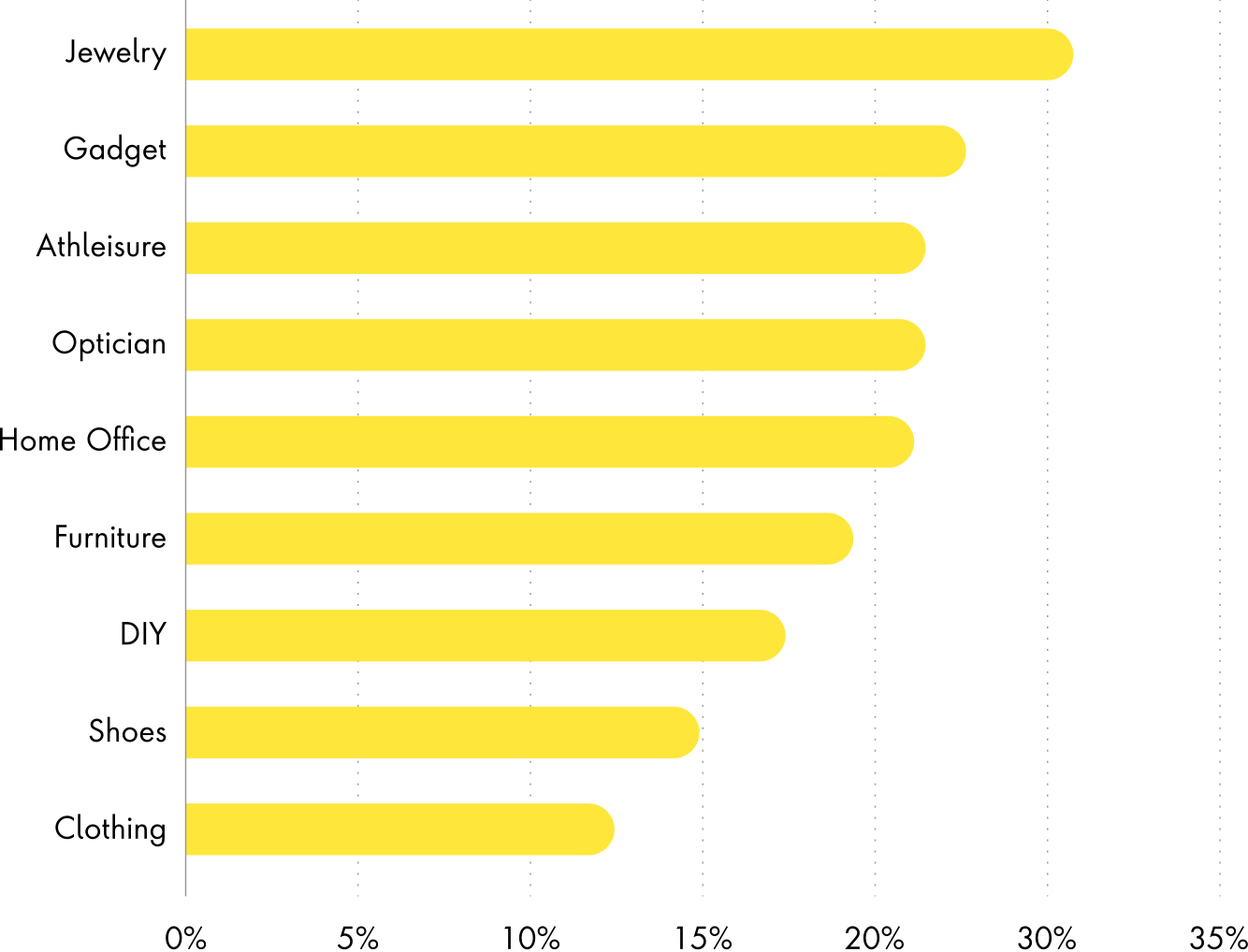

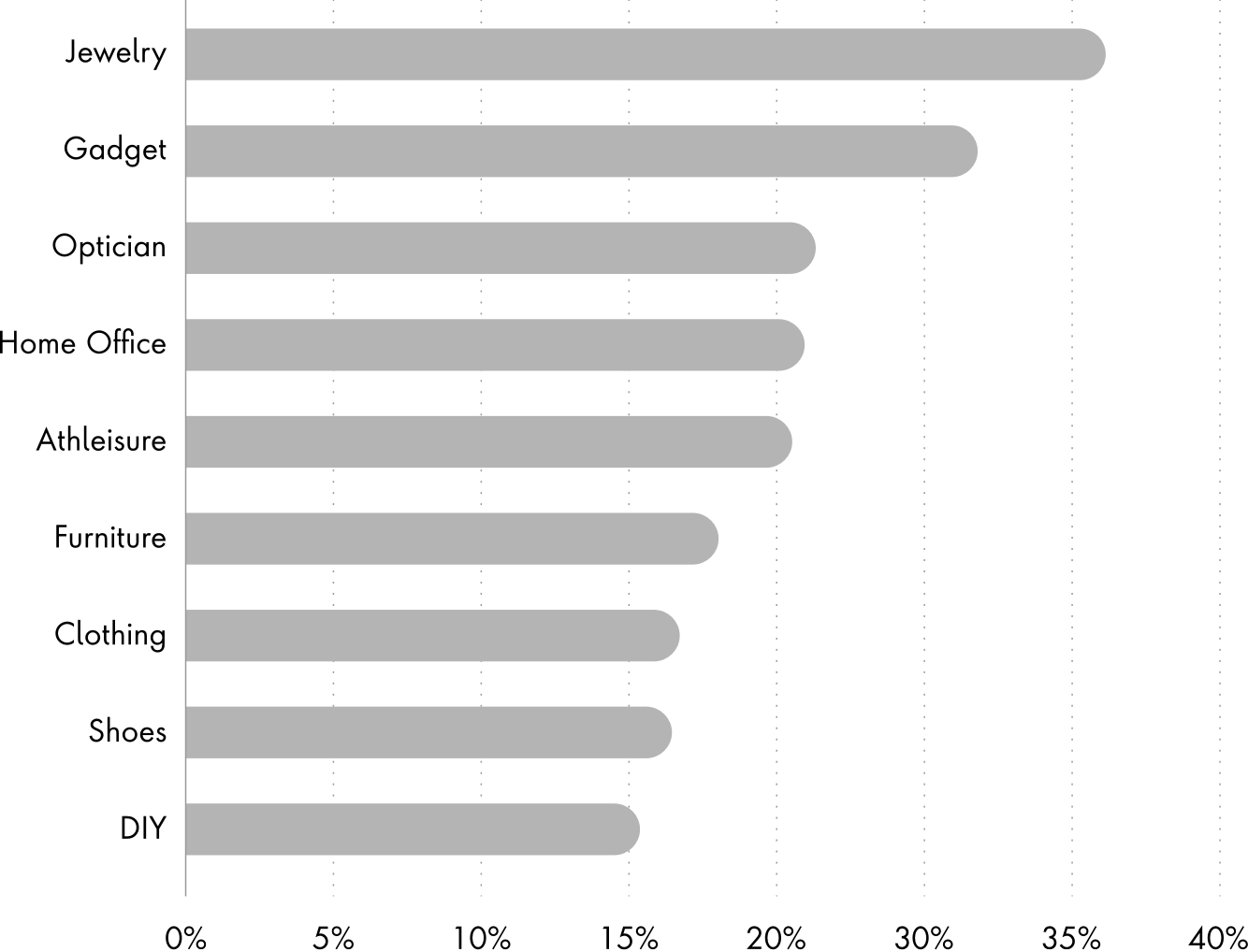

When it comes to where UK shoppers want to fill their carts first, a wardrobe refresh seems to be the biggest need. Sixty percent of shoppers have their eye on clothing, 30 percent specifically singling out shoes and 25 percent looking for athleisure or sportswear. DIY and Home Furniture are also a key target for 30 percent of those surveyed, perhaps to help change up the spaces they’ve spent so much time in over the past 14 months.

Which categories of store are you planning to visit over the next 3 months?

(Select all that apply)