To prepare for the next evolution in financial services, banks should take the following steps -

1. Define the business strategy – Understand the differentiation strategy for all lines of the business. Determine the different roles (i.e., influencers, contributors, coordinators and fulfillers) that third-party providers or the bank will play in this new evolved ecosystem.

2. Identify use cases/customer journeys – The next step is to determine foundational use cases/customer journeys (e.g., customer identification and validation, applicable to all lines of business) and core use cases/ customer journeys (e.g., credit expense management) specific to each line of business to differentiate customer experiences.

3. Define delivery methods – Understand when the bank will deliver alone or in partnership with fintechs. The right methods should deliver against the strategic objectives.

4. Establish infrastructure – Banks will have to establish the infrastructure to help support the adoption and operation of open banking. This includes looking at open banking from the following dimensions:

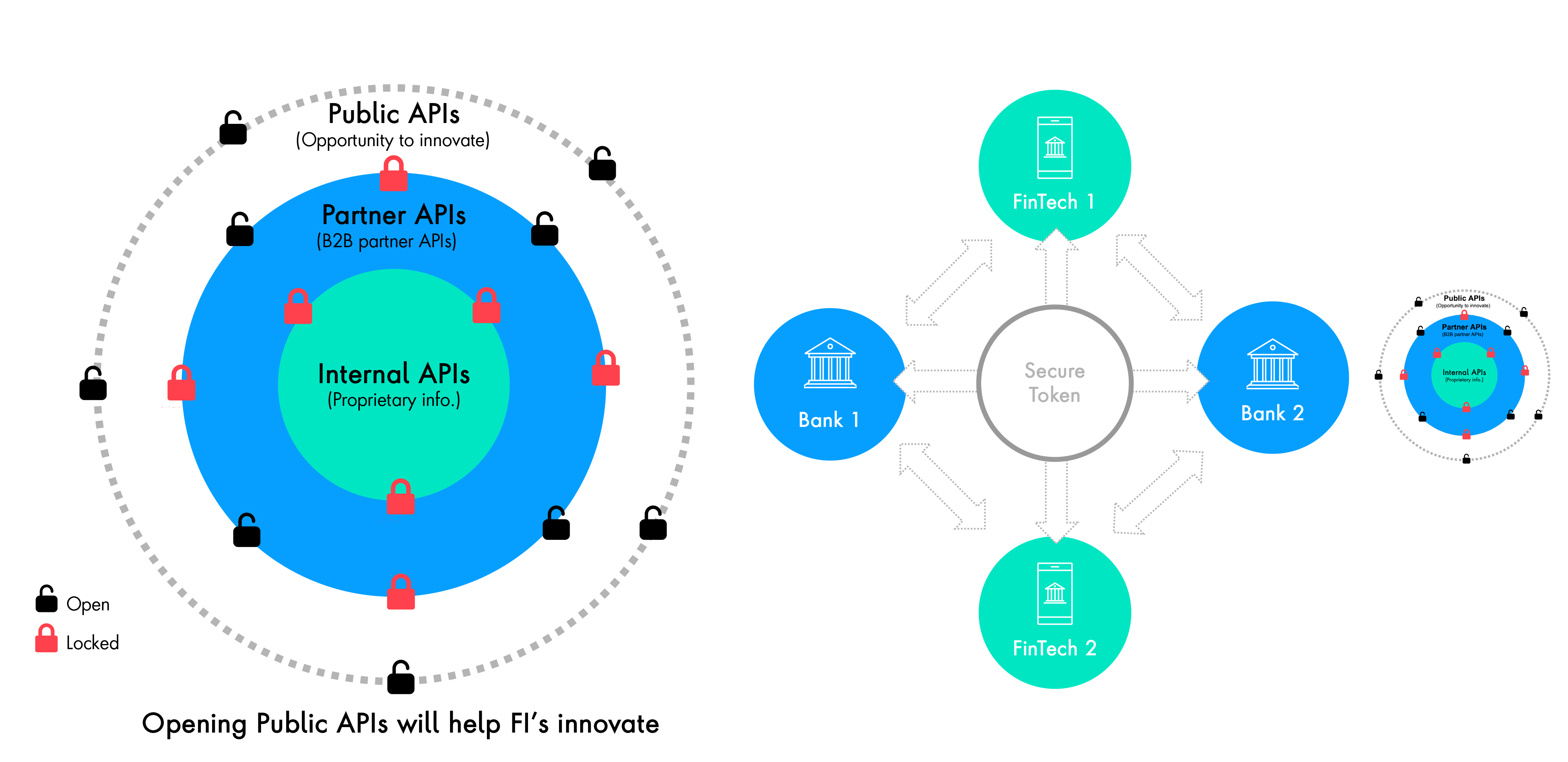

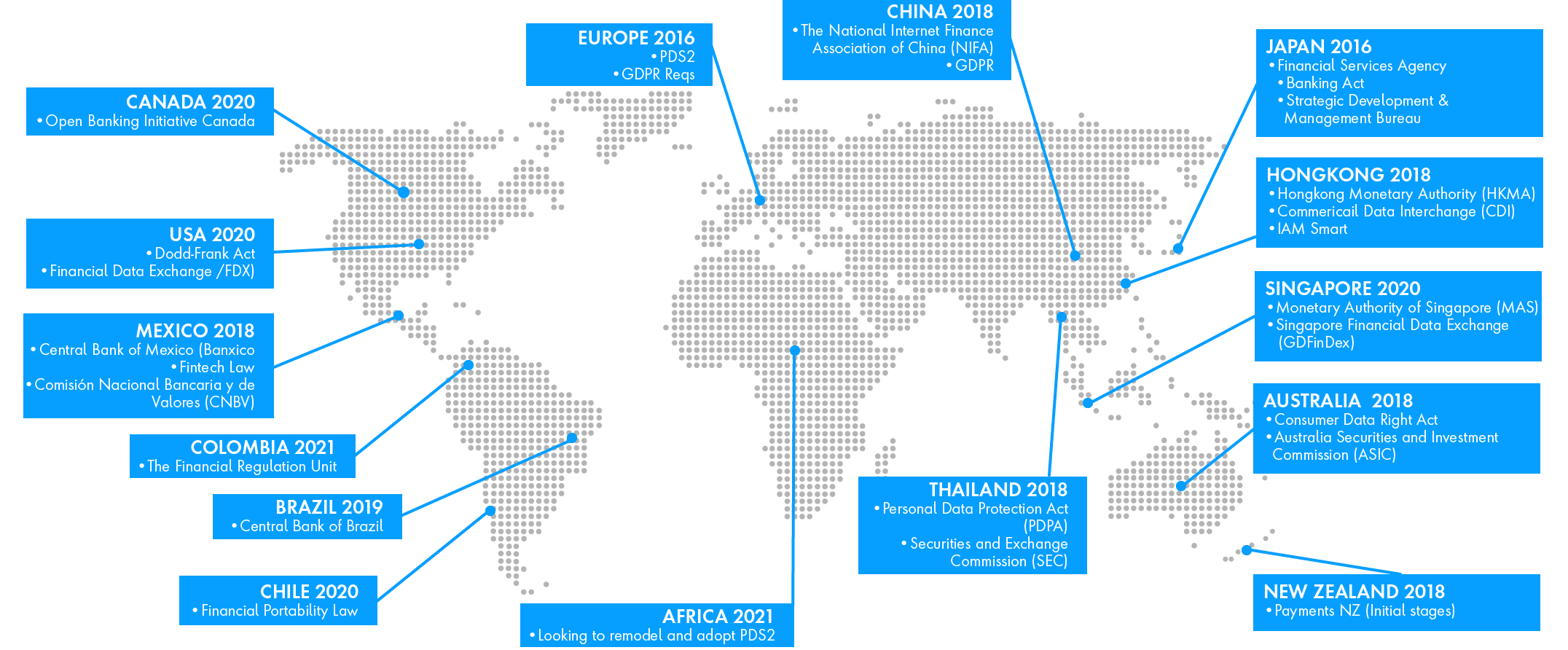

a. Process – This will include aligning interface development with data protection guidelines for public APIs and building the right data sets the support the APIs. Banks will work with respective regulatory bodies (e.g., OBIC in Canada) to ensure alignment with government regulations.

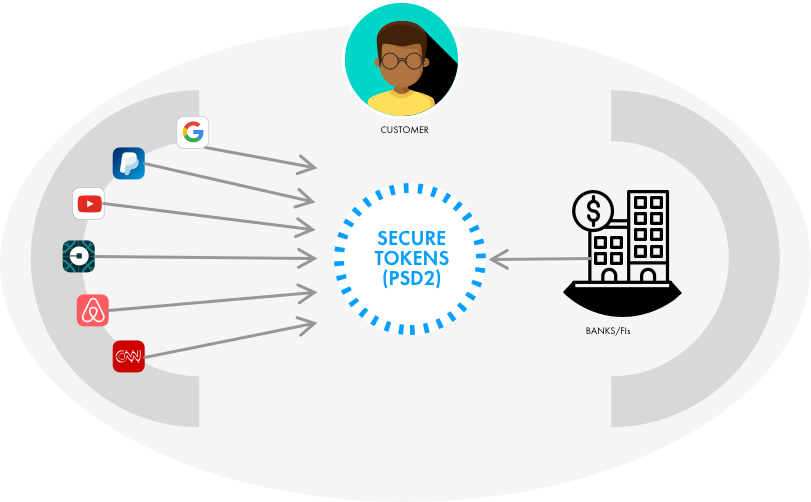

b. Technology – Banks will work with fintechs will use security tokens to protect the exchange of customer information.

c. Organizational structure–Banks will have to define new strategic functions for delivering focused solutions for open banking. Establishing an organizational construct is imperative to help drive delivery and partnership with third-party providers, as this will be different from the traditional client/vendor relationship model.

d. Governance and operating model–There is a massive cultural gap between traditional financial institutions and third-party providers, which operate with more of a product and engineering mindset. To enable successful operations, banks would have to define delivery KPIs, business outcomes, and risk factors.

5. Regulatory and cyber compliance – In open banking, there is greater need for adhering to data regulations and cyber guidelines. To help protect the customer data, financial institutions will have to revisit their fraud, risk and compliance processes and procedures.

6. Re-define API strategy – Given the influence of data analytics and machine learning, financial institutions have been re-defining the API strategy to support customer experience, interoperability and scalability. To achieve efficiency at scale, they need to leverage API solutions provided by third parties.