What issue can we solve for you?

Type in your prompt above or try one of these suggestions

Suggested Prompt

Why Offsite, Not Onsite, Is Your Fastest Path to Media Network Revenue

ROI doesn’t run through your website anymore

Retailers often spend a year building an onsite retail media engine, only to find they’re reaching just 10 percent of shoppers. While onsite channels are important for long-term growth, they require engineering sprints, multiple vendor integrations and meticulous UX planning.

Meanwhile, your competitors are already monetizing their first-party data on offsite channels. Campaigns are launching in as little as two weeks and showing measurable return-on-ad-spend (ROAS) while your team is still stitching together ad server contracts.

eMarketer data shows offsite retail media ad spend growing 42.1 percent in 2025 versus just 15.3 percent for onsite, with leading enterprises generating revenue up to 3x faster with offsite activations.

Onsite builds your future. Offsite pays for it now.

The onsite revenue gap

Most retailers know onsite matters, but it comes with a long runway. The reality is that by the time most teams stand up a functioning onsite network, competitors are already monetizing their data elsewhere.

Research confirms this; successful onsite retail media network (RMN) deployment requires a heavy lift for data integration and technology infrastructure setup, with 99 percent of CPG brands demanding access to 6+ million shoppers before investing, a scale onsite platforms struggle to deliver quickly.

Each vendor (Google Ad Manager, Criteo, etc.) brings its own setup requirements, leading to delayed revenue recognition. In short, it often takes 12+ weeks of effort before the first dollar lands.

It's not that onsite is the wrong move. It's just not your first move.

Offsite: the express lane on the maturity curve

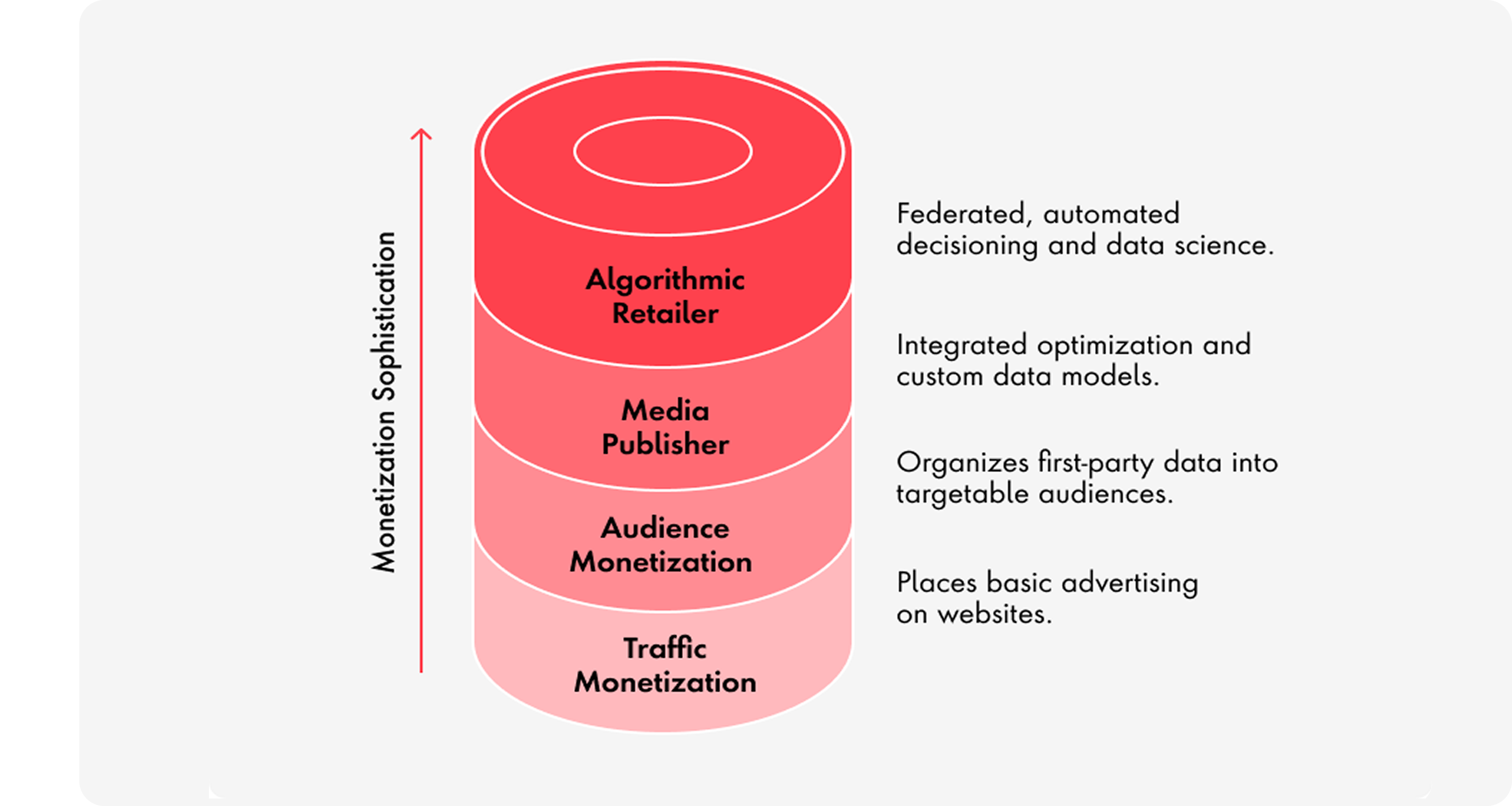

If you think about retail media maturity as a journey, onsite isn’t where you start, it’s where you end up.

- Traffic monetization (basic ads)

- Audience monetization (segments and targeting)

- Media publisher (integrated optimization)

- Algorithmic retailer (AI-powered decisioning—the “self-driving car” stage)

Offsite activations sit right in the middle, giving you publisher-level scale and testing, while laying the data foundation for AI-driven optimization later. In other words: offsite isn’t the end goal for your RMN strategy. It’s the launchpad.

Platform maturity progress from basic to advanced monetization

The AI-powered offsite engine

What makes this launchpad so powerful today is AI. AI and machine learning are reshaping the precision and performance of offsite media campaigns in ways onsite simply can’t match.

By applying AI models to first-party data, retailers can:

- Uncover deeper behavioral patterns

- Automate how they segment audiences

- Dynamically optimize creative delivery across offsite platforms in real-time

According to Nielsen, AI-powered campaigns can deliver 17 percent higher return-on-ad-spend (ROAS) and 23 percent stronger sales lift than manual campaigns.

Machine learning algorithms can improve lookalike modeling by continuously refining targeting based on observed conversions, boosting campaign efficiency, increasing return on investment and ultimately driving greater revenue. For retail media specifically, 69 percent of retailers using AI agents report revenue increases.

Beyond targeting and optimization, AI is also reshaping the creative process. Retailers are experimenting with AI-driven assistants that co-develop co-branded campaigns (e.g., Macy’s + L’Oréal) while ensuring brand guidelines remain intact. This not only accelerates content creation but also enforces compliance across both retailer and advertiser requirements.

Extending audiences beyond your site

The power of AI extends well beyond your own site. With AI-driven lookalikes and audience modeling, retailers can activate across social, programmatic and streaming to reach new buyers—not just known customers.

Post–iOS 14.5, Facebook custom audience match rates dropped to 25 percent, proving the limits of onsite extensions. Offsite flips that problem: once first-party data is centralized, it can be shared across multiple platforms to fuel paid, earned, shared and owned campaigns.

For example, rather than only running ads on a home improvement retailer’s website, first-party purchase data can be activated across streaming platforms to reach households in the market for kitchen renovations.

The result? Greater reach, more efficient ad spend and highly relevant audiences across Meta, Google DV360 and other networks that are all more likely to convert.

The connected TV gold rush

The most explosive of these channels is Connected TV (CTV). As advertiser budgets move into offsite, CTV is emerging as the fastest-growing battleground for retail media spend.

eMarketer confirms that exactly 20 percent of CTV ad spend will be driven by retail media networks by 2027, representing $5.63 billion in retail media CTV spending, up from $813 million in 2024. The CTV growth trajectory shows 86.6 percent growth in retail media CTV ad spend in 2024, growing three times faster than retail media search.

Partnerships as growth drivers

Today, YouTube still dominates retail media CTV activations. The real opportunity is for retailers to redirect budgets into their own CTV partnerships, where they can capture both reach and measurable outcomes. By doing so, they not only close the gap left by declining linear television but also position themselves to own a larger share of high-growth offsite spend.

Partnerships like Walmart–Disney and Kroger–NBCUniversal are already setting this standard: premium inventory, precise targeting and attribution that goes beyond impressions to prove sales impact. Alliances like Uber + Instacart and Albertsons + Best Buy show how competitors can combine audiences to deliver scale for advertisers.

This is also where non-endemic ads come into play. These alliances unlock credible paths for insurers, banks and other non-endemic brands to participate in retail media without feeling out of place.

For example, when Kroger integrated with NBCUniversal’s CTV inventory, financial services advertisers were able to target household-level segments based on purchase data while preserving privacy. Instead of generic commercials, consumers saw contextually relevant ads tied to everyday shopping behavior.

For retailers, these partnerships aren’t just about reach—they’re about creating the only viable path for non-endemic advertisers to participate credibly in retail media.

Solving offsite’s trust problem

But scale alone isn’t enough. The biggest hesitation executives voice is trust. How do you know these offsite activations actually drive sales?

Today, advanced attribution models can connect ad exposure directly to both in-store and online purchases while campaigns are still live. Using privacy-safe identity resolution and consent management tools, media teams can:

- Report on ROI, ROAS and customer lifetime value in near real time

- Optimize spend mid-flight

- Deliver unified measurement across paid, earned, shared and owned media

However, measurement is only part of the challenge. The regulatory environment is also fragmented, with state-by-state rules that can upend targeting strategies. For example, Washington prohibits marketing tied to potential health conditions. Progressive consent models, where permission requests are embedded seamlessly into the user journey, are emerging as a practical way to navigate this complexity while preserving consumer trust.

Yes, margins are often higher onsite because attribution is cleaner. But that comes at the expense of reach and speed. Offsite flips the equation: faster scale, broader audiences and quicker learning cycles. And in a competitive retail media landscape, speed is what advertisers value most.

That’s why dissatisfaction still remains high with many RMN partners—only 12 percent of buyers report being “very satisfied.” Advertisers are demanding not just cleaner attribution, but faster ways to prove impact and optimize spend. Offsite delivers that speed.

The competitive urgency of offsite

Every month you wait is another month competitors are testing, learning and locking in advertiser budgets. The data proves this urgency: offsite retail media jumped from $7.5 billion in 2023 to $20 billion in 2024, representing 167 percent growth in a single year.

Industry adoption patterns also validate this strategic shift. Fifty-six percent of brands work with more than five RMNs, with 58 percent expecting to use more RMNs over the next two years. Programmatic retail media spending is growing 41.7 percent in 2024, with 29.3 percent projected growth for 2025, indicating sophisticated automated buying is becoming the norm and directly benefiting offsite strategies.

By launching offsite early, retailers can:

- Build advertiser trust with clear, early wins

- Create scalable models that port easily to onsite once ready

- Demonstrate value beyond impressions: real business outcomes

Offsite platforms like social media, programmatic networks and connected TV offer the chance to connect with audiences wherever they are, driving sales now while setting the stage for richer onsite experiences.

Combining first-party data and advanced attribution models, media networks can move quickly to offer advertiser brands valuable insights and measurable impact, nurturing long-term relationships and positioning media networks as critical partners for brand sales growth.

The future of offsite activations

The U.S. retail media market will reach $109.4 billion by 2027. Offsite isn’t just media. It’s the fastest path to serious revenue growth.

Looking even further ahead, today’s offsite activations are only the beginning. Emerging trends such as generative engine optimization (GEO) and conversational shopping assistants could disrupt the very foundation of retail media.

Retailers that experiment early with conversational ad units and generative optimization will be better positioned for the next transformation of the retail media landscape.

How Publicis Sapient can help

Publicis Sapient empowers retailers to unlock immediate media network revenue through offsite activation, bridging the gap between market ambitions and activation execution. As a strategic partner, we bring together the technology, data and operational expertise needed to activate high-performing offsite campaigns across social, programmatic and connected TV channels.

We don’t just build media networks; we accelerate them. Through our proprietary accelerator program and by leveraging first-party data, AI-driven audience modeling and privacy-safe identity infrastructure, we help retailers and companies activate scalable, high-converting audiences across the digital ecosystem.

Our integrated measurement and attribution frameworks ensure every campaign is accountable, linking media spend to real business outcomes like in-store sales, ROAS and customer lifetime value.

Through our unified Publicis Groupe Power of One, we offer a modular, end-to-end solution that adapts to each retailer’s maturity. Whether you're launching your first offsite campaign or scaling a full-funnel media network, Publicis Sapient is the catalyst that turns data into demand, and ambition into revenue.

Related reading

To dive deeper into the evolving offsite media landscape and infrastructure best practices, explore: Getting Offsite Retail Media Infrastructure in Place — a practical guide on laying the groundwork for scalable, offsite media execution, by Adam Skinner, Epsilon.