What issue can we solve for you?

Type in your prompt above or try one of these suggestions

Suggested Prompt

How AI is Transforming the Insurance Broker Experience

Turn broker relationships into high-performance partnerships with the power of AI.

Despite a vast network of brokers, many insurance carriers struggle to build strong working relationships with the people who sell their products. Brokers might complete transactions, but do they feel connected to the brand? Do they have the tools and insights needed to serve clients effectively? Are your systems making it harder for them be successful?

Here’s the problem: outdated systems, disconnected data and limited ongoing support leave brokers feeling unsupported. The result? Lower renewal rates, reduced loyalty and missed opportunities hurt everyone’s bottom line.

But what if you could flip this dynamic? What if every interaction with a broker became an opportunity to strengthen the relationship rather than strain it?

That’s exactly what leading carriers are discovering. By reimagining broker engagement with AI-powered tools and insights, they’re turning frustrated or underperforming relationships into productive partnerships. The results speak for themselves:

- 25 percent increase in customer lifetime value

- 15 to 20 percent higher closure rates

- 15 to 25 percent lift in broker promoter scores

The solution isn’t just better technology—it’s rethinking how carriers engage with brokers. Instead of treating them like middlemen, smart carriers are using AI to build genuine partnerships.

The brokerage engagement gap: are you missing out?

The broker channel remains critical for insurance sales, especially in life, specialty, and commercial lines. But most carriers are still managing these vital relationships with outdated approaches and systems that don’t talk to each other.

Current solutions focus more on:

- Onboarding new brokerage firms or agents (aka. account creation, license verifications, contracting and appointment processing)

- Paying commissions and incentives

- Reporting on basic compliance requirements such as FINRA and NIPR

What’s missing? Everything that happens in between onboarding and paying commissions—the daily support, enablement, insights and tools that actually help brokers succeed at championing and positioning your brand and products.

This narrow focus creates a domino effect of problems. Brokers get frustrated and favor carriers who provide better support. They can’t access the market insights needed. They miss opportunities to deliver exceptional client service. Most importantly, they never develop deep product knowledge that turns them into true brand advocates.

- 44 percent of agents are unsatisfied with insurers’ digital tools

- 60 percent of agents lack time to plan a proper sales strategy

- 77 percent of agents would value identification of cross/up-selling opportunities

Industry leaders understand: It’s not about having the most brokers. It’s about having loyal brokers who genuinely want to sell their products and represent your brand well.

Building the tech foundation: how to connect your insurance systems for better broker support

Before deploying AI, you need to solve a fundamental problem: your data silos. Most insurance companies have information trapped in separate systems—customer data in one place, policy information in another, marketing metrics elsewhere.

Here’s the good news: you don’t need to start from scratch. Connect existing systems through APIs—software that lets different programs share information in real-time.

What you need for this to work:

- Unified data model: All your information flowing into one central hub

- Cloud infrastructure: The computing power and flexibility to handle everything

- API connections: The “translators” that let your systems communicate

- Real-time updates: information that stays current, not weeks old

Once you have this foundation, you can layer on the AI capabilities that will transform how your team works with brokers.

For carriers: AI-powered insights to increase broker and MGA engagement

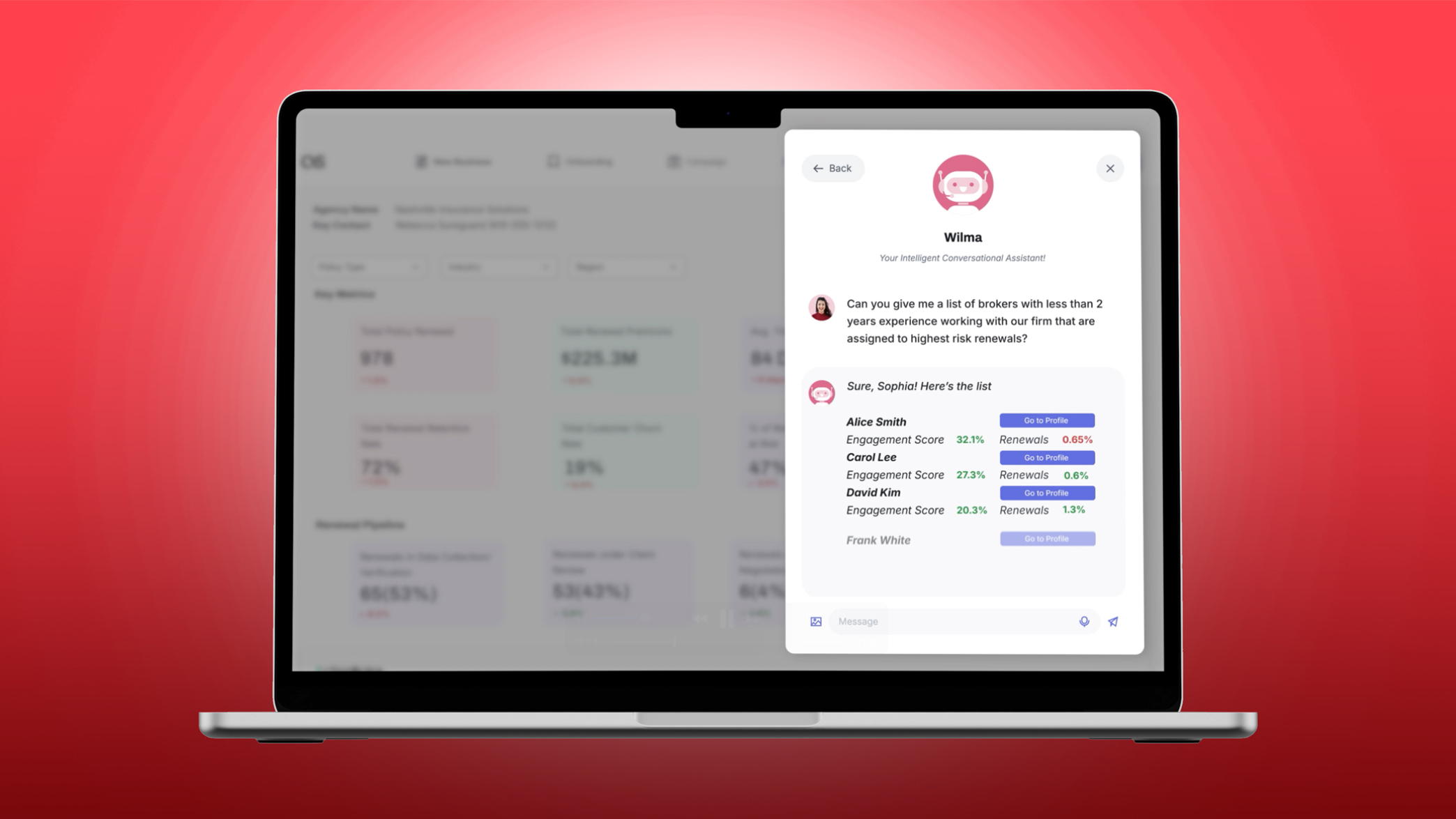

Once systems communicate, AI does the real work. Instead of digging through static, outdated reports, brokers and sales managers get conversational AI assistants that answer specific questions and provide real-time insights.

Let’s look at a carrier example.

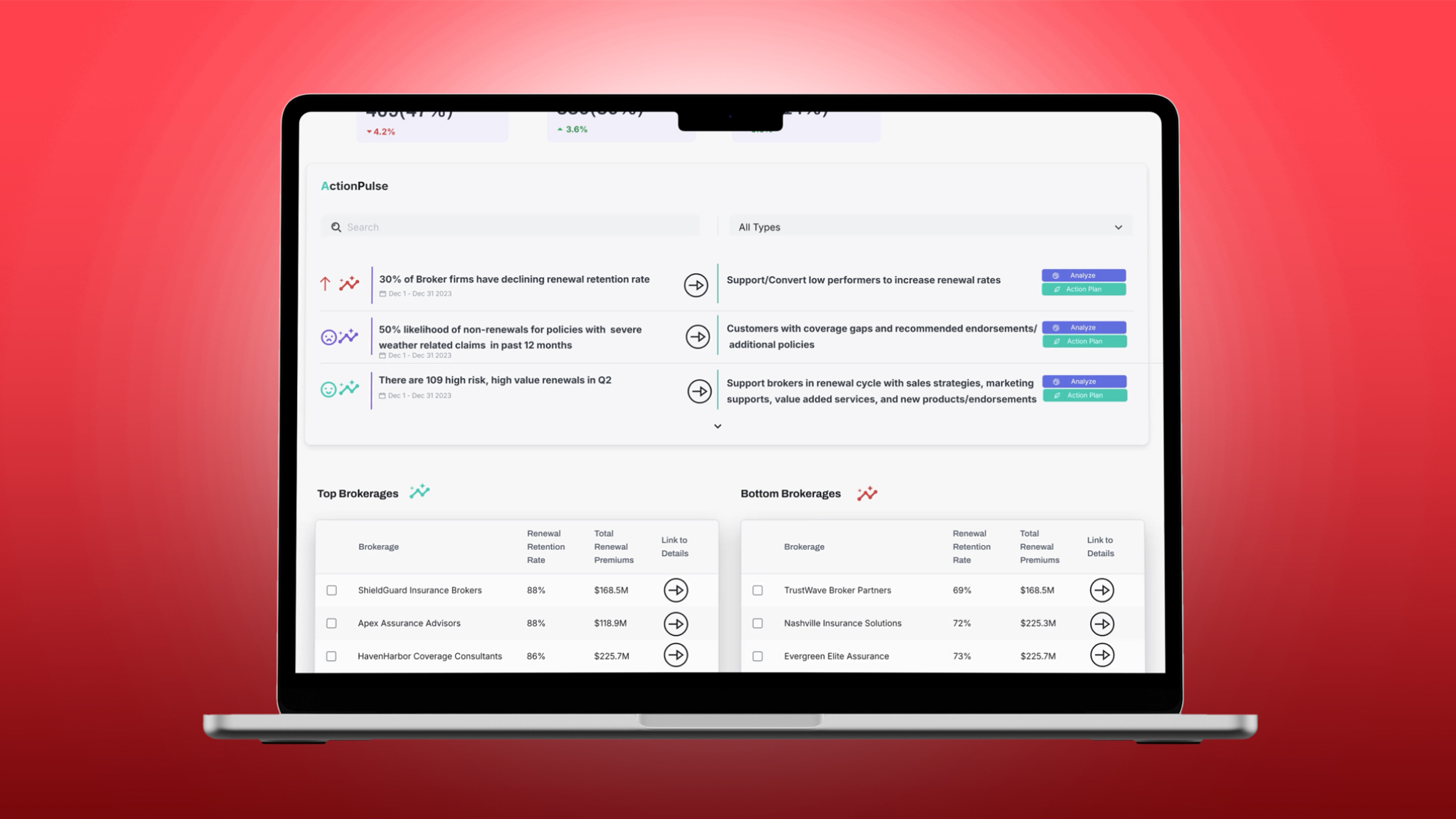

The dashboard shows renewal summary data, average time per renewal, trending patterns and the top 10 cancellation reasons across her territory. Most importantly, it includes an “Action Pulse” section with AI-generated insights and recommended action plans.

Instead of spending hours manually analyzing what’s wrong, the AI-generated action plan instantly suggests targeted interventions to support these lower-performing brokers.

Rather than digging into static reports, the conversational AI assistant gives specific answers.

But AI-powered dashboards for sales managers are only half the story. The real transformation happens when you put these same capabilities directly into brokers’ hands.

For brokers: how to enhance market and customer responsiveness

Let’s look at the broker side.

Clive starts his day by checking his AI-powered broker renewal dashboard. Instead of just showing account information, it proactively flags potential problems. Today, “Action Pulse”--the AI alert system—shows that one of his key accounts is at medium risk for non-renewal.

The system doesn’t just say, “there’s a problem”—it shows him exactly what’s wrong, via the system monitoring external data sources like ZoomInfo and LinkedIn Sales Navigator.

These examples show what's possible, but you might be wondering: how do you actually implement something like this without disrupting your entire day-to-day operations? It starts with understanding the connected ecosystem components needed to support this level of broker engagement, then taking a strategic, phased approach to implementation.

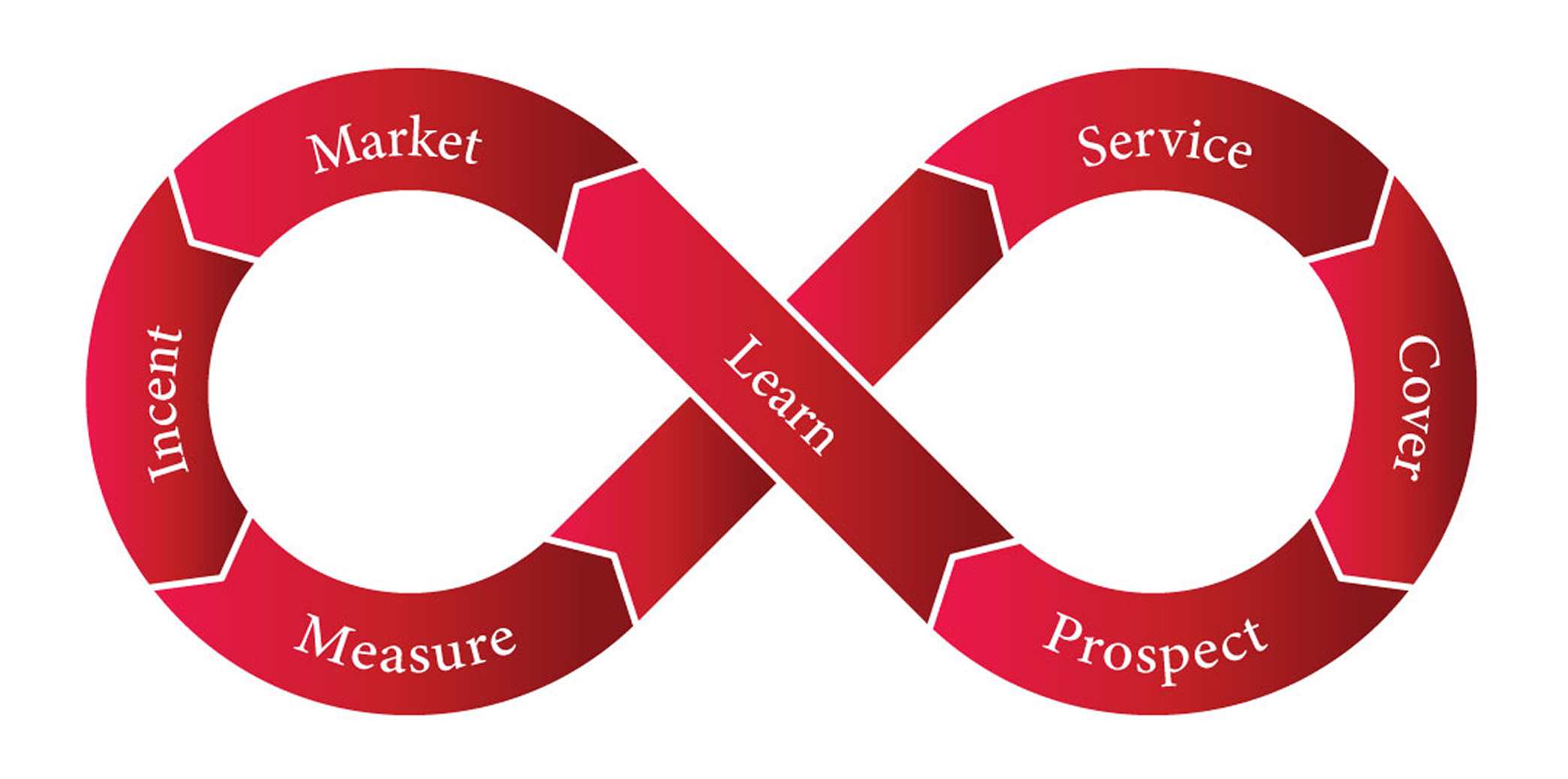

Connected ecosystem components to strengthen broker/agent engagement

For carriers to maximize their producer productivity, it requires a set of digital ecosystem components to be in place to deliver timely insights and great experiences.

- Data: Remove data silos with unified data models to extract insights from core applications and other platforms

- Solution architecture: Foster seamless system, data and application integration using microservices and event-driven architecture

- UX/UI: Increase productivity and engagement with consistent, personalized experiences in intuitive and user-friendly interfaces

- AI: Harness the powers of LLMs, ML and NLP, driven by robust data ingestion pipelines, to enhance decision-making capabilities

- Cloud: Scalable and flexible cloud architecture that supports future growth and compliance with industry standards through operational agility

Path forward: roadmap for transforming the broker/agent experience

The best AI implementations don’t try to do everything at once. Instead of attempting a massive overhaul that disrupts “business as usual,” consider taking a phased approach that builds trust while delivering quick wins.

Phase 1: early momentum and quick impact (0-3 months)

Start simple and prove value immediately:

- Integrate readily available data for quick insights

- Deliver high-value dashboards

- Enable AI-generated next best actions

Phase 2: Enhanced data integration and advanced analytics (3-12 months)

Build out these unified data models:

- Deepen understanding of broker profiles and behavior

- Deploy predictive models and analytics

- Embed solution into existing sales and marketing workflows

Phase 3: Full-scale AI transformation (After Year 1)

Deploy the complete solution:

- Unify remaining data for full 360 broker profile

- Leverage AI for personalized outreach

- Expand AI-driven processes organization-wide

This approach avoids “shiny object syndrome”—chasing the latest tech without clear purpose. It builds user confidence and adoption gradually. Additionally, it delivers measurable results that justify continued investment and allows time to adjust and improve based on real-world feedback.

Of course, you want to know if this actually works in practice. The good news is that we have real-world data showing exactly what kind of results you can expect.

Proven results: what happens when insurance companies get AI right

Here’s a case study from outside insurance that shows what’s possible.

An asset management firm was struggling with lack of growth across products and market segments. Their traditional marketing and sales strategies were proving to be inefficient, and they lacked granular insights into advisor engagement and market demographics.

The solution? Enhanced advisor engagement with tailored digital marketing campaigns and predictive planning to boost advisor activation. Additionally, they leveraged AI for account trend analysis, combining market trends with customer opportunity sizing. With AI solutions in place, the firm was able to boost productivity, equipping sales team with automated lead assignments and tailored product presentations.

After implementing AI-driven marketing and sales tools, they achieved significant results within the first 2 years of the program:

- A 25-30 percent increase in sales team productivity

- A 15-20 percent improvement in converting prospects to clients

What made the difference? Smarter targeting, auto-generated presentations and better use of data to guide outreach.

These same strategies apply directly to insurance broker relationships. When brokers have access to better tools, timely insights and automated assistance, both broker satisfaction and business outcomes improve dramatically.

Given these proven results, the question becomes: what does it mean for your company’s competitive position?

Final takeaway: building a stronger broker network with smarter tools

The insurance industry is at a tipping point. Traditional broker management approaches that worked for decades simply aren’t effective anymore. While some carriers continue treating brokers like transaction processors, industry leaders are using AI to build genuine strategic partnerships.

The results speak for themselves: higher loyalty rates, superior performance metrics and brokers who actively advocate for your products.

Here’s the competitive reality: this transformation is already happening. Companies that move now will build broker networks that become increasingly difficult for competitors to penetrate. Those that wait will watch their best brokers gravitate toward carriers offering superior support.

The technology exists. The business case is proven. Let’s talk.