Pushing against the current: How utility operators can mitigate outages and the economic fallout

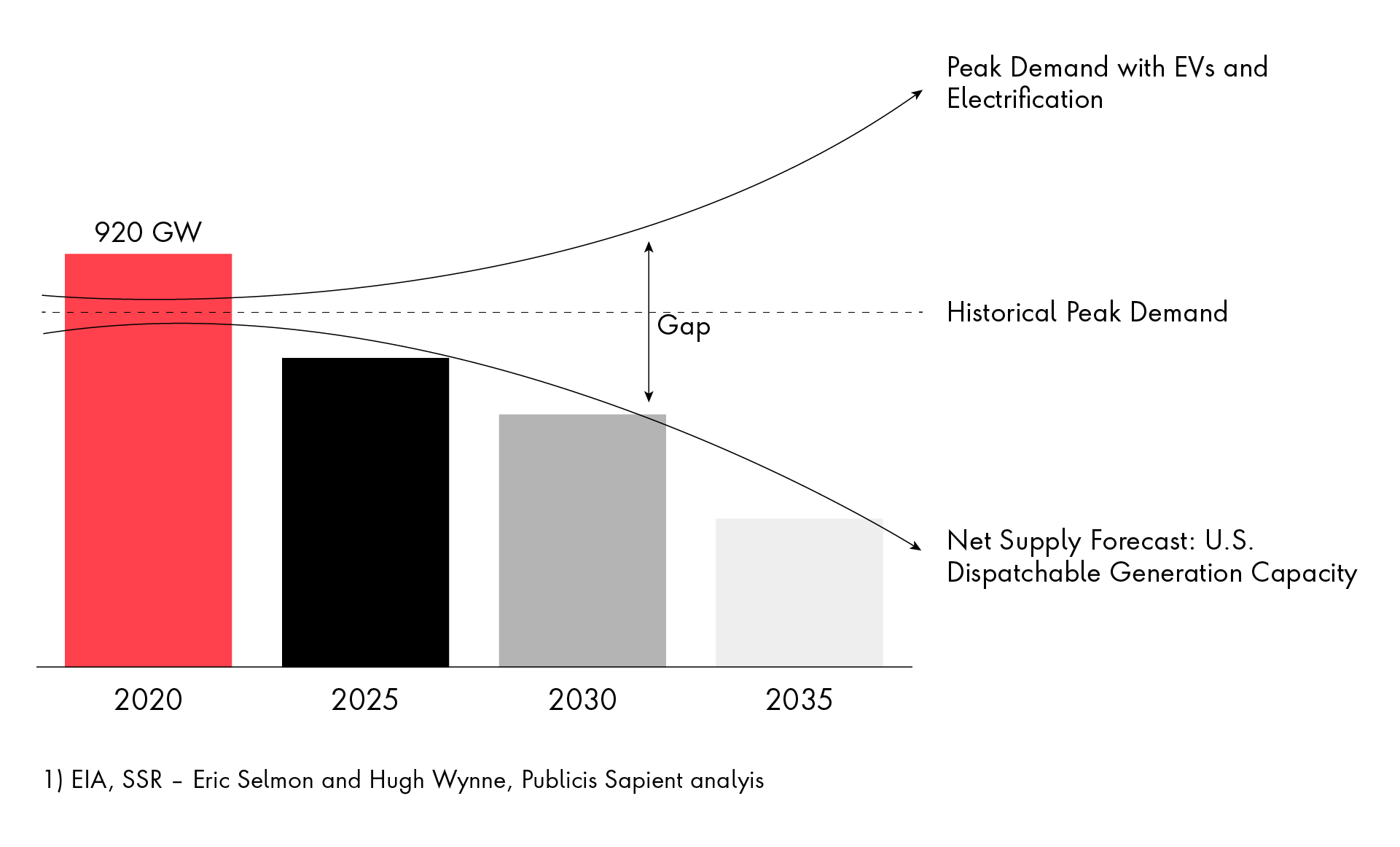

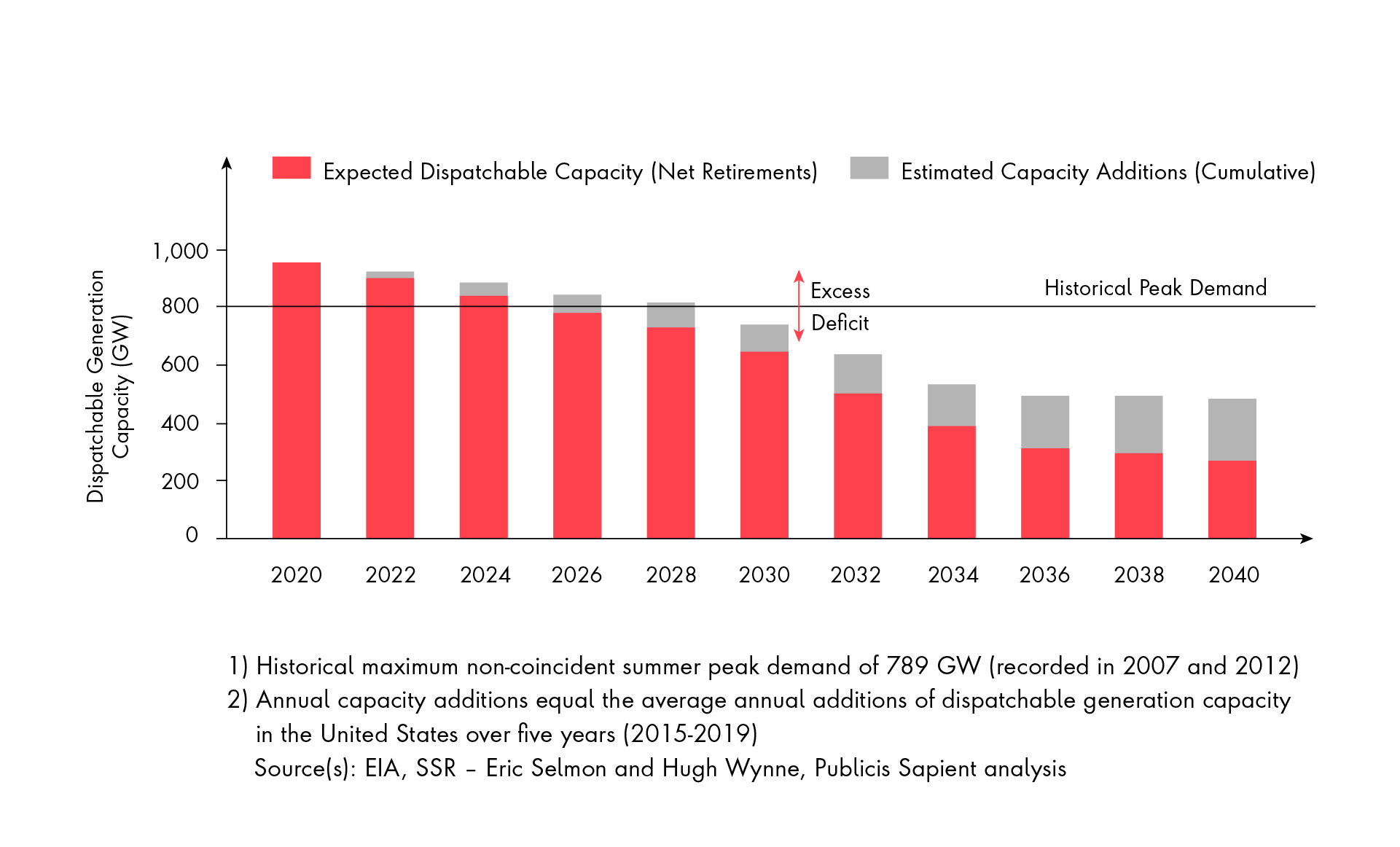

The trends at work in the U.S. generation mix signal that capacity shortfalls are likely to significantly outpace current projections. Our bottom-up analysis of the U.S. fleet suggests 63 percent of today’s firm capacity will retire by 2035, and filling the gap between supply and growing demand will require tripling recent replacement levels of dispatchable resources. Filling this gap with renewables is impractical given intermittency challenges and the high relative cost of battery storage.

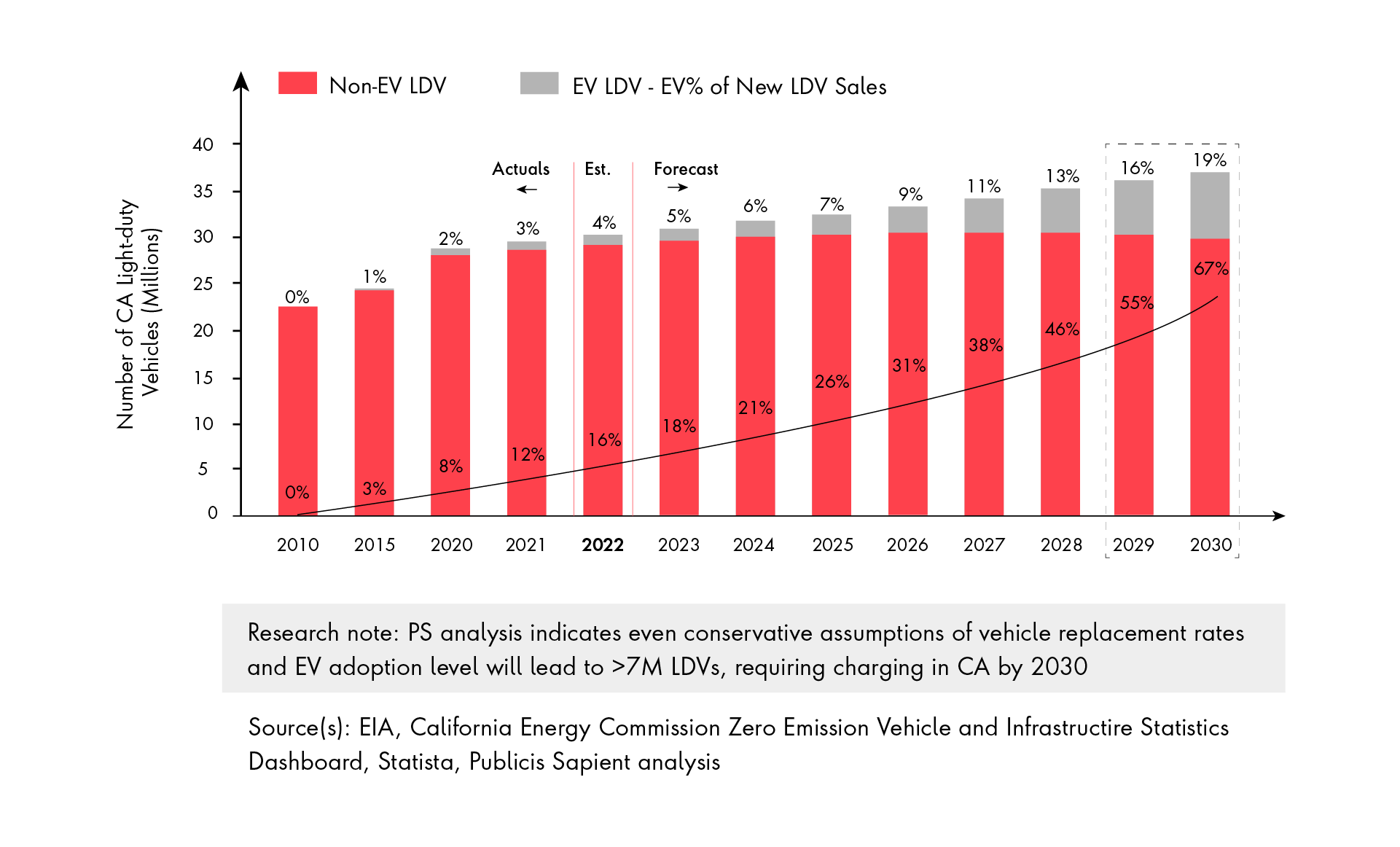

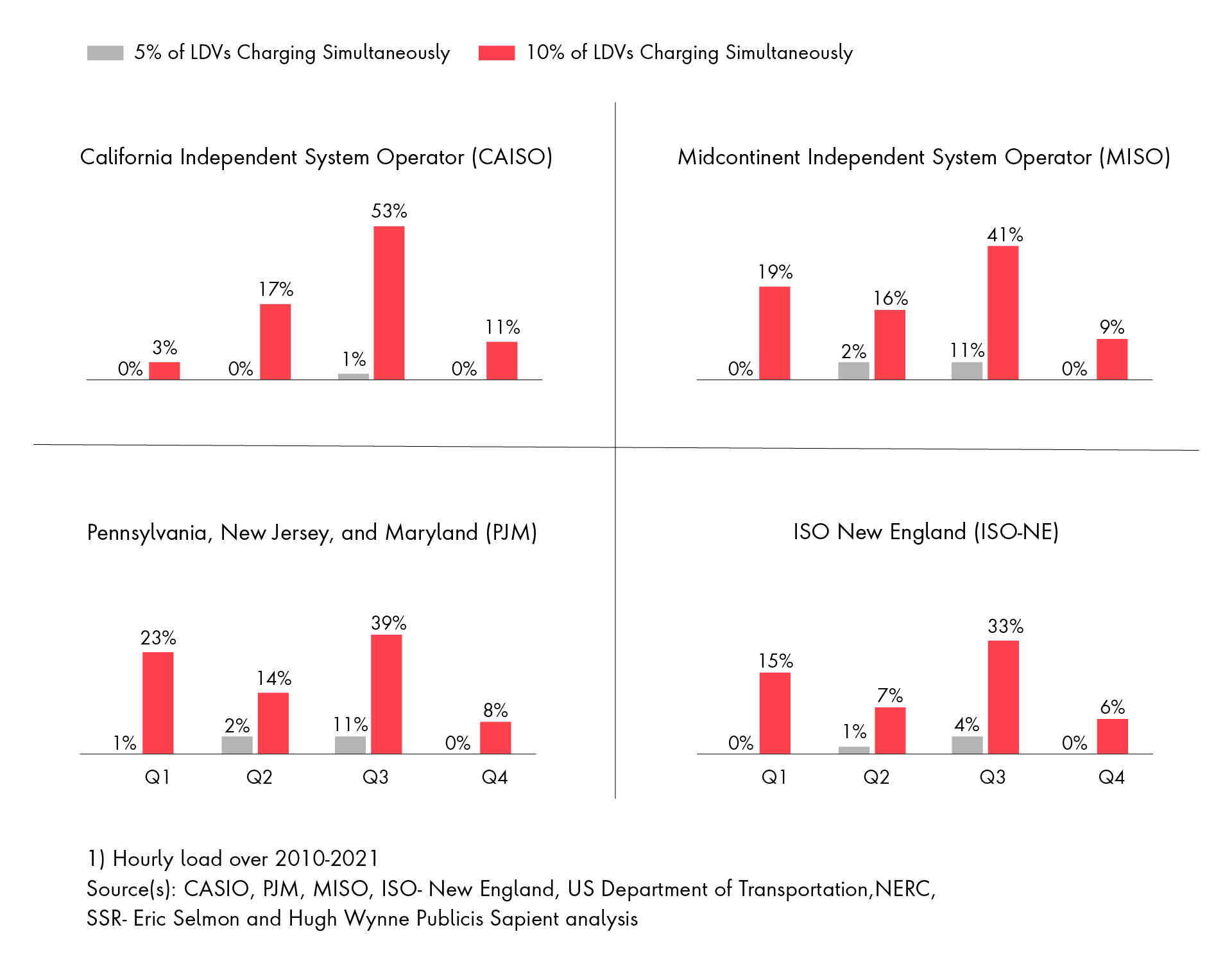

At the same time, gross electricity demand is expected to increase 10 percent by 2030 from EV adoption alone. If overall power demand follows traditional seasonal patterns and we assume that just five to 10 percent of LDVs were charging coincidently, every U.S. regional transmission organization would fail to maintain reserve margins at some point during the year. Furthermore, for several regional operators those capacity challenges are more concerning during the winter months—contrary to the sector’s popular focus on meeting summer demand.

A grid operating within reserve margins is inherently less reliable and more exposed to failure, particularly during extreme weather events. The approaching intersection of these supply and demand trajectories will present stakeholders with many challenges, but it will also create opportunities for solutions that balance climate goals and operational risk. These include services and channels for incentivizing residential customer demand response, as well as creative solutions for commercial and industrial partners that have their own emissions reduction goals. Beyond their direct customers, system operators must also bring regulators and policymakers along on the journey to ensure a uniform understanding of the generation supply tradeoffs required to guarantee system reliability.