What issue can we solve for you?

Type in your prompt above or try one of these suggestions

Suggested Prompt

Energy & Commodities

Shrinking Supply, Growing Demand: The U.S. Bulk Power System Nears a Breaking Point

Shrinking Supply, Growing Demand: The U.S. Bulk Power System Nears a Breaking Point

Tripp Fried and Boris Leshchinskiy

How did Texas become a bellwether for U.S. grid stability?

In February 2021, millions of Americans watched as Winter Storm Uri caused power blackouts across Texas during one of the coldest stretch of days on record. The sudden freeze crippled ERCOT, the state’s grid operator: gas pipes supplying power plants froze, wind turbines stopped spinning and the electric heaters in millions of homes went cold. Three of the fastest growing metropolitan centers in the country were brought to their knees and more than $300 billion in economic damage was inflicted upon the state.

How did Texas, the energy capital of the western hemisphere, fall victim to a disastrous cascade of power failures? What can we learn from the crash of dispatchable generation, which coincided with skyrocketing demand? The obvious answer is the storm: an anomalistic event that crippled an energy network made vulnerable by residents’ heavy dependence on electric heating.

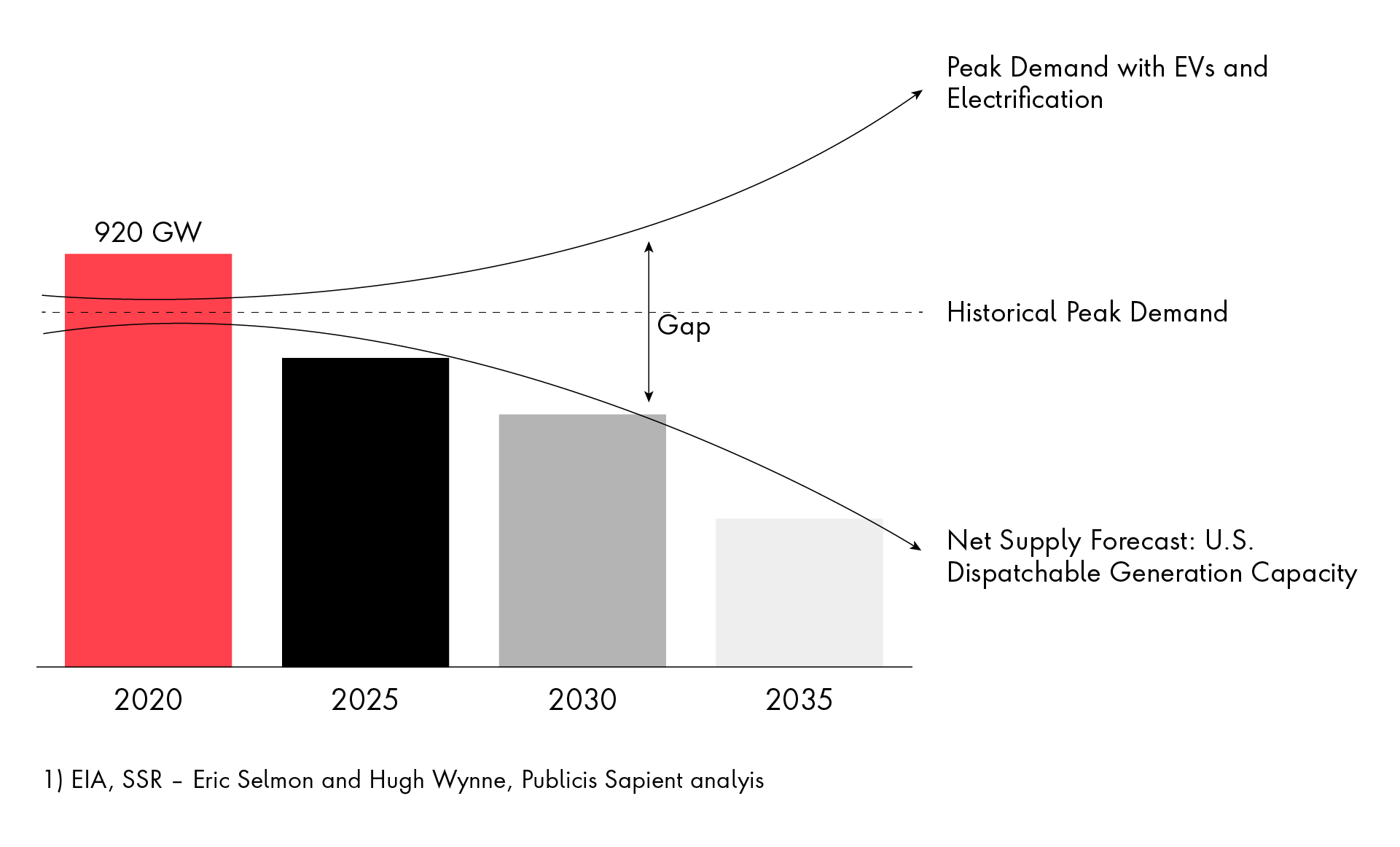

Our analysis suggests almost two-thirds of U.S. dispatchable generation capacity is likely to retire by 2035, well above forecasts from the Energy Information Administration (EIA).

This was more than an extreme climate event but a symptom of a fundamental issue that is common beyond ERCOT. There are clear signals that by 2030, blackouts like this could become a reality year-round across the United States (U.S.). Storm Uri hit Texas in a flash, but those coincident circumstances of rising electric demand and dwindling dispatchable supply are quietly setting the scene for nearly identical events across U.S. Regional Transmission Networks (RTOs). Although this process has none of the “drama” of an ice storm, the outcome for ratepayers and local economies will be the same.

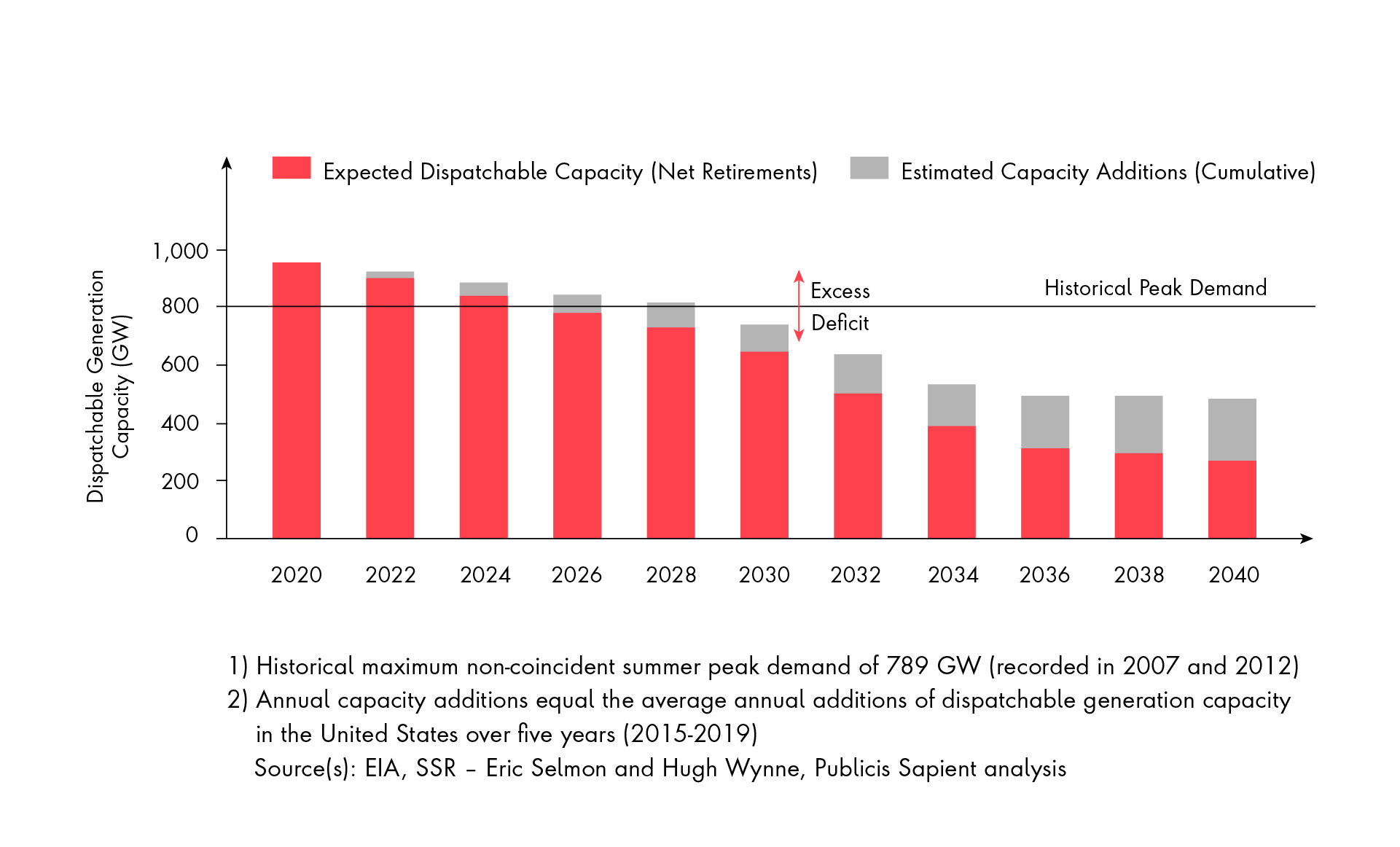

Publicis Sapient partnered with Sector & Sovereign Research (SSR) to examine U.S. energy supply fundamentals from the bottom-up, by facility technology and commissioning date. Our analysis suggests almost two-thirds of U.S. dispatchable generation capacity is likely to retire by 2035, well above forecasts from the Energy Information Administration (EIA). Over the same period, adoption of Electric Vehicles (EV) and widespread advancement of electrification policy will drive peak load well above the historical maximum (789 GW) observed in 2007 and 2012 (Exhibit 1).

Exhibit 1: U.S. Dispatchable Generation Capacity vs. Peak Demand

(GW, see note 1)

As U.S. energy security becomes more precarious, stakeholders must set aside ideological differences to collaborate on practical solutions that balance long-term climate goals against near-term economic and physical risks facing ratepayers.

A delicate (im)balance: Renewable versus dispatchable generation investment

Supply and demand shocks are a fact of life in power markets, but the industry is approaching a capacity constraint as investors and operators grapple with goals aimed at simultaneously reducing carbon emissions and underwriting energy security.

Our useful-life analysis indicates much of U.S. fossil fuel steam turbine generation capacity is likely to be retired over the next 10 to 15 years. Most plants operating today have design lives of 30-50 years and were commissioned between the late-1960s and early-1980s. Upon closer examination of the individual facilities that comprise the dispatchable generation portfolio, we believe conventional forecasts implicitly assume unrealistic availability timelines for a large proportion of today’s capacity. This will likely lead capacity retirements to outpace current expectations, even after adjusting plant operating timelines for upgrades and other investments that will extend design lives.

Capacity retirements are likely to outpace current expectations, even after adjusting plant operating timelines.

Without significant acceleration in upgrades and other plant modernization investments, firm capacity is expected to fall below peak U.S. demand levels as early as 2030 (Exhibit 2). Replacing retired capacity exclusively with renewables is uneconomic due to the huge supplemental investment required for excess capacity and energy storage that will offset the intermittency and availability risk of wind and solar generation.

Capacity retirements are likely to outpace current expectations, even after adjusting plant operating timelines.

Exhibit 2: Net Forecast – U.S. Dispatchable Generation Capacity

(2020 actual GW, totals adjusted for estimated retirements/additions in out years; see notes 1, 2)

Historically, an average of around 11 GW/year has been added to dispatchable generation capacity in the U.S. to fill the looming supply gap. To close the gap seen in the chart above, we need to triple that (to ~29 GW/year) to offset what we expect in retirements.

Electricity demand roars ahead

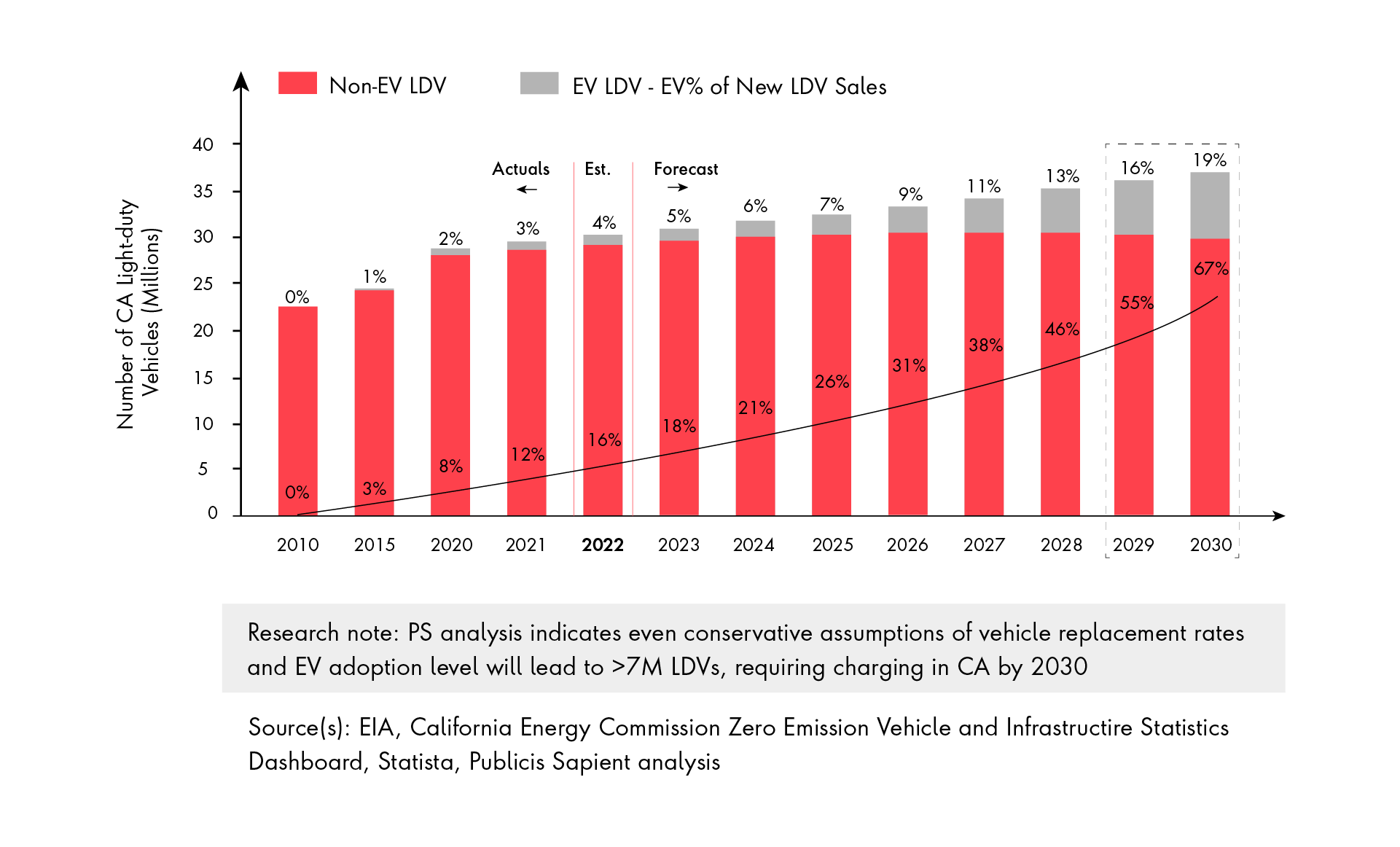

While generating capacity rotates away from traditional technologies, stakeholders are simultaneously negotiating a demand shock caused by policies aimed at disincentivizing natural gas in favor of building electrification, and by the accelerated adoption of EVs. While the pace of EV adoption varies across the U.S., experts largely agree between 20-40 percent of light-duty vehicles (“LDV”) will be electric by 2035 (Exhibit 3). Overlaying the demand effects of LDV charging would increase gross energy demand by five to 10 percent, which appears modest at first glance.

Exhibit 3: California LDV Fleet Growth Forecast, and Estimated Proportion of EVs

(M, 2010 – 2021 actuals, 2022 – 2030 forecast)

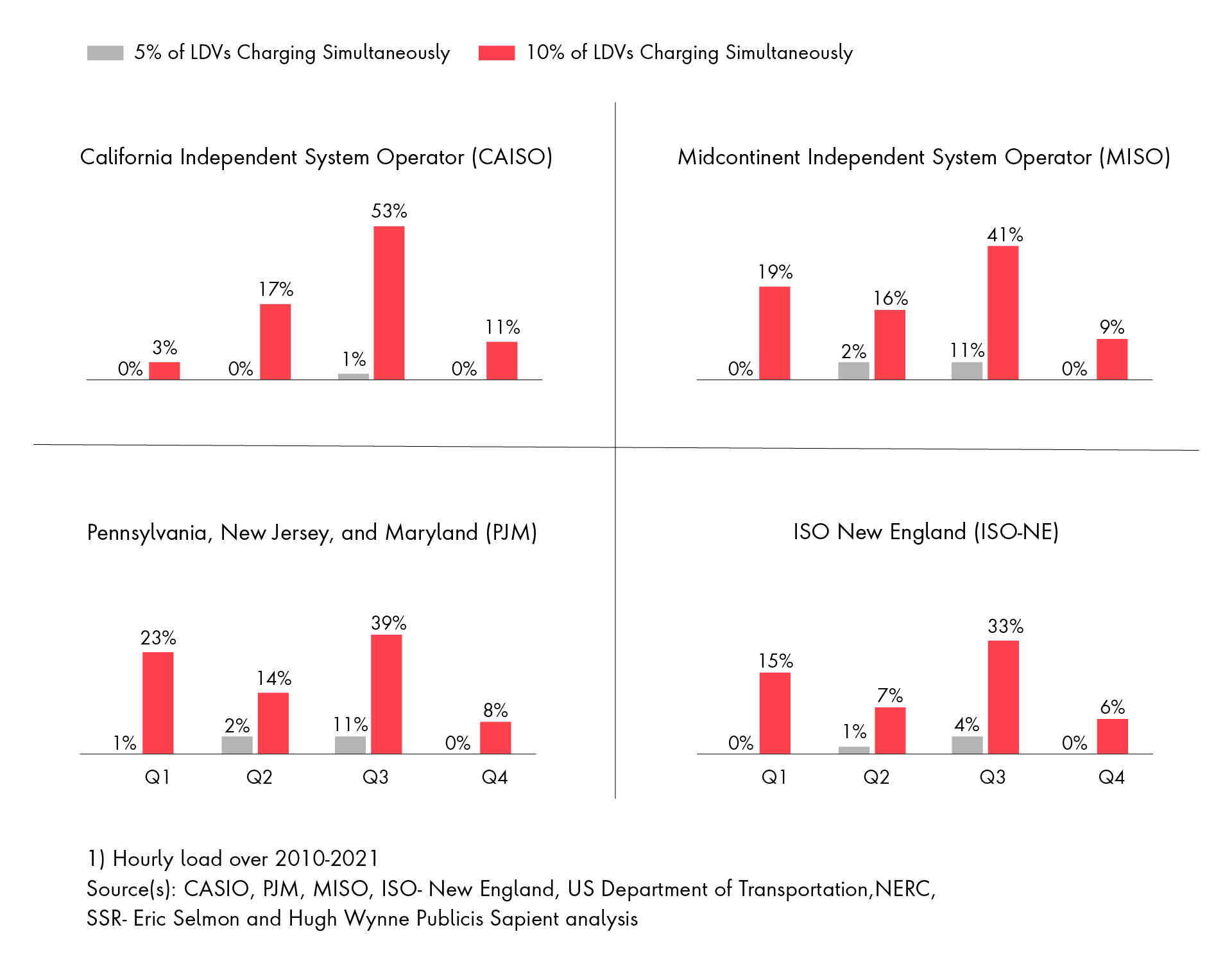

However, the picture is complicated by the uneven shape and seasonality of demand during the typical day, or across the calendar year. For the moment let us set aside the effects of increased base demand due to building electrification and examine the impact of EVs alone. If just five percent or 10 percent of LDVs were charging simultaneously, and we layer that atop historical figures for hourly load, the resulting demand would exceed reserve capacity levels (firm capacity less then 15 percent margin) in most of the U.S.’ regional power markets (Exhibit 4).

Exhibit 4: % Hours Historical Peak Load (see note 1) + EV Charging Would Exceed Firm Capacity

('22 firm capacity less than 15% reserve by RTO; assumes charging at 10KW)

Pushing against the current: How utility operators can mitigate outages and the economic fallout

The trends at work in the U.S. generation mix signal that capacity shortfalls are likely to significantly outpace current projections. Our bottom-up analysis of the U.S. fleet suggests 63 percent of today’s firm capacity will retire by 2035, and filling the gap between supply and growing demand will require tripling recent replacement levels of dispatchable resources. Filling this gap with renewables is impractical given intermittency challenges and the high relative cost of battery storage.

At the same time, gross electricity demand is expected to increase 10 percent by 2030 from EV adoption alone. If overall power demand follows traditional seasonal patterns and we assume that just five to 10 percent of LDVs were charging coincidently, every U.S. regional transmission organization would fail to maintain reserve margins at some point during the year. Furthermore, for several regional operators those capacity challenges are more concerning during the winter months—contrary to the sector’s popular focus on meeting summer demand.

A grid operating within reserve margins is inherently less reliable and more exposed to failure, particularly during extreme weather events. The approaching intersection of these supply and demand trajectories will present stakeholders with many challenges, but it will also create opportunities for solutions that balance climate goals and operational risk. These include services and channels for incentivizing residential customer demand response, as well as creative solutions for commercial and industrial partners that have their own emissions reduction goals. Beyond their direct customers, system operators must also bring regulators and policymakers along on the journey to ensure a uniform understanding of the generation supply tradeoffs required to guarantee system reliability.

A less reliable, more volatile and more expensive U.S. power system will hold challenges but also create opportunities for new solutions for industry participants:

Customer solutions:

Expanded demand for energy services to manage costs and reliability, including distributed generation, storage, backup power and demand response

Utility capabilities:

Utilities will need new and enhanced capabilities to balance power demand with supply, in real time, while meeting customer needs and balancing affordability with system investments

Grid solutions:

Adapting the grid to this situation and integrating more distributed generation, storage, backup power and energy services will require a smarter, more agile system enabled by advanced analytics and artificial intelligence

Power market solutions:

A more volatile market creates opportunities for trading as well as new asset investments (e.g., gas peakers, storage)

Policy support:

The supply and demand imbalance will create political challenges but also an opportunity to work with regulators and policymakers on new solutions

With the ever-changing utilities landscape, finding ways to grow and evolve will continue to be a challenge. Leaders who embrace change and create opportunities for new solutions and capabilities will find themselves at a competitive advantage in the future. At Publicis Sapient, we help clients address industry challenges, uncover new opportunities and work with them to build a plan for transformation and success. Contact us to learn more about our services and how we can help you navigate these challenging times.

SSR Research Reports Cited:

Eric Selmon and Hugh Wynne, June 7, 2021, The Looming Crisis in Generation Capacity

Eric Selmon and Hugh Wynne, September 1, 2021, The Clean Energy Transition: A Primer for PMs, Part 2 – The Rising Cost of Renewable Power

Eric Selmon and Hugh Wynne, February 15, 2022, The Electrification of Light Duty Vehicles Will Increase Electricity Demand by a Quarter

Eric Selmon and Hugh Wynne, February 28, 2022, How Electric Vehicles Will Disrupt the Grid

Eric Selmon and Hugh Wynne, April 25, 2022, The Stability of America’s Largest Power Grids Is at Risk from EV Charging Loads, Especially During Harsh Winter Weather

Related Reading

-

![]()

New Research: Utilities vs Extreme Weather Events

How should utilities react to growing environmental instability? Our whitepaper analyzes the effects of EWEs, the energy transition, outages and more.

-

![]()

Ontario Energy Board Eases Strain on Grid

How data, gamification and the spirit of competition inspire responsible energy usage.

-

![]()

Connecting the Oil & Gas Data Pipeline

In this executive briefing paper and the accompanying video, we explore the importance of a modern, responsive, and resilient value chain in the oil & gas sector –and specifically how a unified approach to data can lead to smarter operational decisions.