Broader consumer trends and preferences show that D2C channels are likely to continue growing but alongside general trends it’s clear that consumers still prefer to purchase from independent agents. As of 2020, captive agents lost 4 percent of the market share since 2015 due to lower customer satisfaction. Carriers have taken note and insurers such as Nationwide are transitioning all formerly captive agents to independent agent channels.

Given this climate, the goal for independent agents is to spend more time on sales and advice to customers and less on servicing, which includes activities such as processing policy changes and bill payments. Independent agents are adopting software to enhance their efficiency in sales, underwriting and service to better meet customer needs and expectations. Considering these trends, carriers can alleviate pain points in four major areas.

Top pain points agents have with insurance carriers

1. Processing policy questions and changes

Insurance agents are spending a tremendous amount of time waiting on the phone for customer service representatives at insurance carriers, with wait times occasionally reaching 90 minutes even for standard policy changes. While agents understand that carriers are understaffed due to the pandemic, this is not sustainable. During our agent interviews, we consistently heard that chatbots frustrated agents looking to answer policy questions or process policy changes for their customers. Carriers can enhance their chatbots and expand online functionality for agents to quickly update policies, with automated notifications when policy updates are needed. This will also reduce call center wait times.

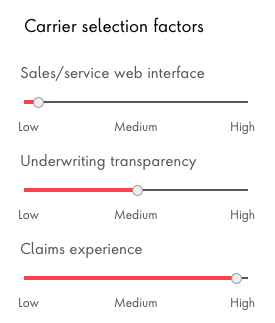

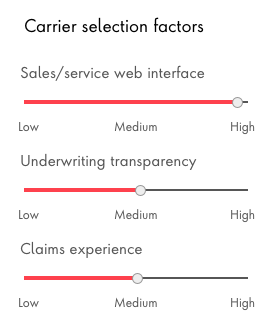

2. More transparency in the underwriting process and access to underwriters

When appealing or reviewing underwriting decisions, agents agreed that they would like more transparency in the process and access to carrier underwriters. During our agent interviews, we learned that agents would appreciate having consistent access to the same underwriters for a given product. There’s also recognition that underwriters need to pivot to a stronger focus on the customer rather than the traditional transactional nature of their role, now exacerbated by the increasing digital nature of the underwriting process. Giving agents more direct access to underwriting features would enable them to better understand the policy makeup and pricing, which they could communicate back to the customer.

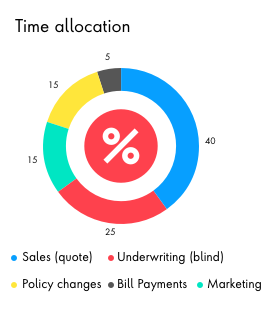

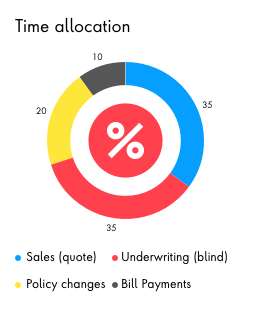

3. Time spent on servicing

Agents feel like they spend too much of their time on servicing tasks for their customers rather than offering sales and advice. For more mundane tasks like bill payments and automatic policy renewals, agents would be willing to let the carrier take over those tasks. However, agents are aware of the value of their direct relationship with the customer and want to maintain their place as point of contact for moments that matter and continued customer trust. One example is the initial intake of claims – agents play a valuable role in determining whether the claim should be processed by the carrier given the policy deductible and long-term premium impact.

4. Lack of customer insights

Agents rely on their agency management software (AMS) as their tool for customer relationship management. For every interaction with the customer, agents refer to their AMS to provide information on the customer. Simple business rules can be set up to trigger agent notifications at customer events such as renewals. For example, one agent we spoke to employs a rule in their AMS to provide an alert to the agent when a customer’s policy increases by more than 12 percent in a given year. This prompts the agent to look at alternative carriers or policy changes. Given rising costs due to inflation, many policies are increasing by 12 percent or more so the effectiveness of these simple rule-based approaches are not meeting agent needs. Carriers could take this opportunity to provide more robust customer insight dashboards, incorporating third party data and machine learning algorithms to provide more robust insights. Since carriers have an abundance of data in their systems, new and enhanced insights and notifications can easily be deployed and refined based on agent feedback. In our interviews, agents noted they would value technology that scans their existing book to identify and prioritize opportunities for additional policies and enhanced coverage.

.png)