The fuel retail landscape has weathered unprecedented demand challenges in the two years since Covid-19 first shook markets. As 2022 unfolds, global virus surges are having a more muted impact on oil use. Mobility indicators by the International Energy Agency (IEA) forecast robust months ahead due to oil demand being stronger than expected in recent months. The easing of lockdown measures provides a boost, and jet and kerosene deliveries are expected to recover by mid-year. But while these indicators are overall positive news for fuel retailers, oil markets could be in for another volatile year depending on unscheduled supply outages, the growth of renewable energy sources, and an increase in extreme weather events. A new report by Publicis Sapient, Energy Central and Appos highlights the threat of climate change for the energy industry – including unexpected, unusual, severe or unseasonal weather at excesses that has not been seen in the past.

What issue can we solve for you?

Type in your prompt above or try one of these suggestions

Suggested Prompt

Energy & Commodities

How Fuel Retailers Can Grab Market Share Through Personalization

How Fuel Retailers Can Grab Market Share Through Personalization

Demand for fuel is picking up, but challenges like severe weather events are keeping fuel retailers alert as consumer requirements evolve.

The fuel retail industry is clearly facing significant change. Fuel retailers and their consumers are experiencing this change from very different points of view. In this environment, fuel retail companies have a lot on their plate. They are thinking about how to preserve their dividends, how to preserve cash and how to reduce costs and inventory. Meanwhile, their customers have undergone a major behavior shift. Personal health and safety concerns are paramount, with considerations such as whether they are safe going to the fuel station, or if contactless service and payment are available. The challenge for industry leaders will be how to bridge this gap—addressing the consumers’ worries while meeting company goals.

All these challenges offer a significant opportunity for the fuel retail industry. If fuel retailers address consumer requirements and personalize products and services, they can build and increase a loyal consumer base. Now is the opportunity to acquire customers and catch a potential upcoming recovery wave early. Publicis Sapient’s approach to consumer engagement can help potentially capture an additional 20 percent to 30 percent of total mogas (motor gasoline) fuel sales while reducing marketing operating expenses.

If fuel retailers address consumer requirements and personalize products and services, they can build and increase a loyal consumer base.

Personalize through data

Personalization has become key to bridging the gap between company and consumer needs. By understanding the behavior profiles of consumers, a company can identify trends and create personalized messaging to go hand-in-hand with product and service offers.

Consumer requirements are continually evolving, region by region, city by city. Keeping tabs on this development is important. People want to know if the convenience store attached to the fuel station can deliver groceries, and what products are stocked in order to make fewer stops. They want to stock their pantry in addition to keeping their gas tank full.

By understanding the behavior profiles of consumers, a company can identify trends and create personalized messaging to go hand-in-hand with product and service offers.

For example, fuel retailers must rethink their offers to satisfy customer safety requirements. Contactless payment as a service must be clearly advertised, for example, through a text message or email. Traditionally, fuel retail promotions have been around discounts on fuel, without providing a new service. With contactless, fuel stations must ensure that they have the technology they advertise. The approach we recommend is to continually look at consumer behavior signals and identify what new or updated services the retailer should offer (for example, hand sanitizers, contactless payment, C-store ecommerce, etc.) and have a coordinated communication campaign.

How fuel retailers can personalize offerings

Fuel retailers can personalize their offerings using the Publicis Sapient and Epsilon approach of combining Data, Technology and Experience.

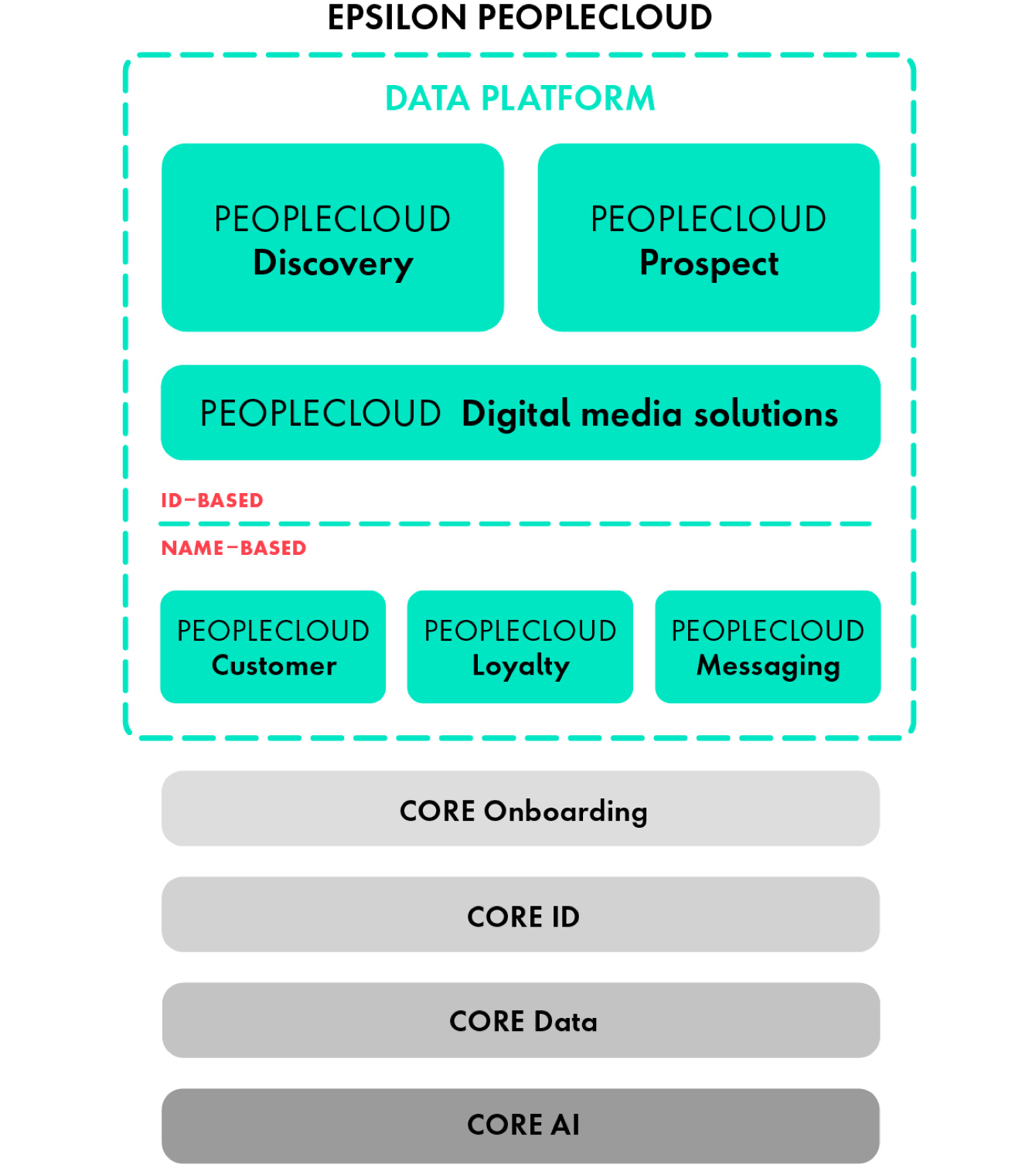

Data – Fuel retailers can access around 200 million customer profiles in the U.S. alone. Similar volumes of data are available in Western Europe, as a lot of available data is compliant with privacy laws including General Data Protection Regulation (GDPR)—a regulation in EU law on data protection. Accessing and unlocking data profiles are the lynchpin to understanding behavior profiles of a large consumer base. We look at the aggregate data and trends to gain a deep knowledge of consumer signals and key moments by audience and geography. Traditional companies have used cookies, which last a day or two. However, platforms such as the Epsilon PeopleCloud are more persistent by connecting the behavior to devices and people. This data provides a 55 to 60 percent accuracy when matching data points. Compared to the industry average of media companies, which is usually between three and four percent. Therefore, using the latest technology to utilize data is a significant competitive advantage.

Technology – Technology allows a fuel retailer to correlate behaviors from different data sources into a single profile. For example, if a consumer has visited certain places, spent money on certain websites and watched various TV shows, this data from different sources can be correlated into key behavior points. The Epsilon PeopleCloud is a data and activation platform used to activate, personalize and drive performance with the power of deep customer understanding. The machine learning algorithms are continually refining the matches as new data points and signals come in. This platform also measures the effectiveness of the various programs so that a marketing team can make a proactive decision rather than a look-back. In addition to communication and measurement, companies also need to ensure that the overall digital experience and offline experience (as described in the next paragraph) are integrated with the data. Because history is no longer a guide to the future, how retailers forecast demand and adjust supply accordingly will need to change. This is another area where consumer behavior signals can help chart a path forward.

Experience – Companies must go to where the consumer is. Consumers are not as likely to download another new app and start using it. Fuel retailers should use the apps that their customers are already using. For example, on-demand delivery start-up, Rappi, in Latin America has enjoyed success. So, fuel retailers can think about creating an offer or promotion inside the likes of Rappi or Amazon. They could even place an ad inside Candycrush; it doesn’t have to be traditional media. Companies must bring personalized media and digital experience into the consumer’s ecosystem. Beyond communication, the end-to-end (online to offline) experience must also be part of the experience design philosophy. For example, eCommerce, full-service fuel stations, contactless payment, stocking high demand items, etc. should be part of the experience design in an integrated way in line with consumer preferences.

Companies must bring personalised media and digital experience into the consumer’s ecosystem.

This approach should not be a one-time event. Once the technologies are in place initially, retailers need to think about how to evolve. This is because consumer sentiment and behavior are also changing week to week and location to location. The idea is to build a data-technology-experience “flywheel” that will allow retailers to continually adapt to evolving sentiments and behaviors.

Measure success

Fuel retailers must test and learn, and on the other hand, they must also respond to rapidly changing consumer sentiment. Consumer worries in April will have changed from their concerns in May, June or August. Companies must stay on top of these shifting needs and understand the requirements. This includes responding to sentiment and behavior as well as to what’s working and what’s not working in terms of new offers and services. It’s a rapid response cycle. Fuel retailers must evolve into nimble organizations to be ahead of the curve of where the consumer is going.

Fuel retailers must evolve into nimble organizations to be ahead of the curve of where the consumer is going.