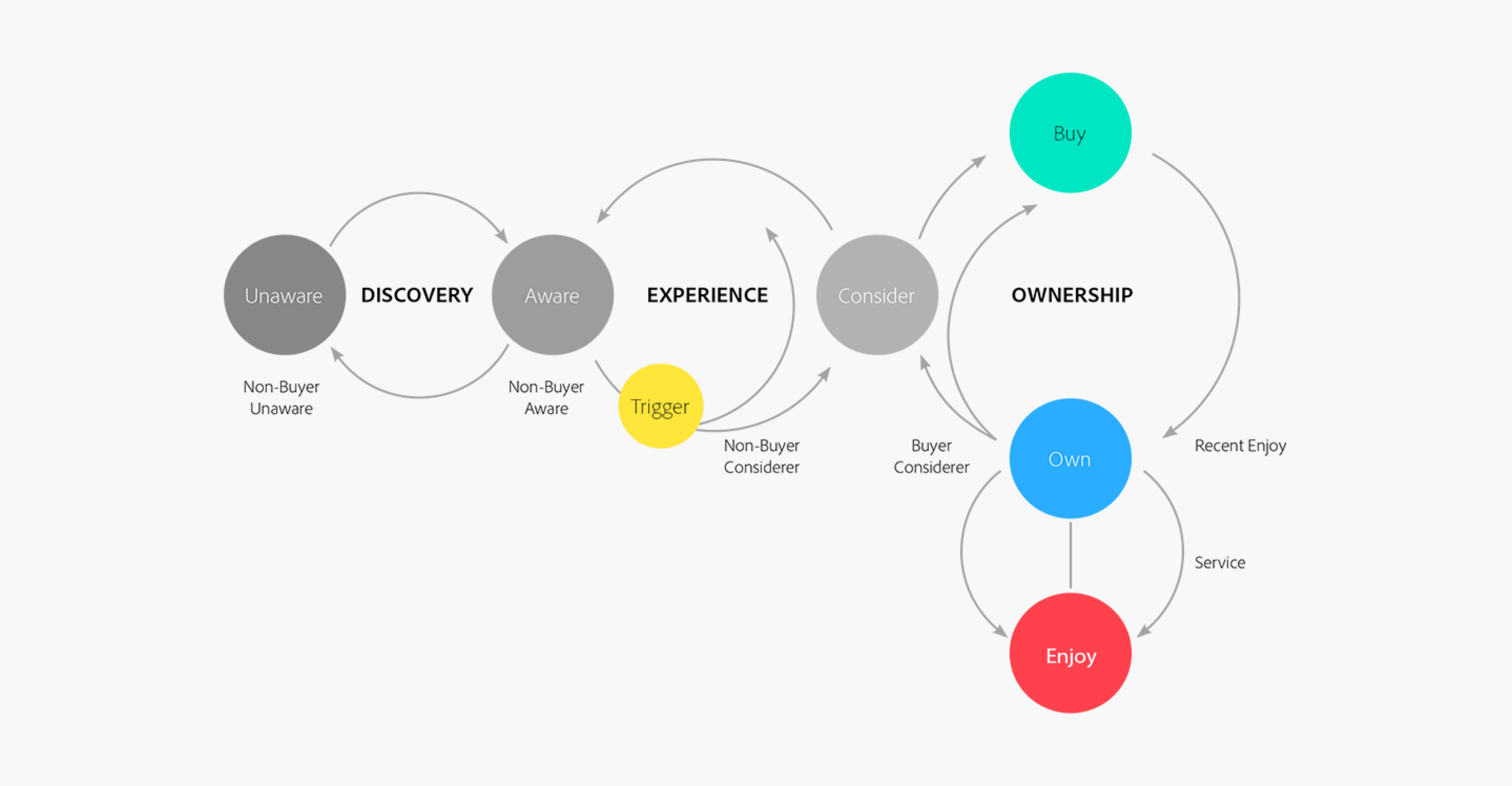

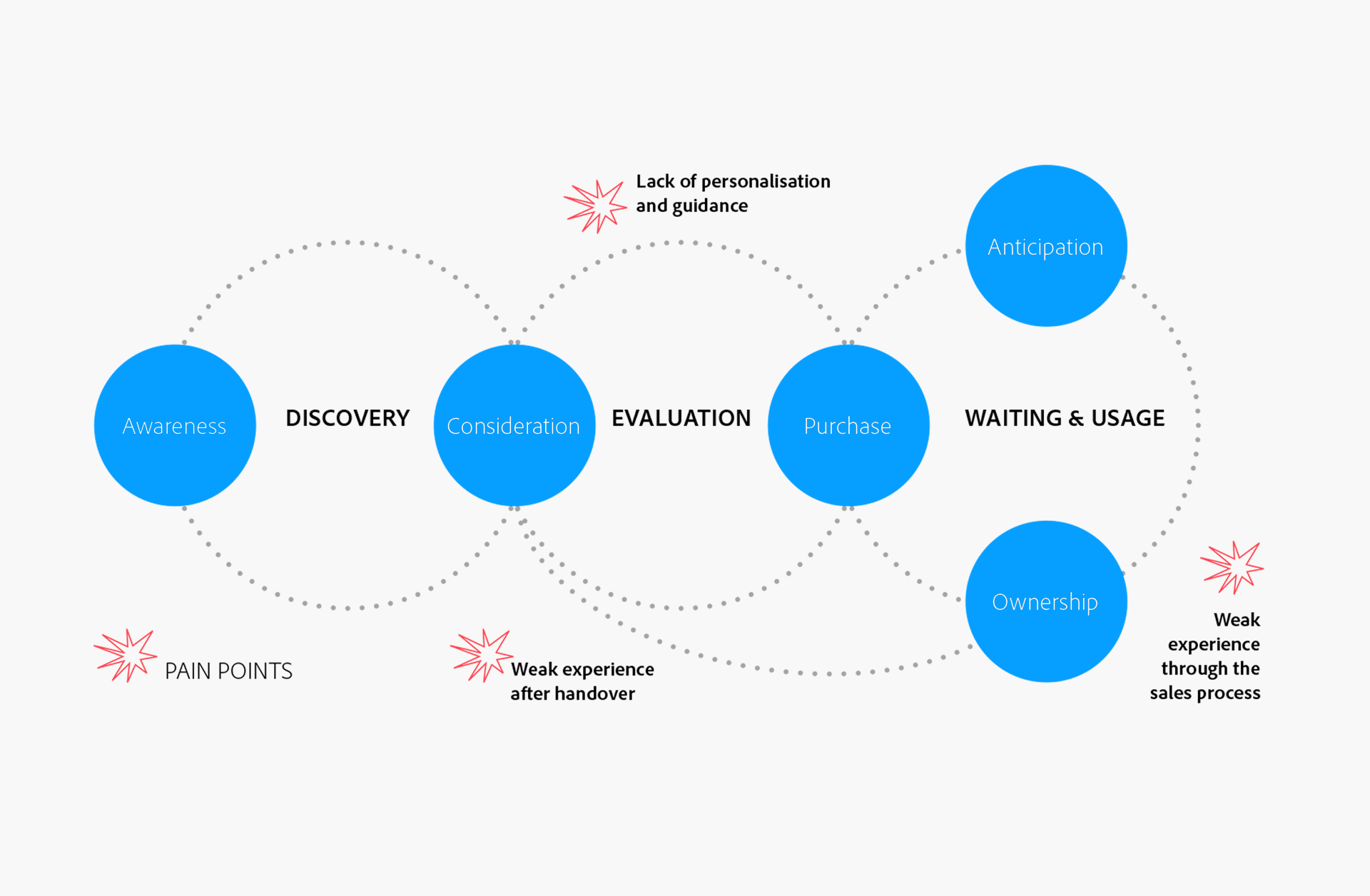

Awareness—who is responsible for this? We most often assume this is the job of the OEM, as their central brand and marketing teams invest in creating big brand and new product launch campaigns. They spend large sums of marketing dollars on TV spots and outdoor advertising to "show" their brand and new product to the world.

Consideration—this is where NSCs come in, in an ideal world connecting the global brand work with harder working, conquesting and sales-driven communications to generate leads.

Purchase—this is where dealers kick in to get the sale, using test drives and an increasing array of attractive finance offers to get prospects over the line successfully.

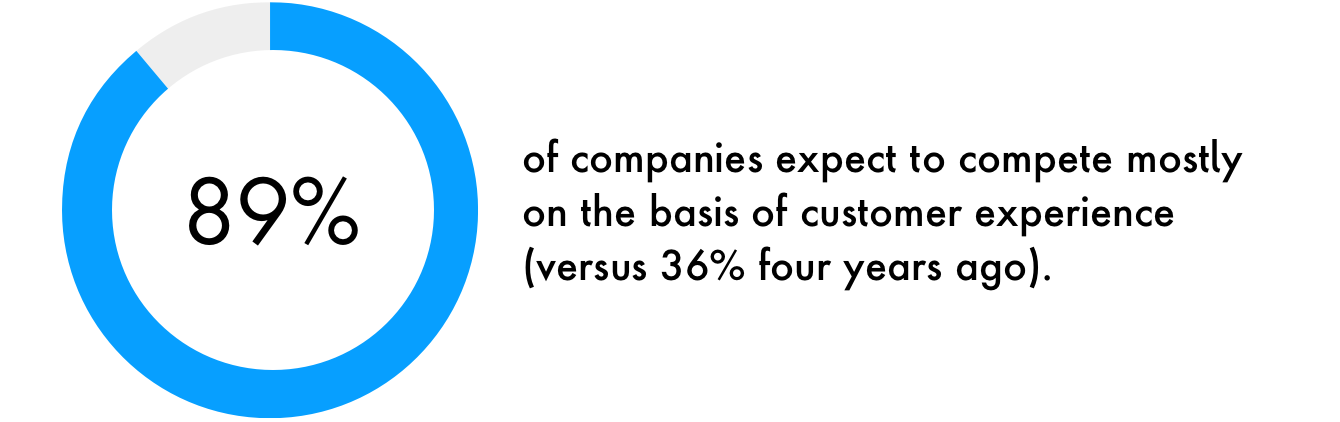

In theory it should all connect, but we have all experienced the reality – generic retargeting ads that stalk us around the internet showing a car we’re not interested in, a dealer visit where we have to provide all our contact details again and brief the dealer on the car we’ve already spent hours looking at on the website. It all adds up to a negative experience with a high propensity to seek a brand that offers us a more connected and contextual experience.

The operating models, data and technology enablement that underpins the OEM, NSC, and dealer ecosystem

We need to look deeper to see what’s missing or misfiring, and examine the connective tissue that brings this all together in a meaningful, contextual and relevant way for prospects so that it in turn unlocks value for OEMs, NSCs and dealers.

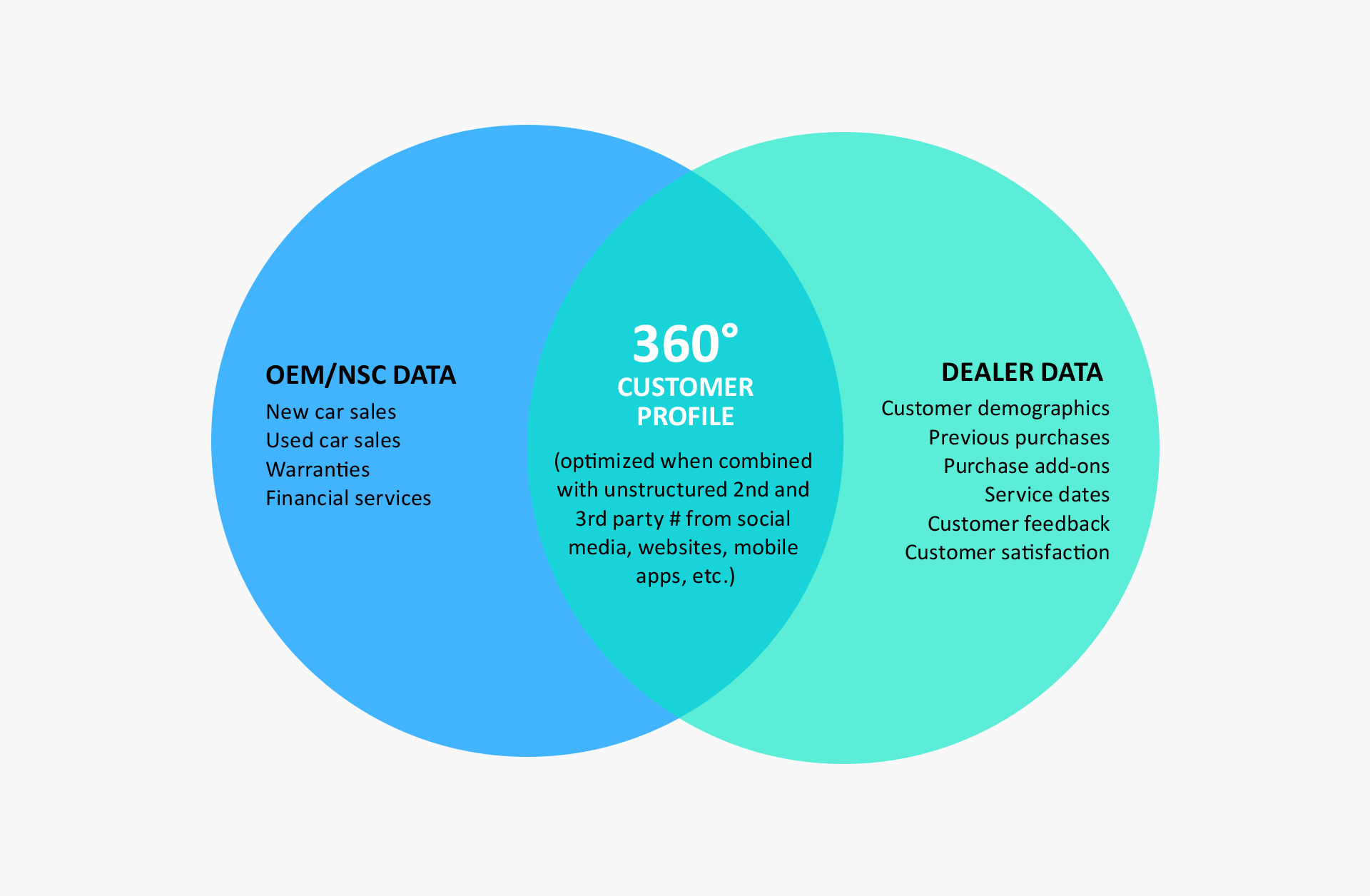

OEM-NSC-dealer collaboration (beyond the exchange of goods and payments) has trust issues on all sides, particularly when it comes to sharing customer data. Indeed, often there are contractual issues that prevent them from being able to or wanting to share data. While OEMs and dealers clearly need each other, the survival of the relationship needs to be transformed to be more collaborative and trustworthy, and where data can be seen as a currency that unlocks value for all parties when used and shared responsibly.

As services on top of the car itself continue to evolve and platforms such as MercedesMe provide insights in real time on usage and driving behaviours, as well as triggers for seeking a new service or replacement model, the imperative to connect data across the operating ecosystem becomes ever greater to ensure brands retain customers and win new ones.

We know OEM, NSCs and dealers have separately invested in content management platforms, advanced analytics, personalization and retargeting capabilities in order to connect with the increasingly discerning buyer. However, the issue is their efforts are not joined up across their operating ecosystem: the data from media is not connected to website analytics, which in turn is not connected to any dealer interactions or CRM communications. And data does not flow across the customer journey in a dynamic and intelligent way to surface insights when and where they are needed to build brand, develop leads and close sales

Hence the lack of connection creates a leaky bucket of missed sales opportunities and the schizophrenic brand behavior that customers often experience. It also means all three parties are missing out on being able to use insights around lifestage triggers such as having a baby, a new job or getting married that bring new people into the car-buying market. It also misses out on machine learning to build propensity models on next best action to nudge prospects effectively through the whole lifecycle and understand which marketing assets they need to invest in most to drive leads and sales.

And so today, the disconnect is still very much in evidence: sales people often have no historical information on previous buyer interactions with the OEM, which inevitably stalls the path to purchase, or can even lead to abandonment. On the other side, the OEM has no dealer data from interactions between the customer and the dealer. As a result, the natural triangulation of OEM, dealer and customer suffers significant loss.

For the future sales network to remain effective in the face of disruptive new players and business models it will require a ground-up transformation that focuses on connecting the people, technology and operations of all these partners to enable them to focus on the customer and connect meaningfully through actionable insights and an intelligent platform.

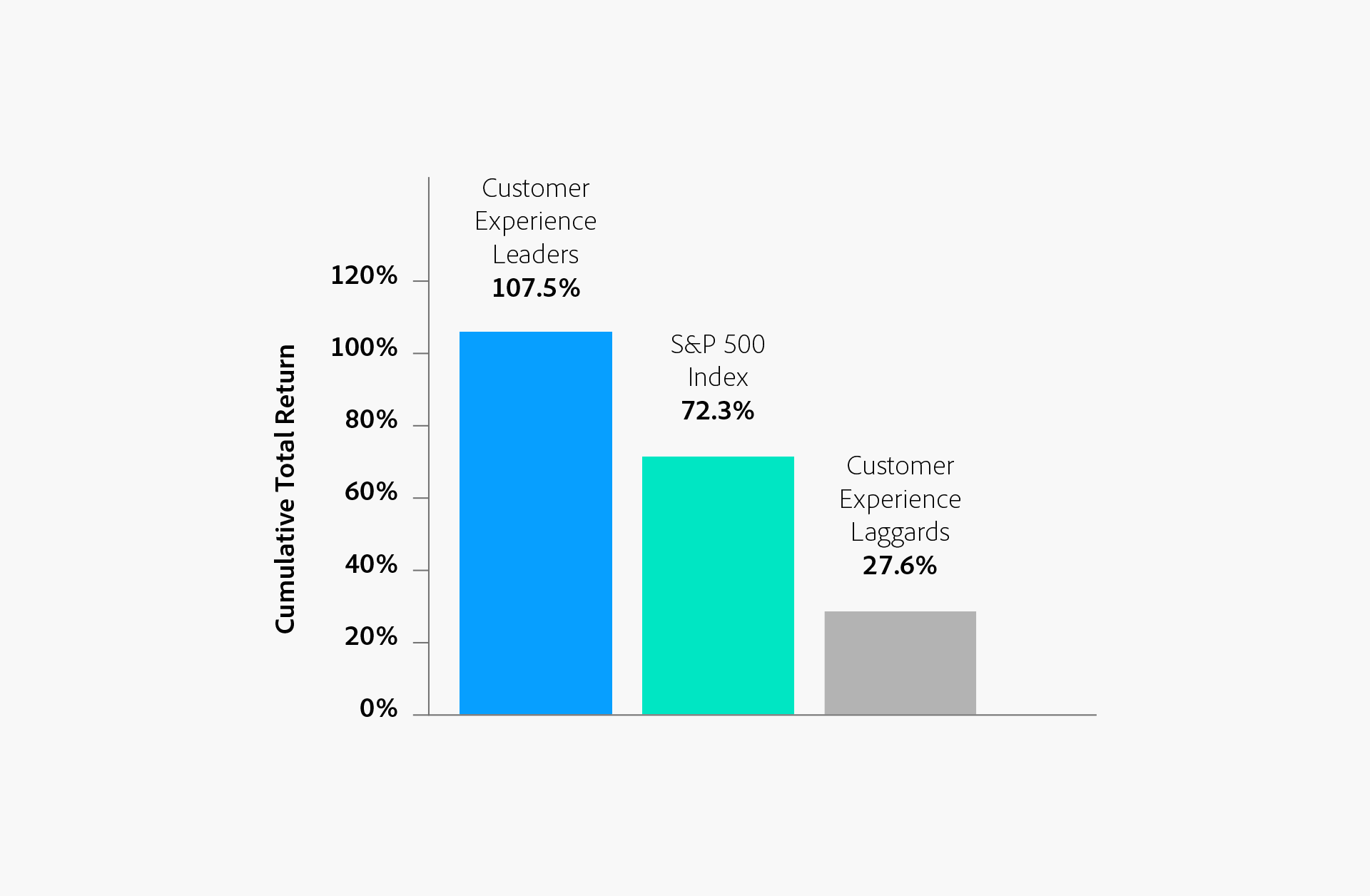

When done right, this transformation can drive the business outcomes all parties want: sustainable sales growth with higher customer satisfaction and good profitability. A recent Publicis Sapient study surveyed 500 global executives and found that 48 percent of digitally mature companies (measured across six key areas) have market-leading profitability, compared with just 17 percent of digitally immature firms.¹

Moreover, the companies that are leaders in developing their digital capabilities are far more likely to be redefining the shape of their industry overall.

If you want to be in business in 20 years, investing in the connective tissue of data and technology enablement needs to happen today.