Most supply chains still rely on gut instinct—here’s how AI is helping leaders finally see what’s coming before it hits.

What issue can we solve for you?

Type in your prompt above or try one of these suggestions

Suggested Prompt

How to Balance Demand Visibility and Intelligent Supply Planning

You’re not alone if you rely on traditional statistical models that over-index on historical sales or shipment data to understand customer demand and align fulfillment.

However, this data assumes the past will repeat itself, plus or minus a few percentage points. Unfortunately, it doesn’t address changes in business dynamics, consumer sentiment or why customers buy. It’s also no help for rapidly changing and overlapping product portfolios that cannibalize each other and make it difficult to assess market trends year over year. Plus, it doesn’t optimally segment products on a good-better-best basis for meaningful lifecycle and Halo analysis to determine which products will stick—and which will drive revenue.

Relying exclusively on historical data assumes that better forecast accuracy is the only factor that will drive better business performance. It measures demand without understanding the drivers of surges and slumps. There is a better way to understand demand and maximize margins at the same time.

The $2 trillion mistake: why supply chains fail without demand intelligence

Improving cost efficiency, ensuring product availability and increasing supply chain resilience remain top concerns for supply chain leaders going into 2025. But here’s the thing. These improvements hinge on how well you understand customer demand and use this knowledge to your advantage, which is one of the hardest things that supply chain organizations do.

Forecasting isn’t a perfect science. Every industry is different. For example, forecasters in consumer products get it wrong half of the time. The average error rate in food and beverage is 25 percent. The goal isn’t a perfect number but improved forecast accuracy at specific and actionable lags, at the right statistical level of significance, to enhance product availability, plan adherence, and cost to serve.

What’s more, not all products are forecastable, especially niche ones with erratic demand or slow-moving consumption patterns like brake pads for a 20-year-old car or highly specialized lab equipment. This is why it’s important to establish forecasting approaches that help you intelligently manage product procurement, production, inventory management and distribution visibility in a way that balances demand visibility with intelligent supply planning.

The retail industry alone loses an estimated $1.75 trillion in sales every year because of out-of-stocks. Overstocks cost ecommerce companies $362.1 billion every year."

Imbalances here have massive impact. Out-of-stocks hurt topline growth. Overstocks increase holding costs and waste. Mismatches between where customers are and where you store products increases transportation costs and delivery delays. And when business exceptions happen, there’s no insight to weigh the cost of action versus inaction. All of this can damage customer retention and competitiveness.

Demand sensing changes the game, moving your organization from placing bets to predicting behaviors. From reactive to proactive. From a cost center to a value center.

Demand sensing uses data derived from macro- and microeconomic sources to identify, correlate and anticipate shifts in demand patterns. This gives your planners valuable insights from leading indicators to help predict and validate movements in consumer sentiment well ahead of a costly investment.

AI is supercharging the world of demand sensing. It makes it possible to simultaneously evaluate the impact of various factors on forecast performance, assess value add and conduct better consensus-based decisioning across complex and market sensitive product portfolios.

But even the best predictive forecast models require some common-sense interaction and oversight. And they are no substitute for a strong demand-supply balancing approach. Demand sensing is only the first half of the equation. What’s essential is closing the gap between demand and supply by executing on the signals from demand sensing with intelligent fulfillment practices. This is the end game. Getting products into customers’ hands at the right time—and at the right cost.

Why supply chains still run on gut instinct

It’s astounding that 92 percent of supply chain executives are forced to “go with their gut” on key decisions because they don’t get predictive guidance. This exposes how stuck in the past forecasting is.

It’s not that historical data has no value. In fact, the highest volume, least differentiated and lowest margin products are often the easiest to manage with historical data. But highly differentiated products are most at risk from volatility and are the hardest to forecast, inventory and distribute profitably. If there’s one thing that a decade of global instability, black swan events and the TikTok effect has taught us, it’s this: customer demand isn’t static.

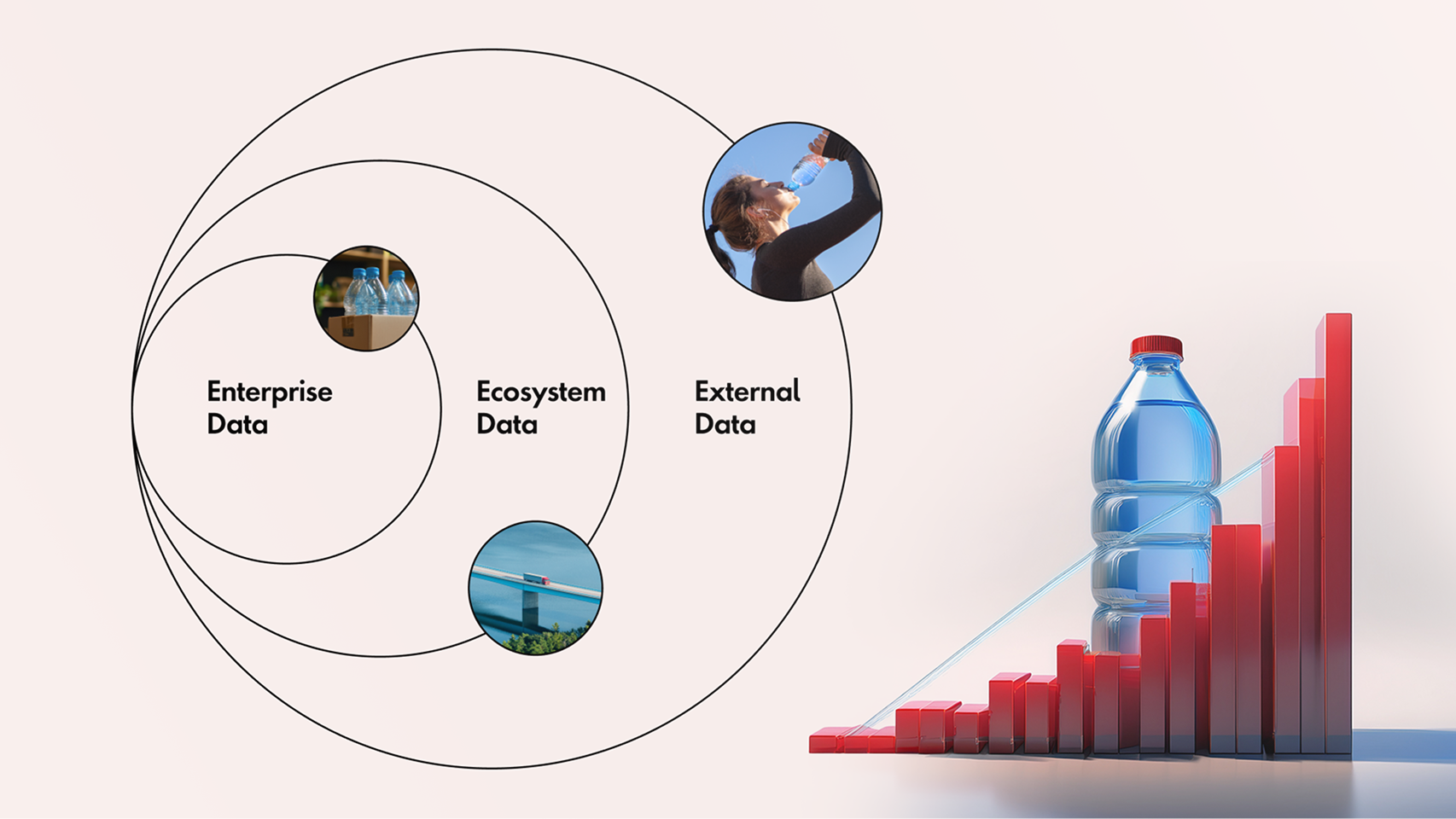

By analyzing enterprise, ecosystem and external data, you can stop waiting for the past to repeat itself. You can supercharge demand planning, forecasting, sensing and shaping—actually influencing demand. Your organization can determine the probability of an event and compare previous predictions to actuals. Adding contextual data and human judgment provides new intelligence to override models. The goal? Aggregate data to the most relevant level of statistical significance and then manage forecasts at reasonable periods that make sense for your business’s optimal replenishment schedules.

Figure 01

Prevent the Stockout: How Data Predicts a Bottled Water Surge

Outcome: “System flags high sell-through risk. Automatically triggers priority restock and reallocation of bottled water to Southern U.S. stores—before the shelves go empty.”

1. Enterprise data: Retailer-owned signals:

• POS velocity on bottled water (spike detected over past 48 hours)

• On-shelf availability in stores in affected zip codes

• eCommerce search volume for “cold drinks” and “hydration”

• Regional promotion calendar (local campaign for beverages)

• Inventory position at DCs (distribution centers)

2. Ecosystem data: Signals from supply chain partners:

• Lead time from beverage supplier and 3PL

• Fill rate history for bottled water SKUs

• Distributor stock availability

• Vendor forecast commits vs. retailer updated demand

• Driver route ETAs based on regional congestion

3. External data: Uncontrollable demand drivers:

• 10-day heatwave alert from NOAA in Southern states

• Spike in local social media mentions of “heat,” “hydration,” “AC broken”

• Regional outdoor event calendar (state fair this weekend)

• Power outage reports (more people out shopping for cold beverages)

• Local water advisory notices (tap water concerns)

This is what powersports leader Polaris does. The pandemic was a turning point for the company. With interest rates low and people at home, demand for off-road vehicles spiked. The made-to-order business changed overnight. Implementing a planning system robust enough to sense and adapt to various market conditions and provide performance processes to measure the response to ever-changing market conditions saved the day. The company can now balance made-to-order versus made-to-stock inventory no matter which direction the macroeconomic pendulum swings. It’s a profound shift from chasing demand to predicting—and even shaping—it with targeted promotions when conditions are ripe.

A leader in Running Shoes' demand planning solution takes demand prediction to another level. It goes beyond the typical portfolio planning and external point-of-sale (POS) data. The solution derives rich insights from AI-driven actual consumer appeal data. Instead of just tracking demand for specific running show models, the footwear producer can build an entire seasonal portfolio based on real customer driven preference. The system also breaks down shoe designs into core elements to understand demand drivers with surgical precision. It can anticipate how trending color and design preferences will influence consumer buying behavior—and get ahead of it—in support of long production and procurement cycles for supply.

Demand sensing has crossed the Rubicon—now’s the moment to double down

What these companies have accomplished is the essence of demand sensing, moving past black-box forecasting that predicts a tomorrow that never comes.

Now is the ideal moment to double down on demand sensing, focusing on sure-win bets and product investments. AI has clearly enabled demand sensing to cross the proverbial Rubicon. Just over half (56 percent)of global organizations are applying it to supply chain planning. It’s no wonder. AI is a breakthrough for correlating multiple streams of data and understanding causation. It powers real-time scenario planning with digital twins. AI is also unlocking new ways to shape demand with dynamic pricing, targeted advertising, product bundling, cross selling and more.

To be clear, demand sensing isn’t just about reacting to everyday fluctuation in demand. It’s essential to make sense of perceived changes in consumption to avoid firefighting during the supply response. Imagine a manufacturer gives raw materials vendors a monthly forecast each week. This isn’t inherently a problem. However, it becomes one if the company whipsaws its forecast every week. Customer demand naturally ebbs and flows. Changing the forecast at every shift introduces noise to even the best statistical and AI models. In turn, this creates unnecessary instability for suppliers and fulfillment teams. Plus, it often happens in frozen periods when the only possible response is a costly expedite. Demand sensing silences the noise, helping supply planners determine if responding to a fluctuation is necessary.

AI makes fulfillment smarter—even when your forecast isn’t

While demand sensing can bring you better forecast accuracy, it won’t make forecasting perfect. That’s why intelligent fulfillment is so valuable. Forecasting is logical. Intelligent fulfillment is actionable. It uses data, analytics and automated systems to support multi-echelon inventory strategies and well-managed replenishment modeling for sourcing, manufacturing and supply plan operations and adherence.

Intelligent fulfillment is a powerful counter to inherent forecast error. When the perfect plan is thwarted by imperfect performance, the appropriate place to hedge is within the constraints of supply-side operations. With intelligent fulfillment, you can invoke strategies to improve plan adherence, maximize profit and lower the cost of insufficient yield, expedites and stranded inventory—all while increasing speed, choice and convenience for customers. That’s a win-win for efficiency and customer satisfaction.

Imagine that your company creates good-better-best versions of a product. Understanding consumer sentiment, disposable income and whether specific customers buy new or used, influences what you focus on in your product portfolio. It also influences how you manage the ratio of forecast to inventory, where it resides and what on-time fulfillment looks like for various tiers of customers.

AI boosts the impact of intelligent fulfillment. It assesses plan variability discrepancies and exceptions, identifying root causes and improving plan inputs. AI-powered placement strategies such as test marketing, dynamic routing and demand-driven replenishment can further enhance operational performance by moving inventory closer to demand. Plus, AI doesn’t just detect discrepancies. In many cases, it can automatically resolve them in line with corporate policy and market strategies.

There’s no killer app—just smart strategy and execution

To deliver on customer demand, your holy grail must better forecast accuracy and intelligent fulfillment. It’s not one or the other. It’s both working in tandem based on your company’s target operating model.

There is no one-size-fits-all answer. Every company is different. That’s why you should assess your business model and operational goals to develop your target operational model for planning. Be sure to avoid the distraction of competing models, ideals and policies.

Next, set up guardrails for planning operations and identify the data you need to meet your goals. From there, develop a complementary forecasting and intelligent fulfillment model and policies. Once established, planning solutions make the process repeatable.

Before putting in a new demand planning system, semiconductor manufacturer Micron spent time improving strategy, processes and data quality. This hard work paid off. The company successfully moved from “push-based” to “pull-based” demand planning in a massively complex landscape.

As your organization moves forward, bring your people through the process. Be intentional about change management. At the same time, plan to improve the new operating model and measure results on an ongoing basis. Also, be prepared to change systems and approaches as business conditions shift. (They will.) Remember, nothing stays static in customer demand, not even your systems.

To boost your competitive advantage, layer on AI to predictive and prescriptive insights. This will help your organization react better to changing business scenarios. You can also seize opportunities to gain incremental revenue, brand loyalty or market share, using empirical data to validate these decisions.

Understanding demand is a fundamental responsibility for supply chain organizations. With human behaviors in the mix, it’s will never be a perfect science. However, combining demand sensing and intelligent fulfillment can increase the odds for more accuracy more often—with higher margins.