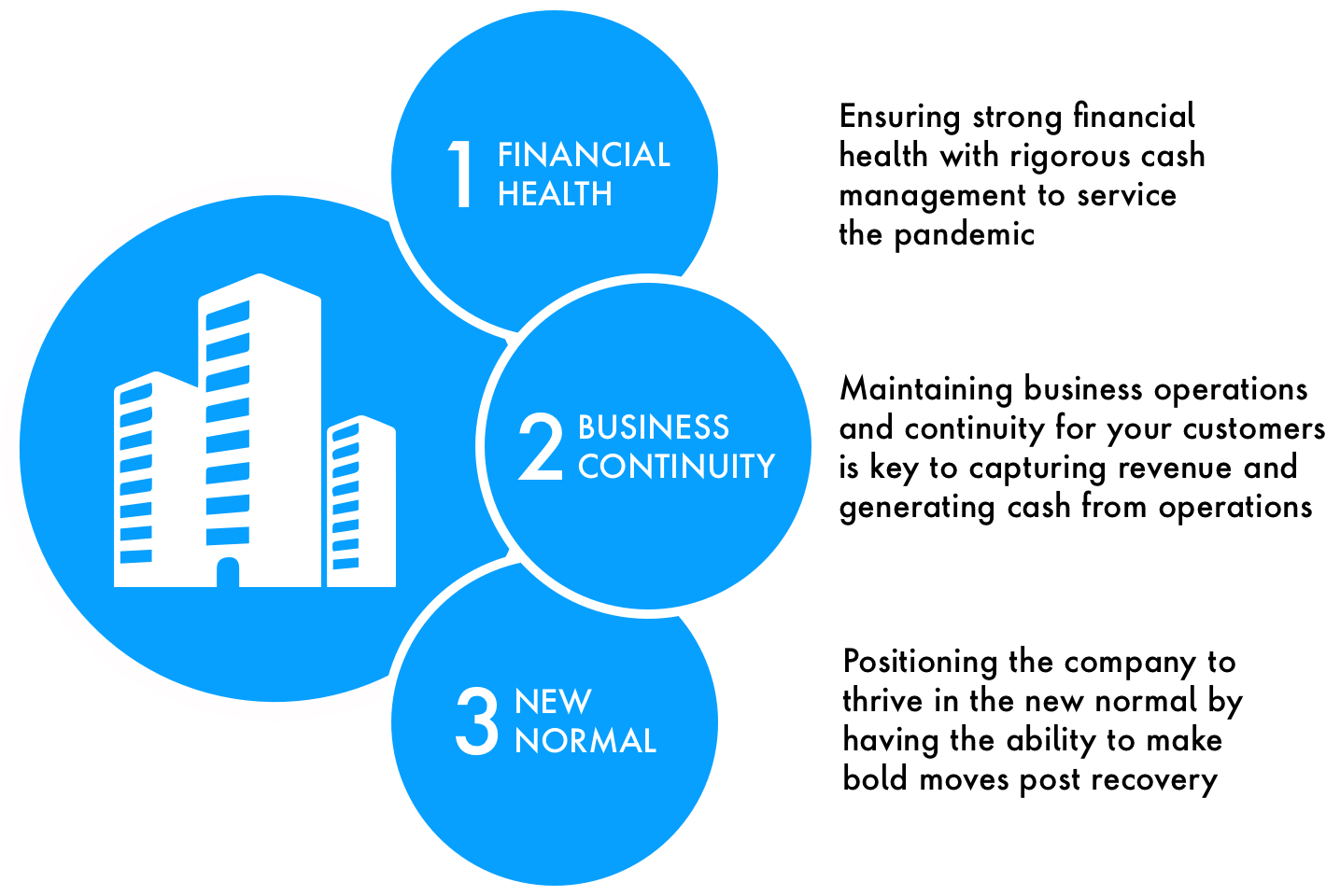

Three steps for finance teams:

- Financial health: Ensuring strong financial health with rigorous cash management to survive the pandemic

- Business continuity: Maintaining business operations is key to capturing revenue

- Get positioned for the new normal: Have the ability to make bold moves post-recovery

Amid the health and economic uncertainty all industries are facing from COVID-19, CFOs will play a pivotal role in helping companies navigate the crisis while searching for what the new normal will be. The crisis has caused demand to drop, leading to an exponential drop in revenue. In this new normal, cash is not only king but is necessary for the overall financial health of companies.