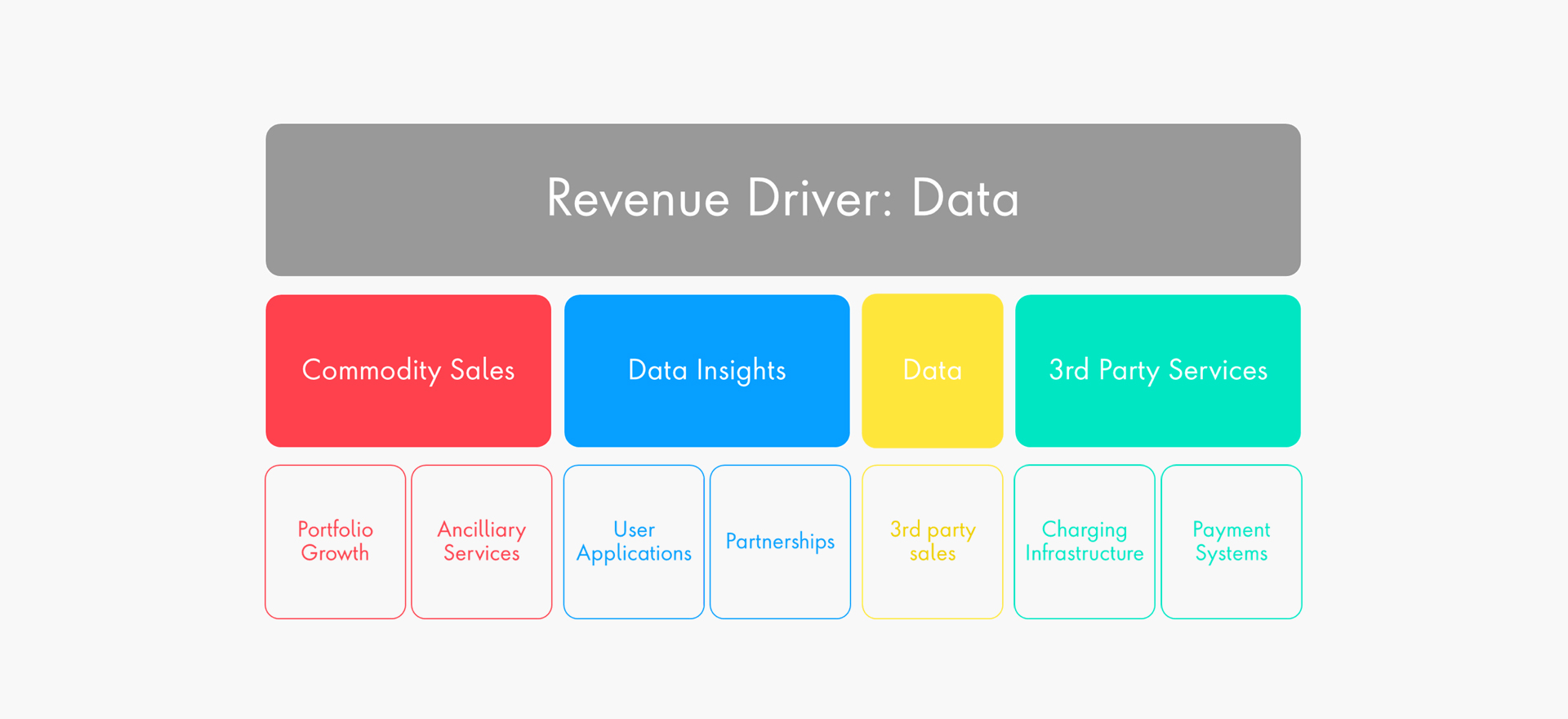

To support this shift and be able to leverage insights from data, utilities will also need to make technology infrastructure changes. Any benefit the utility may derive from the increased amount of data collected can only be realized if this data is managed in a way that is optimized for use by algorithms and other machine learning paradigms. Since energy trading is already a highly automated and data-driven environment, this upgrade process has already started for many utilities.

Modern infrastructure and process changes alone will not be enough. Becoming part of the digital world will require a highly specialized employee skill-set. To transform data into new customer solutions, utilities will need to develop expertise in analytics, machine learning and AI. This might be challenging, since they will be competing for talent in an environment where the majority of companies are also transforming their businesses.

Changing the way a company works, the tools it uses and the people doing the work is a daunting task. The best way forward is to start small; identify a specific area or project and use that as a proof of concept. Once you are able to demonstrate value, scaling these capabilities and making wholesale changes will be easier.

Seizing the window of opportunity in e-mobility

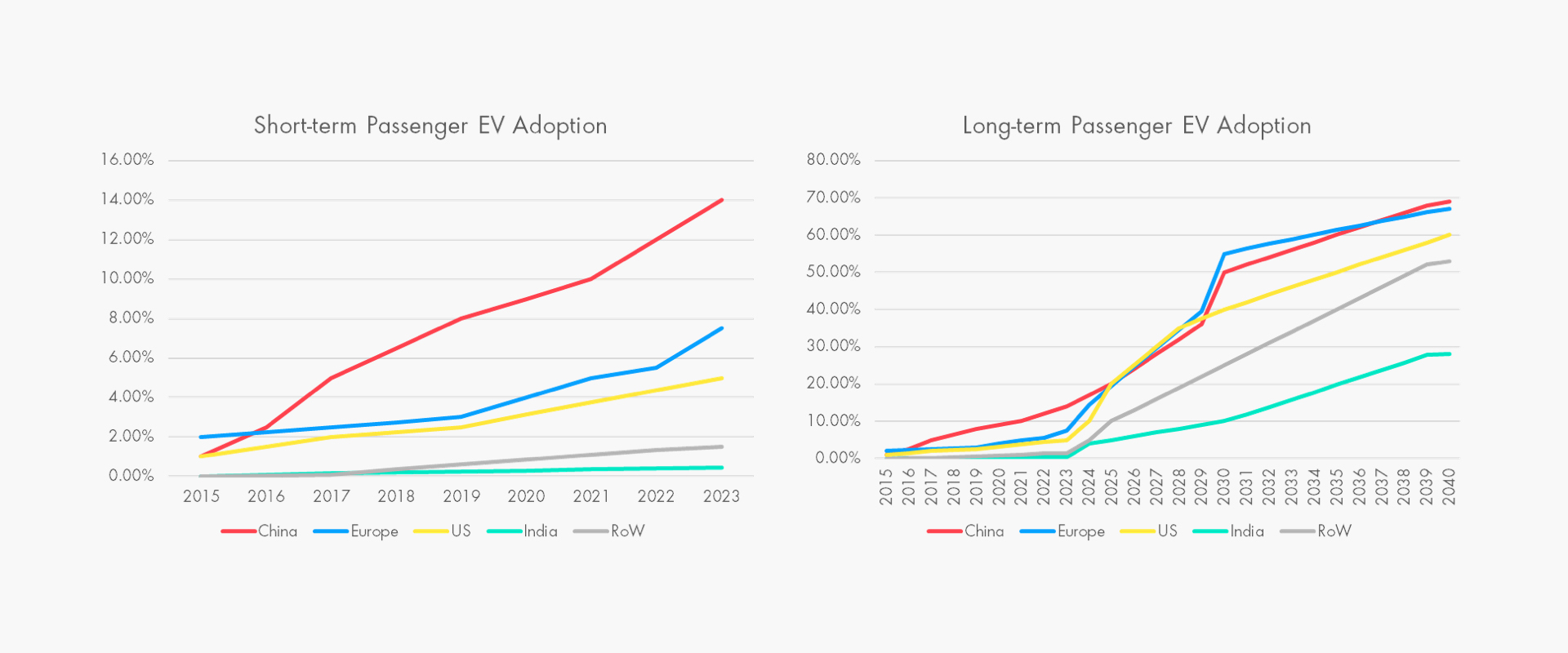

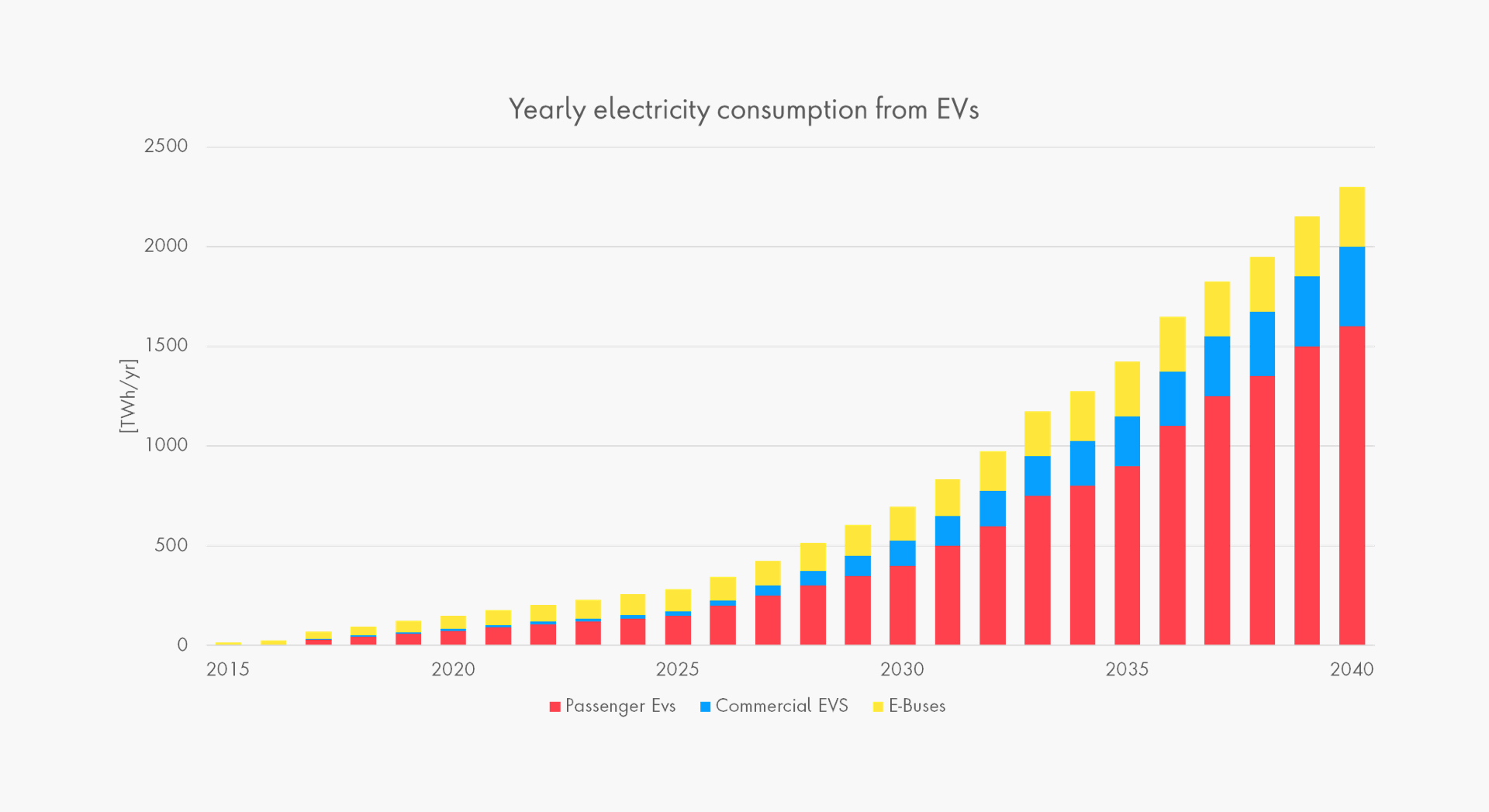

Remaining competitive in today’s changing market is a considerable challenge for many utilities. It requires a radically customer-centric approach to product and service delivery, as well as the ability to leverage market trends, such as e-mobility, to drive growth. The data utilities can generate from e-mobility customers can be augmented and used to create entirely new revenue streams, enter new markets and extend their value in countless ways. Yet, the window of opportunity to be a true innovator in this space is small. Utilities that don’t act fast might struggle to catch up, particularly since once consumers have made their choice of e-mobility energy provider, they will be unlikely to change in the short to mid-term.