Executive Summary

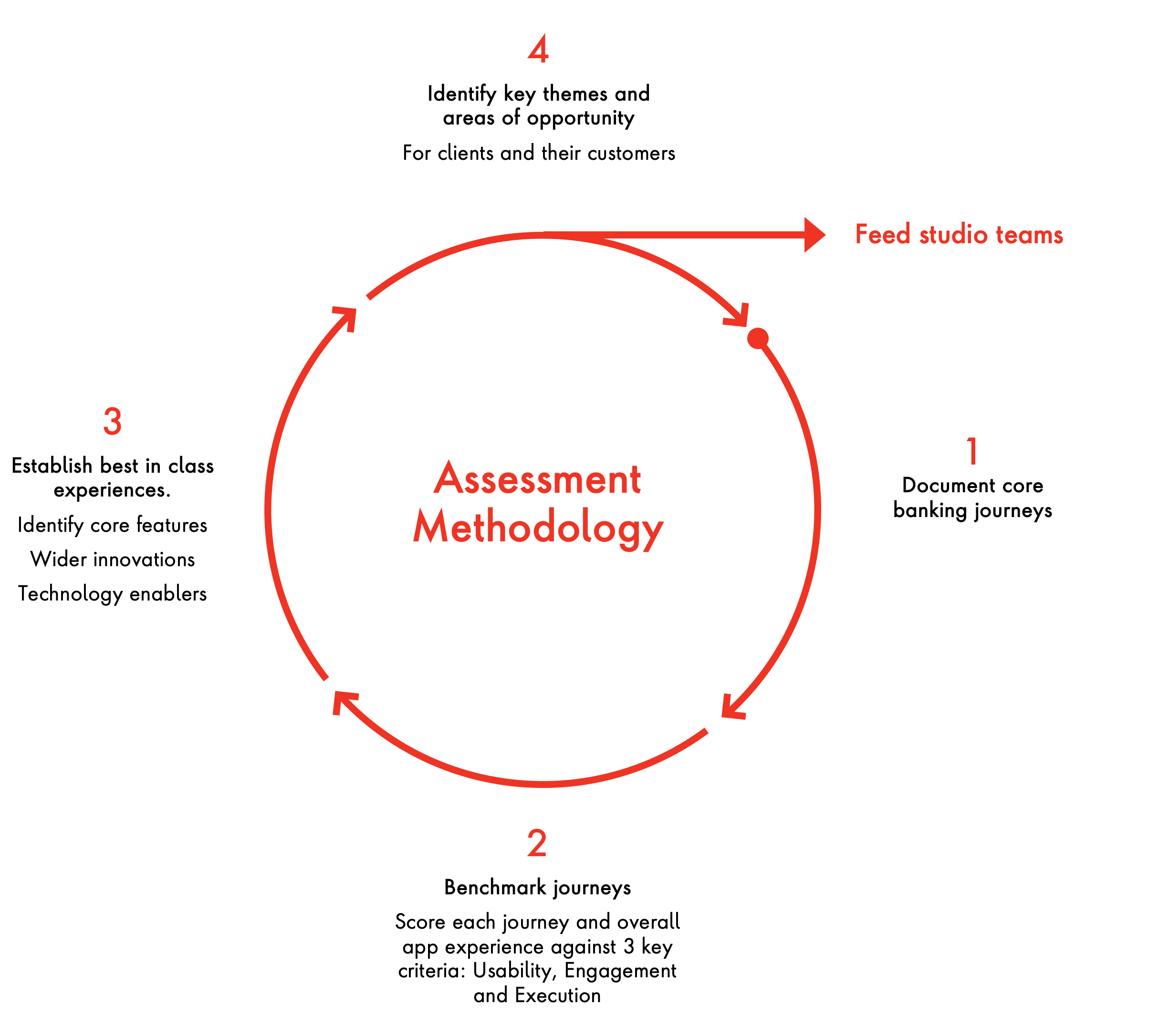

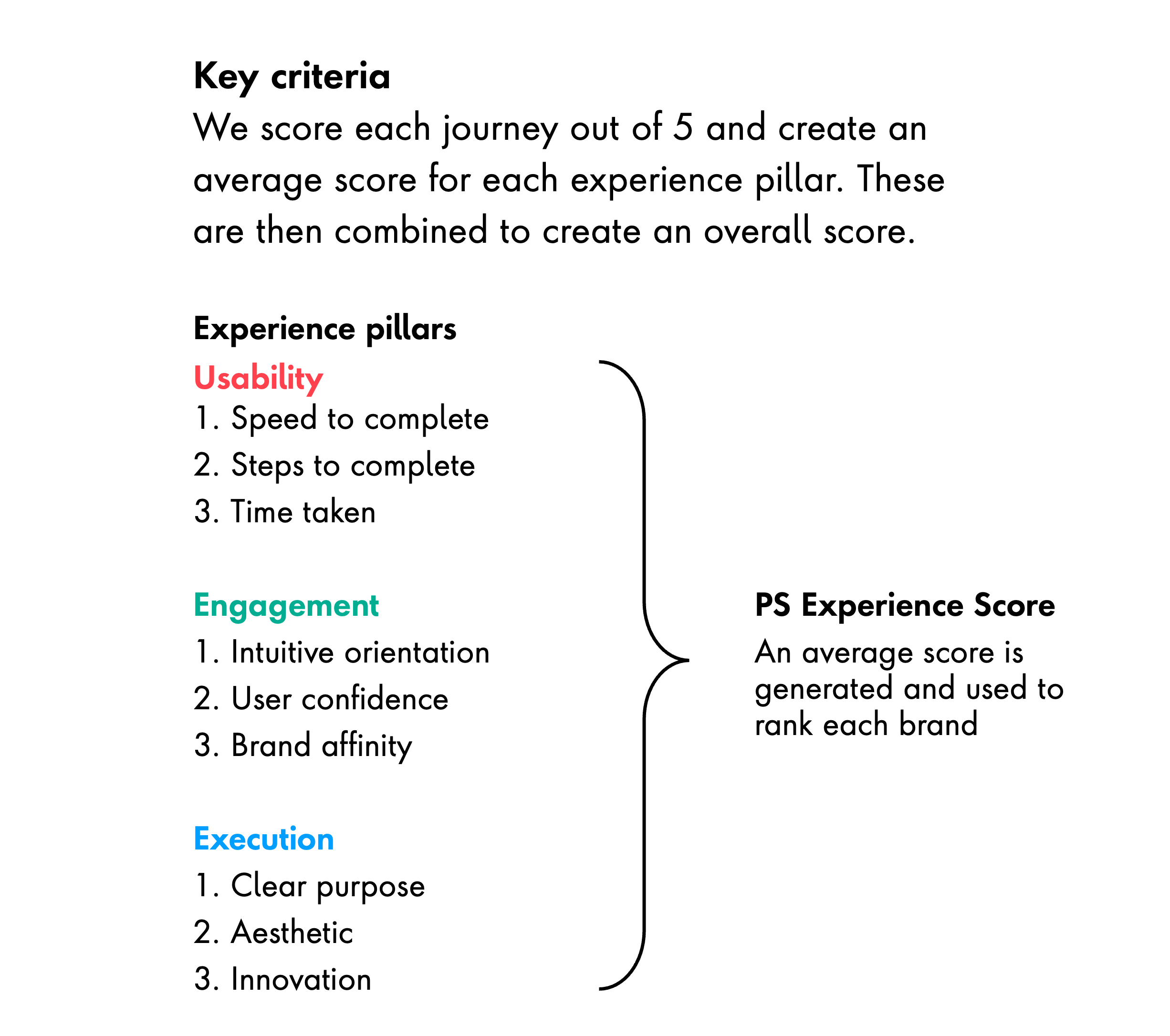

The following benchmarking study sets out to answer the questions: How can banks deliver excellent and distinctive customer experience? Who are the winners, losers, visionaries and laggards? And, what are the crucial technologies to realize these opportunities and enable a competitive edge?

The rise of neobanks has reshaped the way banking is conducted—but has also elevated customers’ expectations for innovative and easy-to-use mobile banking solutions. Traditional banks have sought to narrow the gap through large-scale digital transformation programs.

However, in a digital-centric era, excelling in everyday banking journeys is critical. As analog channels diminish, digital CX becomes the key to capturing and retaining customers.

Empathetic design and distinctive features are vital, but robust technology is equally critical. Six key tech elements were identified as being instrumental to delivering an excellent user experience.

Beyond experience fundamentals, there are considerable opportunities for innovation, sustainable advantage and differentiation. Publicis Sapient identifies four pivotal trends for differentiation: hyper-personalization, inclusive design, progressive interfaces and expanding banking boundaries.